Montana Form MEDIA-COMP is required for media production companies to include employee compensation in the Montana media production credit bases. This form must be completed by the production company or its agent for employees and employees of loan-out companies providing personal services in a state-certified production. It ensures proper withholding of taxes and substantiation of compensation costs for the Montana media production credit.

How to File Montana Form MEDIA-COMP

- Obtain the Form: You can access Form MEDIA-COMP online or directly from the Montana Department of Revenue website.

- Complete the Form: Follow the detailed line-by-line instructions provided below to fill out the form properly.

- Submit the Form: The completed form must be kept by the production company for their records, with a copy sent to the certified public accountant and attached to the Montana media production credit application. It must also be provided to the loan-out company or its agent when applicable.

How to Complete Montana Form MEDIA-COMP

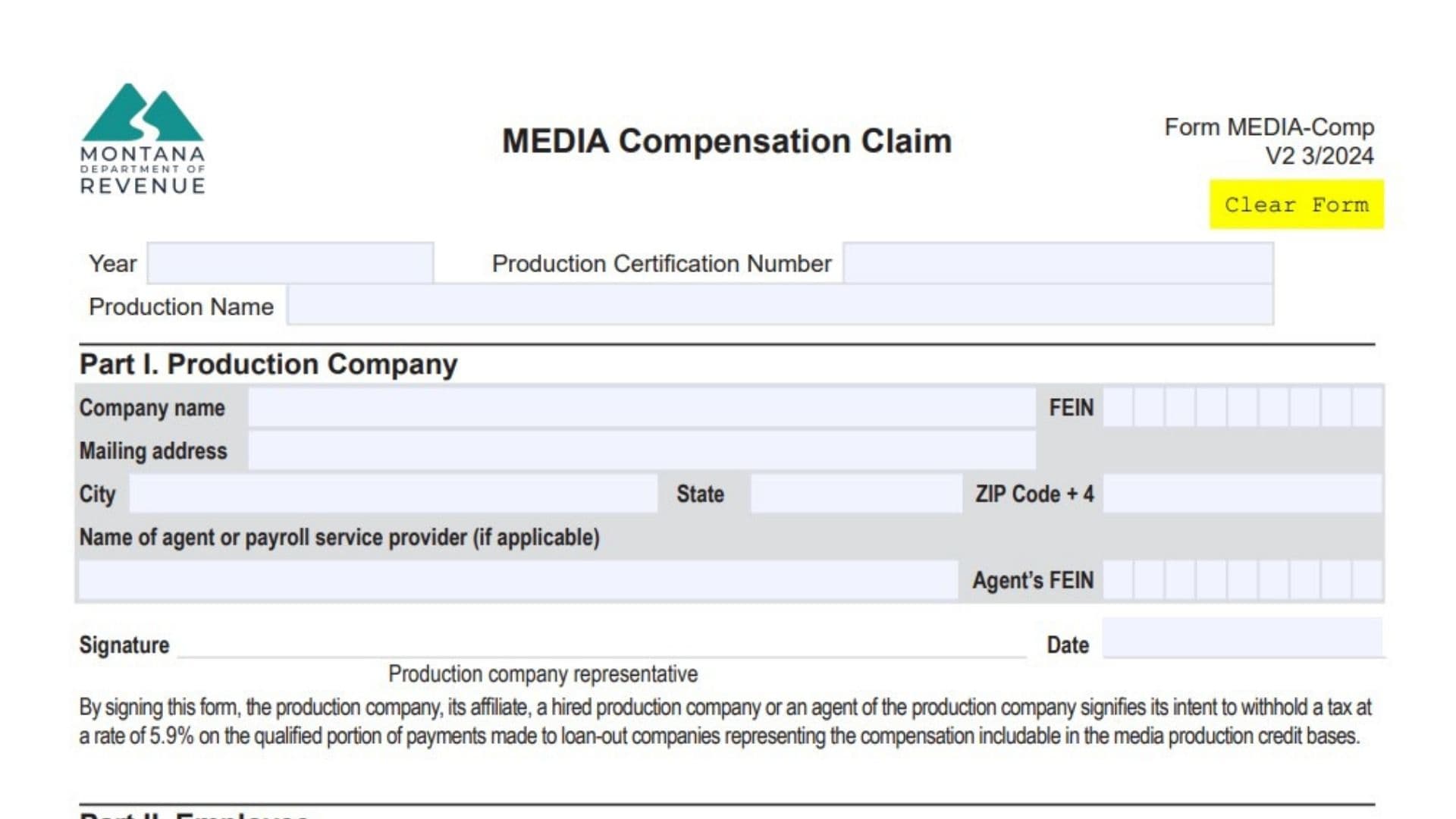

Part I. Production Company

- Year: Enter the calendar year when compensation was paid for the state-certified production in Montana.

- Production Certification Number: Enter the certification number provided by the Montana Department of Commerce upon certification of the production. If this is missing, the form will not be valid for the verification of the media production credit.

- Production Name: Enter the name of the production for which the compensation is being reported.

- Company Name: Provide the full legal name of the production company.

- FEIN (Federal Employer Identification Number): Enter the Federal Employer Identification Number for the production company.

- Mailing Address: Provide the production company’s mailing address, including city, state, ZIP code, and ZIP+4 code.

- Agent or Payroll Service Provider Name: If applicable, provide the name of the agent or payroll service provider for the production company.

- Agent’s FEIN: Enter the Federal Employer Identification Number of the agent or payroll service provider, if applicable.

- Signature and Date: The production company’s representative must sign and date the form, confirming the intent to withhold 5.9% tax on qualified payments made to loan-out companies for compensation included in the media production credit bases.

Part II. Employee

- Employee Name: Enter the full name of the employee who performed services for the production company.

