Montana Form MW-3, titled the Annual W-2 1099 Withholding Tax Reconciliation (Version V4 11/2025), is the state’s mandatory end-of-year “true up” document for employers and businesses. Its primary purpose is to balance the books between what you withheld from your employees’ paychecks throughout the year and what you actually paid to the Montana Department of Revenue. Think of it as a final summary report: it tallies up all the state income tax you held back from wages (W-2s) and non-wage payments (1099s) and compares that total against the deposits you made during the tax year. If you withheld $10,000 but only sent the state $9,000, this form reveals the discrepancy so you can fix it. Crucially, every employer must file this form—even those with a “Not Required” pay frequency who did not withhold any tax—because it serves as the cover sheet for submitting your employee wage statements to the state.

How To File Form MW-3

Deadline: You must file this form, along with all accompanying W-2s and 1099s, by January 31 of the following tax year.

Filing Methods:

- Online (Preferred): The fastest way is to file and pay via the TransAction Portal (TAP) at tap.dor.mt.gov.

- Mail: If you choose to file on paper, send the completed Form MW-3, your W-2s/1099s, and any payment due to:

Montana Department of Revenue

PO Box 5835

Helena, MT 59604-5835

How To Complete Montana Form MW-3

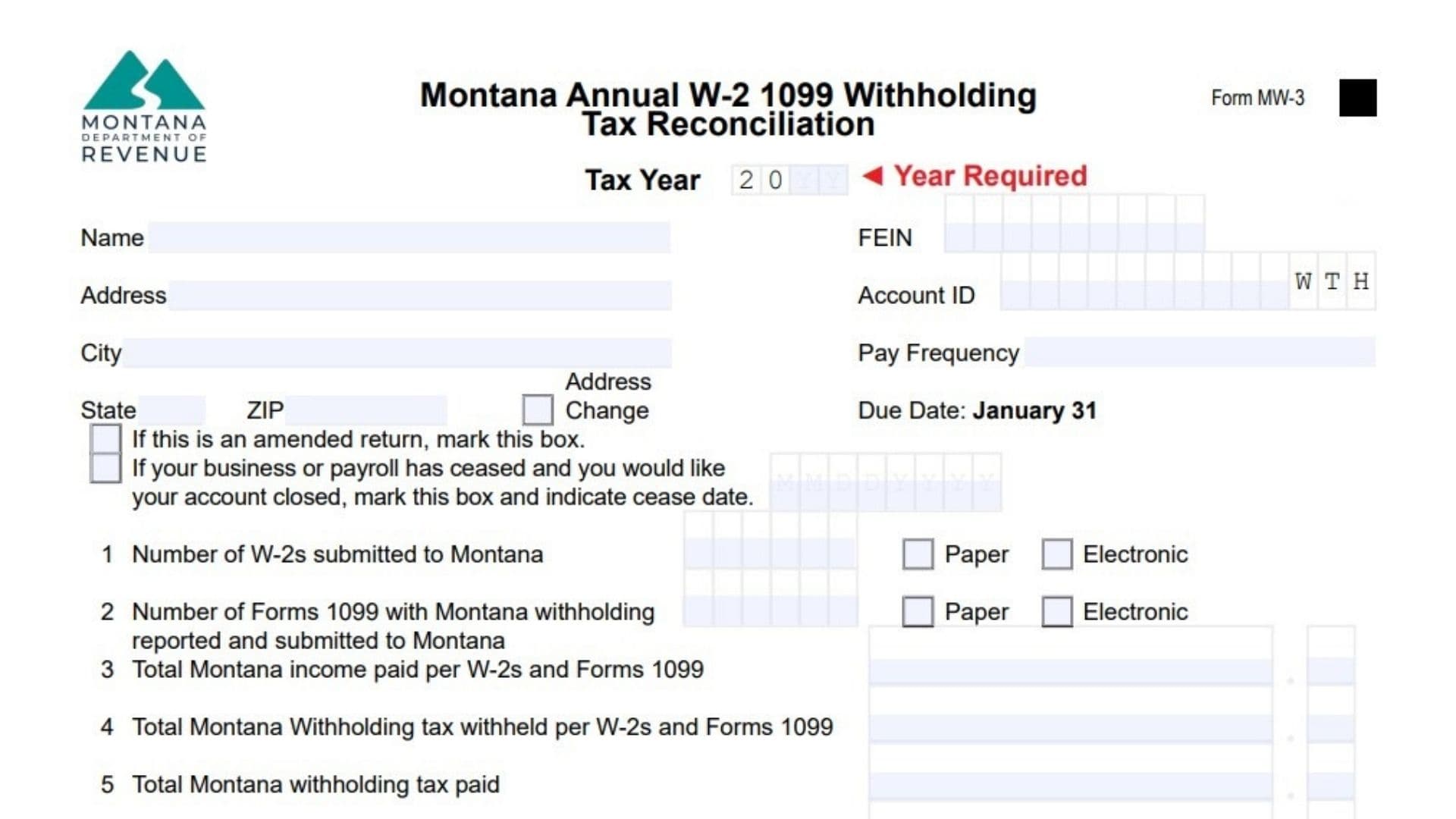

Header Information

- Tax Year: Enter the 4-digit year you are reporting for (e.g., 2025).

- Business Info: Fill in your Name, Address, City, State, and ZIP Code.

- IDs: Enter your Federal Employer Identification Number (FEIN) and your Montana Account ID.

- Address Change: Mark the box if your address has changed.

- Pay Frequency: Indicate your filing schedule (e.g., Monthly, Accelerated).

- Amended Return: Check this box if you are correcting a previously filed return (you must also include W-2Cs).

- Close Account: Check this box and enter the date if your business has ceased operations.

Reconciliation Section

- Line 1: Enter the total number of W-2 forms you are submitting. Check the box to indicate if you are sending them via Paper or Electronic.

- Line 2: Enter the total number of 1099 forms (only those with Montana withholding). Check the box for Paper or Electronic.

- Line 3: Enter the total amount of Montana income paid to all employees/payees as listed on your W-2s and 1099s.

- Line 4: Enter the total Montana withholding tax withheld from all W-2s and 1099s. This is the amount you should have paid the state.

- Line 5: Enter the total amount of withholding tax you actually paid to the Department of Revenue during the year.

- Line 6: Subtract Line 5 from Line 4.

- If the number is positive, you owe money.

- If the number is negative (use a minus sign), you overpaid and will receive a refund.

Preparer Info

- May we discuss this return with your preparer? Check Yes or No. If Yes, provide their name and phone number.

Payment Schedule (Columns A-E)

This table details your payments period-by-period.

- Column A (Deposit Period End Date): Enter the end date for each period.

- Monthly filers: Last day of each month (e.g., 01/31, 02/28).

- Annual filers: 12/31.

- Accelerated filers: The date reported on your vouchers.

- Column B (Date Paid): Enter the specific date you sent the payment to the Department.

- Column C (Montana Tax Withheld): Enter the amount of tax you withheld from employees for that specific period. The total of this column must match Line 4.

- Column D (Montana Tax Paid): Enter the amount you actually paid for that period. The total of this column must match Line 5.

- Column E (Difference): Subtract Column D from Column C. The total of this column must match Line 6.

Important Reminders

- W-2s and 1099s: You must submit copies of every W-2 (even those with no withholding) and every 1099 that has Montana withholding.

- No Federal Forms: Do not send the federal W-3 form; Montana only accepts the MW-3.

- Full ID Numbers: Do not hide or truncate SSNs on your submitted W-2s; the state needs the full numbers.