Montana Form CB-1, or “Request for Informal Review,” is the official document used to formally object to the collection actions or fund offsets initiated by the Montana Department of Revenue. Taxpayers, debtors, or businesses must file this form within 30 days of receiving an initial notice from the Collections Bureau or Other Agency Debts unit if they wish to dispute the department’s process. The form serves as the legal mechanism to trigger an internal review of the case. Upon receiving the completed form, the department will investigate the objection and issue a determination letter outlining their findings. Filing this form is a critical step in resolving disagreements regarding debts before further legal or collection actions proceed.

How to File Montana Form CB-1

Deadlines:

You must file this form within 30 days of the date on the initial notice you received.

Where to Send:

You have two options for submission:

1. By Mail:

Montana Department of Revenue

Other Agency Debts

PO Box 1712

Helena MT 59604-1712

2. By Email:

Send the completed form to: dorotheragencydebts@mt.gov

Questions:

Call (406) 444-3900 or Montana Relay at 711.

How to Complete Montana Form CB-1

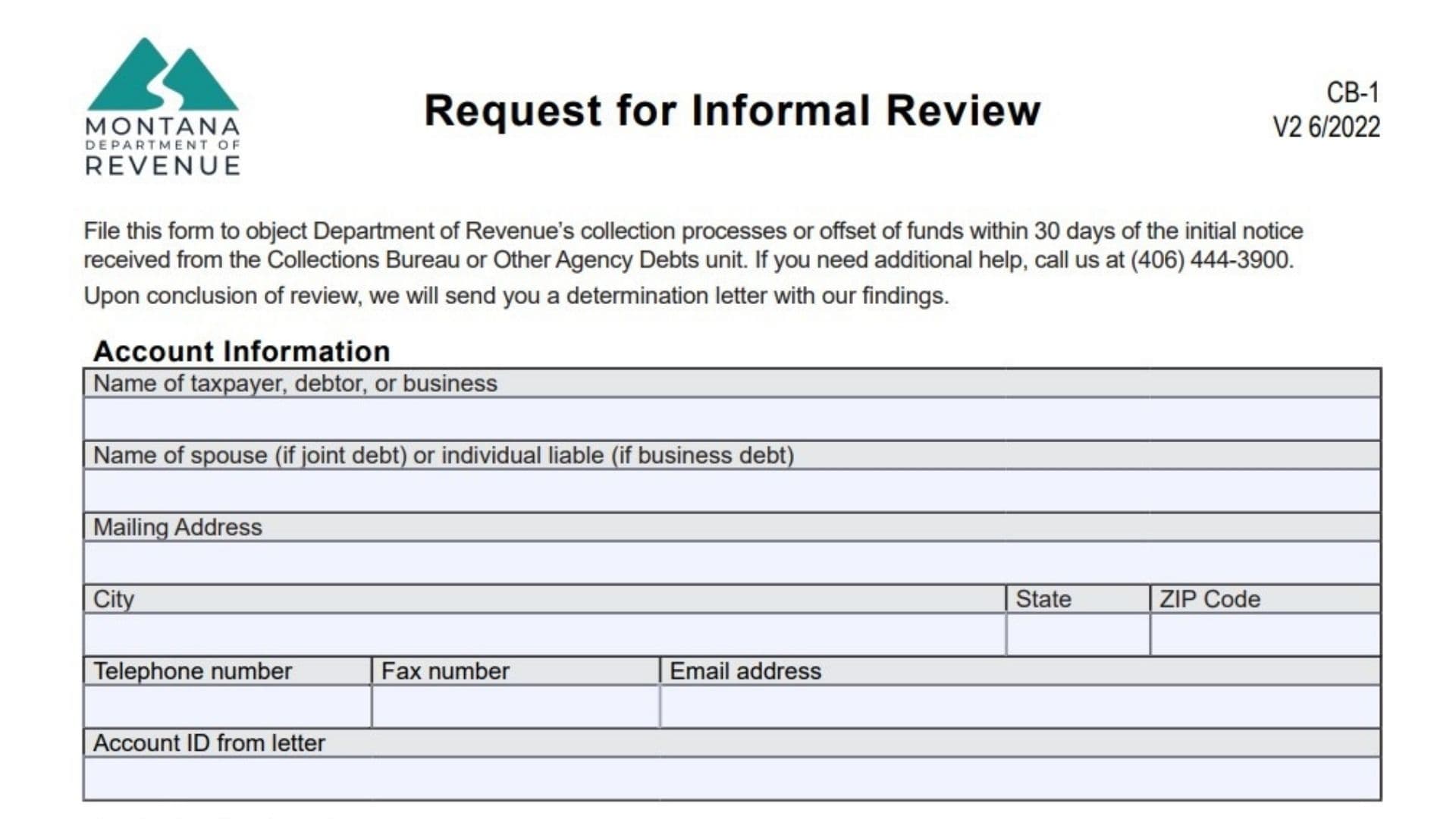

Account Information

- Name of taxpayer, debtor, or business: Enter the full name of the primary person or entity listed on the debt notice.

- Name of spouse or individual liable: If the debt is joint (like a married couple’s tax debt) or a business debt where an individual is liable, enter that person’s name here.

- Mailing Address: Provide the current mailing address where you want to receive the determination letter.

- City / State / ZIP Code: Complete the address fields.

- Telephone number: Enter a contact phone number.

- Fax number: Enter a fax number if available (optional).

- Email address: Provide a valid email address for correspondence.

- Account ID from letter: Crucial Step: Enter the specific Account ID number found on the notice you received from the Department.

Basis for Objection

- Written Explanation: This is the most important section. As required by law, you must provide a detailed written explanation of why you are objecting to the collection or offset.

- Instructions: Use the lines provided to clearly state your case.

- Tip: If the space provided is not enough, you are encouraged to attach additional sheets to fully explain your objection. Failure to provide a basis for objection may result in the denial of your request.

Signatures

- Signature of taxpayer/debtor or individual liable: The primary person objecting must sign here.

- Title: If signing for a business, enter your job title.

- Date: Enter the date of signing.

- Spouse’s Signature: If this is a joint debt, the spouse must also sign and date the form.

Authorization of Representative

Complete this section only if you want another person (like an attorney or accountant) to represent you during this review process.

- Name of Representative: Enter the representative’s full name.

- Telephone number: Enter the representative’s phone number.

- Attachment Requirement: You must attach a completed Power of Attorney form (available at MTRevenue.gov) or a fully executed federal Form 2848 to this request. The department cannot discuss your case with a representative without this legal authorization.