If you are a business holding unclaimed property—such as dormant bank accounts, uncashed payroll checks, or forgotten insurance policies—you have a legal obligation to remit those funds to the Montana Department of Revenue. The Montana Form UCH, also known as the Unclaimed Property Holder Payment Voucher, is the essential document that must accompany your check payment to ensure the money is correctly credited to your account. Filing this form accurately is the final step in the reporting process, following your annual report of abandoned property. Whether you are a life insurance company with a December deadline or a retailer filing in the summer, understanding how to fill out this voucher prevents processing delays and helps you avoid penalties for non-compliance. This guide breaks down exactly how to prepare the voucher, write your check, and meet the specific mailing requirements.

What Is Montana Form UCH?

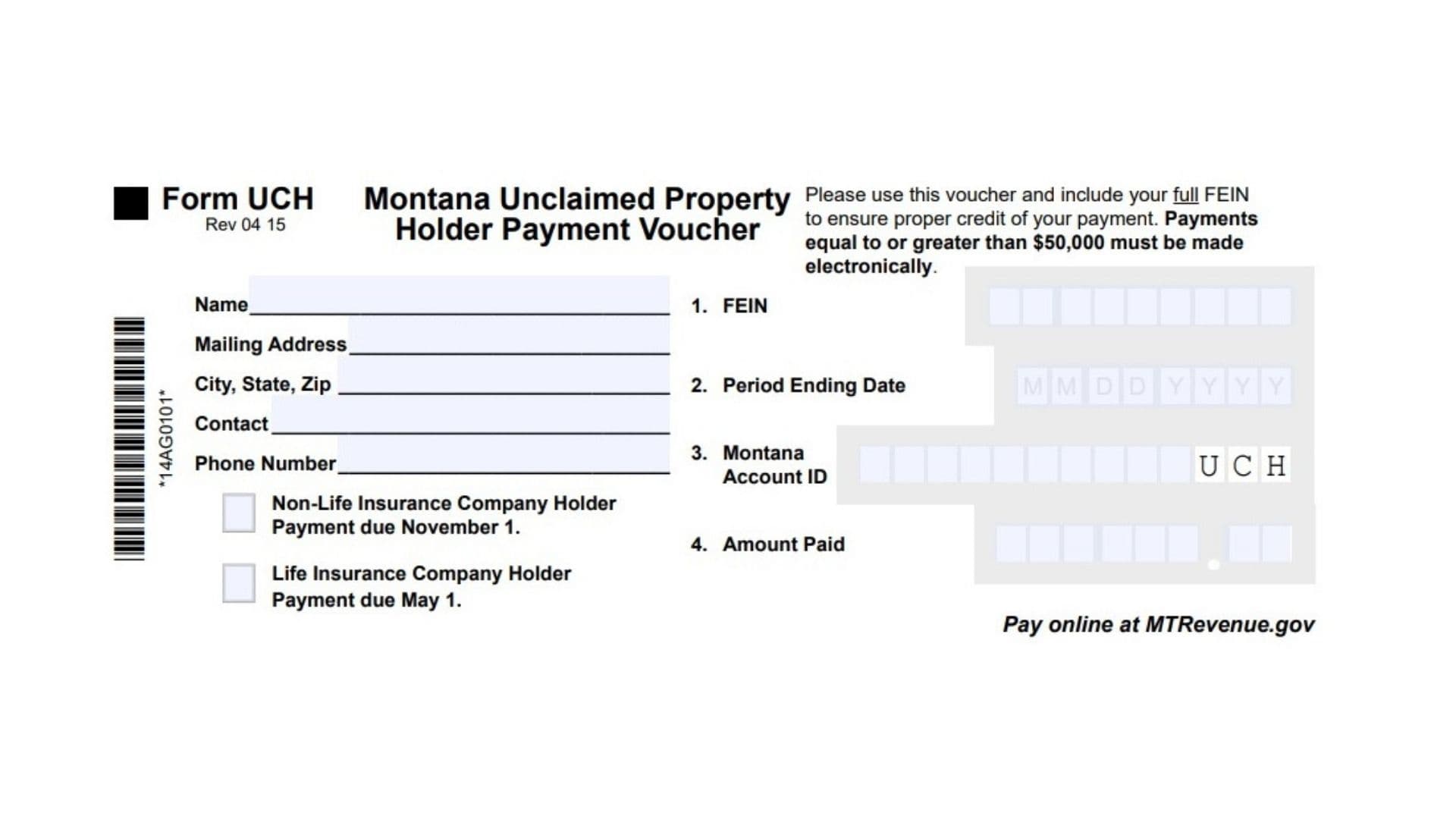

Form UCH is a payment coupon used by “holders” (businesses) to remit unclaimed funds to the state of Montana. It is designed solely for those paying by paper check. The state mandates that if your total payment is $50,000 or more, you must pay electronically and cannot use this paper form. For payments under that threshold, this voucher ensures your check is matched to the correct tax period and holder account.

How To File Form UCH

If you are eligible to pay by check (remitting less than $50,000), you must mail the detached payment voucher along with your check to the specific address below. Do not staple or tape your check to the voucher.

Mail to:

Montana Department of Revenue

PO Box 5805

Helena, MT 59604-5805

Electronic Payment Options (e-Pay):

For faster processing, or if you are required to pay electronically, you can use the state’s online services at revenue.mt.gov. You may also use ACH Credit through your online banking service, which requires a one-time registration with the Department.

How To Complete Form UCH

Follow these specific instructions to ensure your payment is processed correctly.

Holder Information

- Name: Enter the full legal name of your business (the holder).

- Mailing Address: Enter your complete mailing address.

- City, State, Zip: Fill in the city, state, and zip code.

- Contact: Write the full name of the person responsible for this report.

- Phone Number: Provide a direct phone number for the contact person.

Holder Type And Due Date

In the lower left-hand corner of the form, you must check one of the two boxes to indicate your business type and deadline:

- Non-Life Insurance Company Holder: Check this if you are a general business, bank, or other entity. Your payment is due November 1.

- Life Insurance Company Holder: Check this if you are a life insurance company. Your payment is due May 1.

Numbered Boxes

- Box 1 – FEIN: Enter your full Federal Employer Identification Number. This is critical for matching the payment to your business record.

- Box 2 – Period Ending Date:

- Life Insurance Companies: Enter 12/31/YYYY (December 31st of the reporting year).

- All Other Holders: Enter 06/30/YYYY (June 30th of the reporting year).

- Box 3 – Montana Account ID: Enter your 13-digit account ID assigned by the Montana Department of Revenue. If you do not have one, leave this field blank.

- Box 4 – Amount Paid: Enter the exact amount of the check you are enclosing, including cents. Do not use dollar signs, commas, or decimal points (e.g., write “125000” for $1,250.00).

Check Writing Instructions

- Make the check payable to Montana Department of Revenue.

- On the memo line, write your FEIN or Account ID and the Period Ending Date (e.g., “FEIN 12-3456789, Period Ending 06/30/2025”). This ensures your payment can be traced if it gets separated from the voucher.

- If paying for multiple periods, use a separate voucher for each period and clearly indicate the amount for each.