The Montana Domestic Brewery License Application is a formal request document submitted to the Montana Department of Revenue’s Alcoholic Beverage Control Division. It serves as the primary instrument for individuals or business entities seeking to manufacture beer within the state, specifically products containing between 0.5% and 14% alcohol by volume. This comprehensive paperwork collects essential data on the business structure, ownership details, physical premises, and operational plans to ensure compliance with state laws. Beyond just new breweries, this form is also utilized for transferring ownership of an existing brewery, changing a brewery’s location, or updating the corporate structure of a licensed business. The state uses this information to initiate background checks, verify zoning compliance with local officials, and ensure that all “beer” definitions—regarding alcohol content and ingredients—are strictly met before granting the privilege to brew and sell malt beverages.

How To File Montana Domestic Brewery License Application

Once you have meticulously filled out the entire document, you must compile it with all “Required Documents” listed in the instruction section, such as your Federal Brewer’s Notice, floor plans, and financial agreements. The complete package can be mailed directly to the Montana Department of Revenue at the address provided at the end of the form. Alternatively, for a faster and potentially more streamlined process, applicants are encouraged to apply online through the state’s official revenue portal. If you choose to mail the physical form, ensure you include the necessary fees and allow for a processing period that typically ranges from 60 to 90 days, during which local officials and the Department of Justice will conduct their respective reviews and investigations.

How to Complete Montana Domestic Brewery License Application

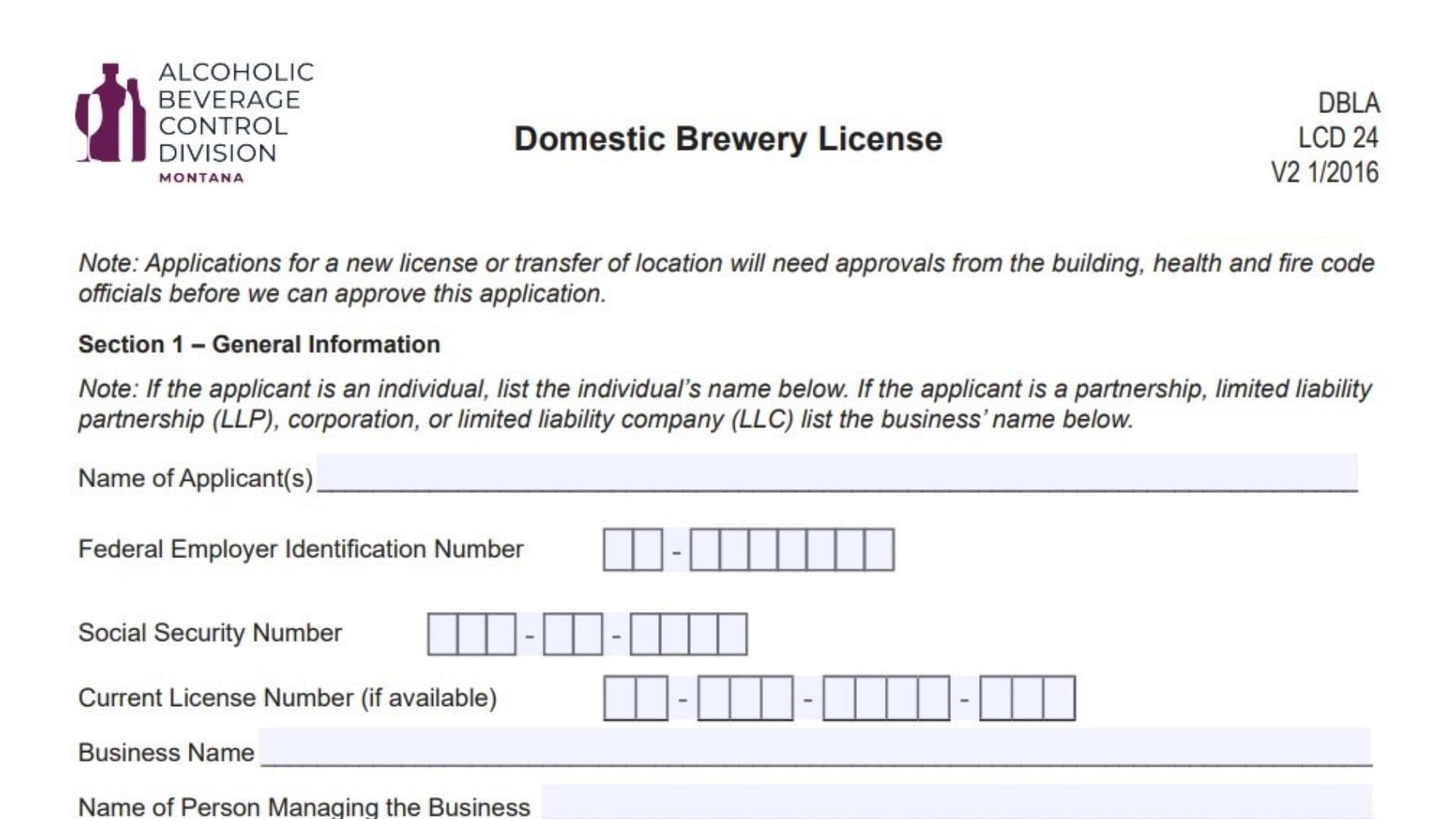

Section 1: General Information

This initial section establishes the identity of the primary applicant and the business entity.

- Name Of Applicant(s): Write the full legal name of the individual applying. If the applicant is a business entity like a partnership, LLC, or corporation, list the specific name of that business here.

