The Montana Authorization to Disclose Tax Information Form allows the Alcoholic Beverage Control Division (ABCD) to access confidential taxpayer information from the Business and Income Taxes Division. This form is necessary when applying for or transferring an alcoholic beverage license, as the ABCD needs to verify the applicant’s compliance with Montana’s tax laws. The form is completed by the taxpayer, and in some cases, the spouse, partner, or representative of the taxpayer must also sign. This article provides step-by-step instructions for completing the Montana Authorization to Disclose Tax Information form. This form authorizes the Montana Department of Revenue’s Alcoholic Beverage Control Division to access your confidential tax information for verifying compliance with licensing criteria.

How to Complete Montana Authorization to Disclose Tax Information Form

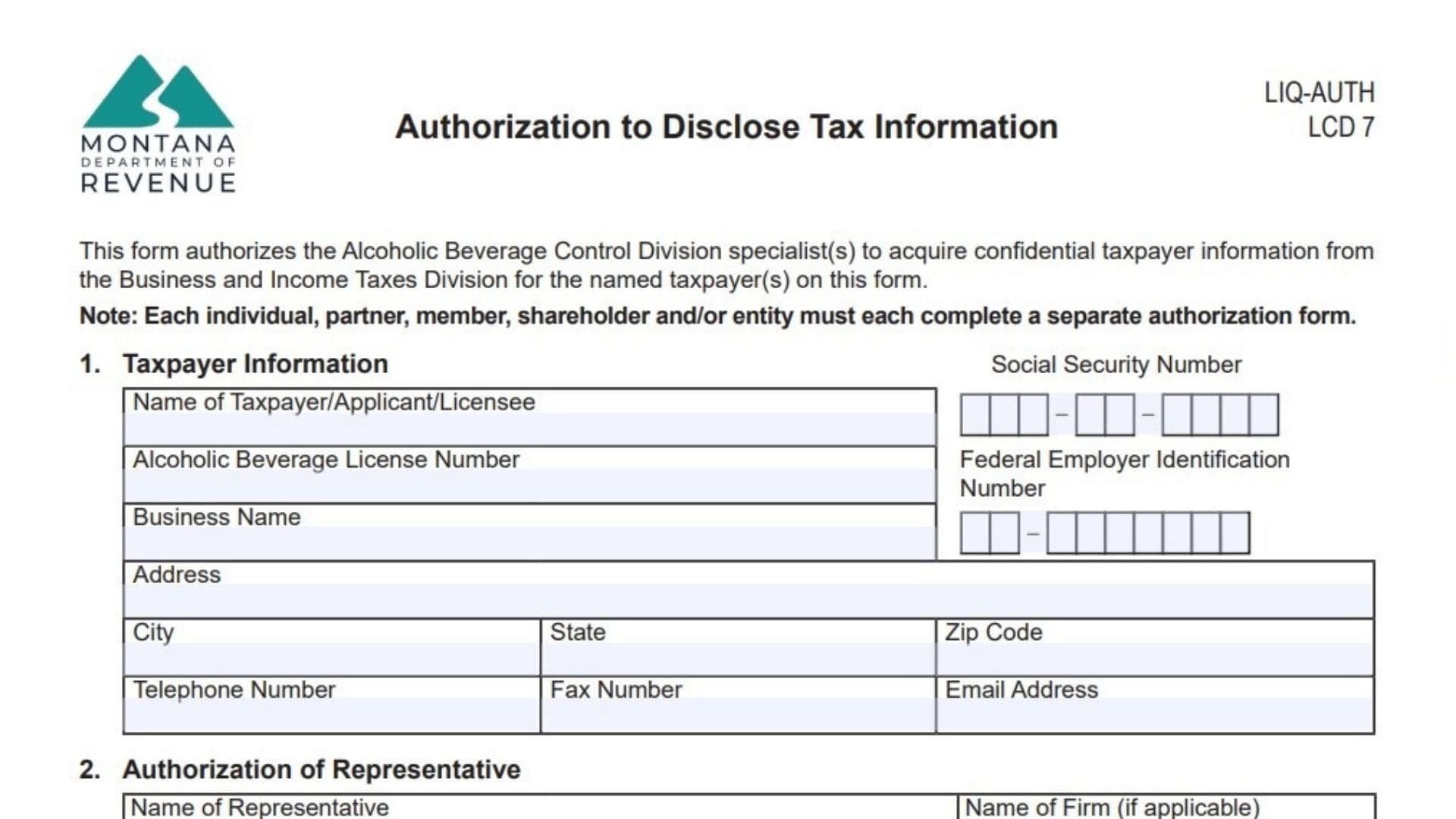

Section 1: Taxpayer Information

- Taxpayer Name: Enter the full legal name of the taxpayer or business entity applying for the license. If you are an individual, enter your name as it appears on official documents. For business entities, enter the business name.