- SSN (Social Security Number): Provide the employee’s Social Security Number.

- Mailing Address: Enter the employee’s mailing address, including city, state, ZIP code, and ZIP+4 code.

- Signature and Date: The employee must sign and date the form, declaring under penalty of false swearing that they are an employee of the production company or have been assigned to perform services for the production company.

- Actor, Director, Producer, or Writer: Mark the appropriate box if the employee is acting as an actor, director, producer, or writer.

- Resident of Montana: Mark this box if the employee is a resident of Montana. A Montana resident is someone domiciled in Montana or maintaining a permanent place of abode in the state. The employee must understand that as a resident, they are subject to Montana state income tax on their worldwide income.

- Student: Mark this box if the employee is a student enrolled in a Montana university or college, and their work on the production will result in college credits.

- Signature and Date: The employee must sign and date this section for the form to be valid.

Part III. Loan-Out Company

- Loan-Out Company Name: Enter the name of the loan-out company if applicable.

- Loan-Out Company FEIN: Provide the loan-out company’s Federal Employer Identification Number.

- Mailing Address: Enter the loan-out company’s mailing address.

- Employee of Loan-Out Company: Mark this box if the employee listed in Part II is an employee of the loan-out company. Loan-out companies are those hired to produce or contribute elements to a state-certified production.

Important Notes

- Record Keeping: The production company must retain a copy of the completed form for its records and submit it to the certified public accountant responsible for signing the production expenditure verification report.

- Substantiation: A copy of Form MEDIA-COMP must be included with the substantiation documents required for the media production credit application. Any media production credit claims for compensation costs incurred in Montana without substantiating Form MEDIA-COMP will be denied.

- Multiple Productions: If an employee works on multiple state-certified productions in a given year, a separate Form MEDIA-COMP must be completed for each production.

Final Submission

Once the form is completed, signed, and dated, the production company must retain the original form in its records, submit a copy to the certified public accountant, and include it in the substantiation documents for their Montana media production credit application.