The Empowerment Zone Tax Credit Program is available for businesses operating in an empowerment zone and employees who live in an empowerment zone. In addition to a tax credit, the empowerment zone credit may also be used to offset up to 25 percent of alternative minimum tax liability. The program is expected to benefit businesses and employees yearly, assuming that the employee makes at least $15,000 annually. In order to get the credit, you are required to complete a Form 8844. Check out the instructions section if you need to learn how to fill it out.

The form has fillable fields that you can use to fill out information about your business. You can print or share the form. You can claim this credit on your Form 1040, but it must be added to your return. This credit is only available for businesses. There are exceptions to this rule. For example, a family member of the business owner may be a qualified zone employee.

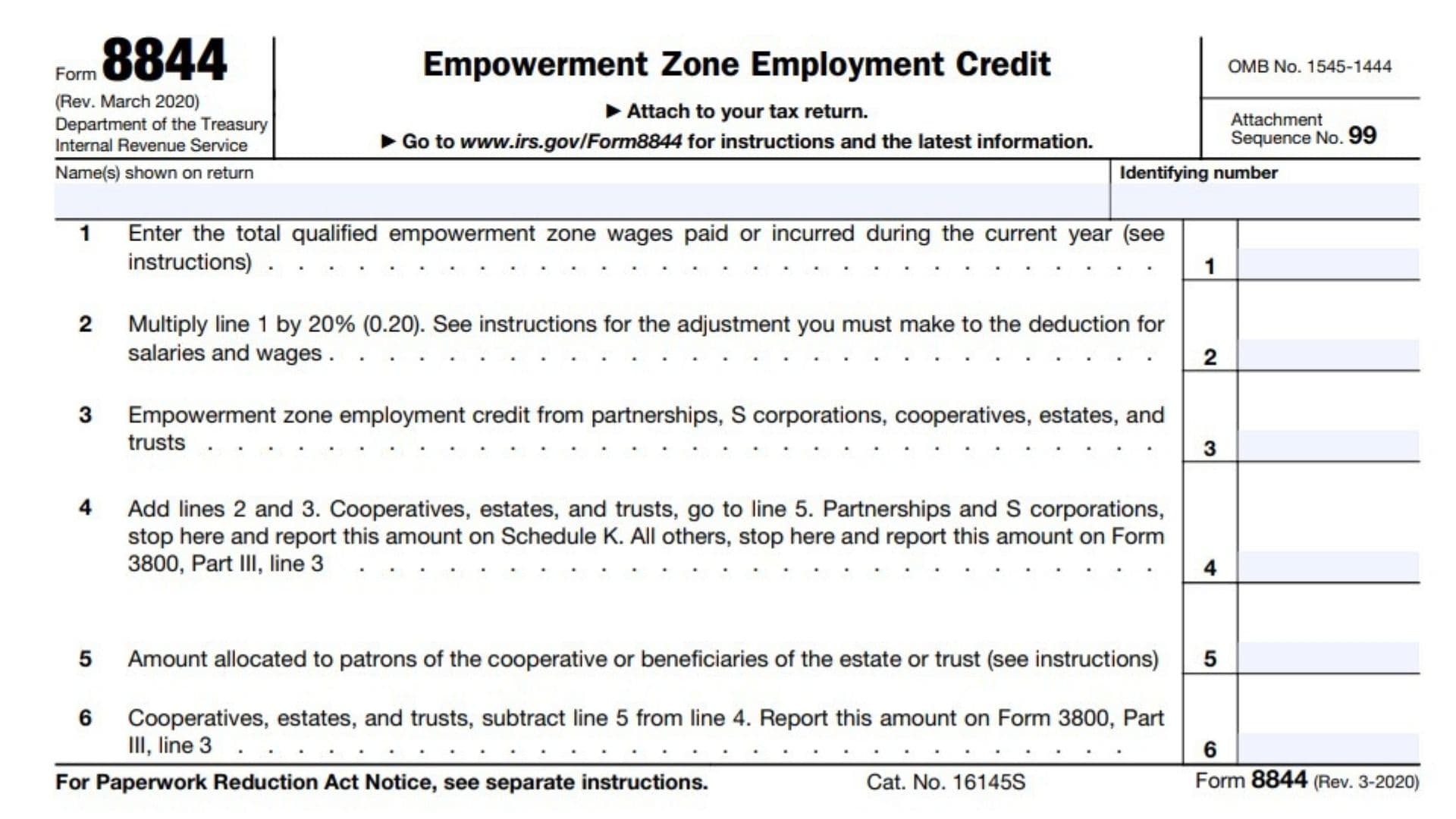

How to Complete Form 8844?

There are only 6 lines in Form 8844. This form is one of the easiest IRS forms to fill out. If you have trouble with the fillout process, we suggest you visit a specialist for help. Here are the line-by-line instructions for IRS Form 8844:

Line 1: Enter the total qualified empowerment zone wages paid or incurred during the current year.

Line 2: Multiply line 1 by 20% (0.20).

Line 3: Empowerment zone employment credit from partnerships, S corporations, cooperatives, estates, and trusts

Line 4: Add lines 2 and 3. Cooperatives, estates, and trusts go to line 5. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, stop here and report this amount on Form 3800, Part III, line 3

Line 5: Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

Line 6: Cooperatives, estates, and trusts; subtract line 5 from line 4. Report this amount on Form 3800, Part III, line 3

Notes

- Qualified zone wages are qualified wages paid or incurred by an employer for services performed by an employee. In contrast, the employee is a qualified zone employee (defined earlier).

- Complete Form 8810, Corporate Passive Activity Loss and Credit Limitations, to determine the allowed credit that must be allocated between the cooperative and the patrons. For details, see the Instructions for Form 8810.

- To Fill Out Line 3, Enter total empowerment zone employment credits from:

Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc., box 15 (code L);

• Schedule K-1 (Form 1120-S), Shareholder’s Share of Income, Deductions, Credits, etc., box 13 (code L);

• Schedule K-1 (Form 1041), Beneficiary’s Share of Income, Deductions, Credits, etc., box 13 (code K); and

• Form 1099-PATR, Taxable Distributions Received From Cooperatives, box 12, or other notice of credit allocation.