- Social Security Number: Provide your Social Security Number (SSN) if you are an individual applicant. For business entities, this section is not required, and you can leave it blank.

- Alcoholic Beverage License Number: Enter the Alcoholic Beverage License Number issued by the Montana Department of Revenue for the applicant.

- Federal Employer Identification Number (FEIN): If applicable, provide the FEIN for your business or entity. This is required for business entities such as corporations and LLCs.

- Business Name: For business entities, enter the official business name here.

- Address: Provide the business address or mailing address where you receive official communication. This must be a physical address, as P.O. Boxes are not accepted.

- City, State, ZIP Code: Complete this field with the city, state, and ZIP code of your business or mailing address.

- Telephone Number: Enter the contact telephone number for the taxpayer or business entity.

- Fax Number: Provide the fax number (if applicable) for official correspondence.

- Email Address: Enter a valid email address for correspondence.

Section 2: Authorization of Representative

- Name of Representative: Provide the full name of the representative you authorize to access your tax information. This could be a business partner, attorney, or other appointed agent.

- Licensing and Compliance Specialist: This information is pre-filled, referring to the Montana Department of Revenue, Alcoholic Beverage Control Division.

- Name of Firm: If applicable, enter the name of the firm representing you. This could be a legal or accounting firm assisting with your license application.

- Montana Department of Revenue Address: The address of the Montana Department of Revenue Alcoholic Beverage Control Division is:

- 2517 Airport Road

- Helena, MT 59601

- Telephone and Fax Numbers: These are pre-filled with the department’s telephone number (406) 444-6900 and fax number (406) 444-6642.

Section 3: Signature

- Individual Signature: If you are an individual applying for the license, you must sign and date the form.

- Joint Return: If this form is for a joint return (for married couples), both spouses must sign and date the form. If only one spouse is completing the form, the signature of the other spouse is not required.

- Corporate or Partnership Signature:

- If you are a corporation or partnership, the authorized officer or partner must sign and date the form. The person signing must have the legal authority to bind the corporation or partnership.

- If one partner is authorized to act on behalf of the partnership, include a copy of the authorization.

- LLC Signature:

- For LLCs, if the LLC is member-managed, all members must sign, unless one member has the authority to sign on behalf of the LLC. If a manager oversees the LLC, the manager must sign the form.

- Estate, Trust, or Fiduciary Signature:

- If the applicant is an estate, trust, or other fiduciary, the personal representative or trustee must sign the form.

- Specify the capacity in which the person is signing, such as “John Doe, guardian of Jane Doe.”

- Title: If the person signing holds an official title (such as corporate officer, partner, manager, etc.), provide the title next to the signature.

Section 4: Filing the Form

- Filing Instructions: After completing the form, mail or fax it to the Montana Department of Revenue, Alcoholic Beverage Control Division at the address or fax number provided:

- Mail:

- Montana Department of Revenue

- Attn: Alcoholic Beverage Control Division Authorization

- P.O. Box 7149

- Helena, MT 59604-7149

- Fax: (406) 444-6642

- Mail:

- Important Notes:

- Each individual, partner, shareholder, or entity associated with the alcoholic beverage license must complete a separate form.

- Do not include this form with your liquor license application. The authorization form should be filed independently.

FAQs

- What is the purpose of the Montana Authorization to Disclose Tax Information Form?

The form authorizes the Montana Department of Revenue’s Alcoholic Beverage Control Division to access your confidential tax information to verify compliance with Montana’s licensing laws. - Who needs to sign the form?

The form must be signed by the taxpayer or authorized representative. If applicable, the spouse, corporate officer, partner, or manager must also sign, depending on the entity type. - How do I file this form?

You can file the form by mailing it to the Montana Department of Revenue or faxing it to (406) 444-6642. - Is a separate form required for each individual or entity?

Yes, each individual, partner, member, shareholder, or entity associated with the alcoholic beverage license must complete a separate form. - Do I need to submit this form with my license application?

No, do not include this authorization form with your liquor license application. It should be filed separately.