- Federal Employer Identification Number: Enter the unique FEIN assigned to your business by the IRS.

- Social Security Number: If applying as an individual, provide your personal Social Security Number.

- Current License Number: If you already hold a license and are applying for a change or transfer, input your existing license number.

- Business Name: Write the name under which the brewery operates or will operate, often referred to as the trade name.

- Name Of Person Managing The Business: Identify the individual responsible for the day-to-day operations of the brewery.

- Telephone: Provide the primary contact phone number for the business.

- Fax: Enter a fax number if applicable.

- Cell Phone: List a mobile number for direct contact.

- Email Address: Write the main email address used for business correspondence.

- Physical Location: Enter the exact street address, city, state, and zip code where the brewery is or will be physically located.

- Mailing Address: If different from the physical location, provide the address where you want to receive mail.

- Electronic Renewal Checkbox: Check this box if you prefer to receive your annual license renewal notifications via email instead of paper mail.

- Attorney Correspondence Checkbox: Select this option if you want all official correspondence regarding this application to be sent directly to your lawyer.

- Attorney Name: If the box above is checked, print the full name of your legal counsel.

- Phone: Enter your attorney’s telephone number.

- Email: Provide your attorney’s email address.

- Mailing Address: Fill in the complete mailing address for your attorney’s office.

Section 2: Type Of Transaction And Fees

Select the specific reason for your application and calculate the costs involved.

- New License: Check this box if you are applying for a brand new license and enter the standard license fee amount.

- Transfer Of Ownership: Select this if you are acquiring an existing licensed business.

- Transfer Of Location: Choose this option if an existing license is moving to a new physical address.

- Corporate Structure Change: Check this box if the internal structure of the licensed entity is changing (e.g., adding partners).

- Processing Fee: This is a mandatory fee required for all transaction types; ensure the pre-filled amount is included in your total.

- Fingerprint Fee(s): Enter the total cost for background checks, calculated by multiplying the per-person fee by the number of individuals submitting fingerprint cards.

- Total Amount Enclosed: Add the license fee, processing fee, and total fingerprint fees, then write the grand total. Make your check payable to the “Department of Revenue.”

Section 3: Corporate Statement

This section details the ownership structure. Sole proprietorships can skip this, but all other entities must complete it.

- Shareholder, Member Or Partner Name: List the full name of every individual with an ownership stake.

- SSN: Provide the Social Security Number for the listed individual.

- Address: Write the personal residential address for this owner.

- Date Of Birth: Enter the individual’s birth date.

- Actual Number Of Shares And % Of Ownership: Specify how many shares they hold and their total percentage of ownership in the company.

- Officers And Directors: Use the lower half of this page to list key executives who may not be owners.

- Officer Or Director Name: Print the name of the officer or director.

- SSN (Optional): You may provide their Social Security Number here.

- Address: Enter their residential address.

- Date Of Birth (Optional): Enter their birth date if desired.

- Title: Specify their corporate role (e.g., President, Treasurer, Secretary).

Section 4: Questions

Answer “Yes” or “No” to these legal and operational compliance questions.

- Question 1: Indicate if any applicant or owner holds an interest in any retail alcohol license, agency liquor store, or wholesaler license in any state. If yes, explain.

- Question 2: State whether any owner has a spouse, child, or parent with a pending retail alcohol license application.

- Question 3: Disclose if any owner’s spouse, child, or parent currently holds a financial interest in a retail license.

- Question 4: Reveal if anyone other than the listed applicant has a financial interest in this business. If yes, attach details.

- Question 5: Confirm if the proposed location is in a zone where alcohol sales are prohibited by local ordinance.

- Question 6: State if you own or are purchasing the building. If yes, send the purchase agreement or tax bill; if no, send the lease.

- Question 7: Indicate if you own the furniture and equipment. If no, submit the lease or purchase agreement for these items.

- Question 8: Confirm if the building is ready for use. If no, provide the completion date and check whether it is new construction or a remodel.

- Question 9: State if you plan to manufacture “high alcohol” beer (8.75% to 14% ABV). If yes, you must initial the statement agreeing that your products meet the legal definition of beer.

- Question 10: Select how your products will be distributed. Choose “Self-distribution” or “Licensed wholesaler/distributor.” If using a distributor, list their license number, name, and city.

- Question 11: Indicate if you plan to have a sample room. If yes, mark its location on your floor plan.

- Question 12: State if this license will be used for contract brewing. If yes, provide the contractor’s name and explain the agreement.

Section 5: Temporary Operating Authority

Complete this section only if you are requesting permission to operate while the transfer is being processed.

- Request Checkbox: Check “Yes” to request temporary authority or “No” if not needed.

- License Number: Enter the license number for which authority is requested.

- Signature Of Applicant: The person applying for the transfer signs here.

- Printed Name: Print the applicant’s name legibly.

- Date: Write the date of signing.

- Signature Of Recorded Owner: The current license holder must sign here to authorize the temporary operation.

- Printed Name: Print the current owner’s name.

- Date: Write the date the current owner signed.

Section 6: Declaration And Affidavit

This final section swears that all information provided is true under penalty of law.

- Signature: The applicant or authorized representative must sign.

- Date: Enter the date of the signature.

- Printed Name: Print the name of the signer.

- Title: Write the signer’s official title (e.g., Owner, President).

- Additional Signatures: Two extra sets of signature lines are provided if multiple applicants or officers need to sign the affidavit.