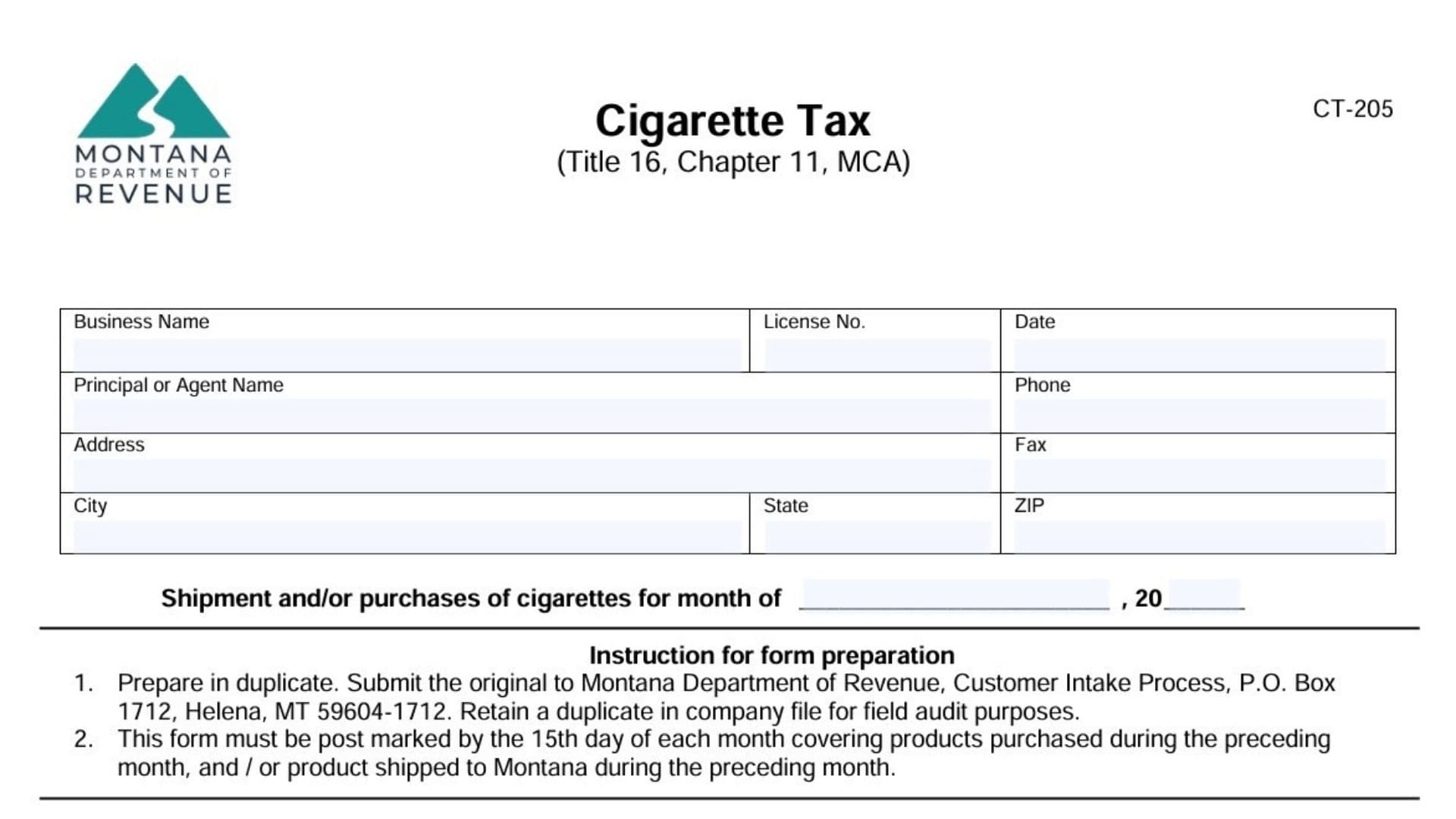

Form CT-205, the Montana Cigarette Tax Return, is the monthly reporting document required under Title 16, Chapter 11, MCA for cigarette wholesalers, distributors, and out-of-state shippers who handle unstamped or decal-applied cigarettes entering the state. This form tracks your cigarette inventory reconciliation, calculates tax liability based on both traditional stamping methods and newer decal systems, and ensures accurate remittance of Montana’s $0.085 per cigarette tax rate. Wholesalers must submit detailed purchase records, distribution summaries, and exemption documentation to verify compliance, while the form’s dual-section structure handles both traditional cigarette reconciliation and the decal reconciliation for modern tax collection methods. Due by the 15th of each month for the prior month’s activity, CT-205 requires duplicate preparation with the original mailed to the Montana Department of Revenue and a copy retained for audit purposes.

Filing Requirements And Deadlines

Who Must File

- Montana cigarette wholesalers

- Out-of-state wholesalers shipping into Montana

- Distributors handling unstamped inventory

- Anyone affixing cigarette tax decals

Due Date

Postmarked by the 15th day of each month covering purchases and/or shipments from the previous month.

Submission Address

Montana Department of Revenue

Customer Intake Process

P.O. Box 1712

Helena, MT 59604-1712

Preparation Rules

- Prepare in duplicate

- Mail original to DOR

- Retain duplicate for field audits

How To Complete Form CT-205

Header Information

- Business Name: Enter your full legal business name

- License No.: Write your Montana cigarette wholesaler license number

- Date: Current date of preparation

- Principal or Agent Name: Name of responsible individual

- Phone: Business phone number

- Address, Fax, City, State, ZIP: Complete contact information

- Month/Year: Specify “Shipment and/or purchases of cigarettes for month of [Month], 20[Year]”

Section 1: Cigarette Reconciliation

Montana wholesalers only complete this reconciliation of unstamped cigarette inventory.

- Line 1: Enter beginning unstamped cigarette inventory at start of the month

- Line 2: Record total cigarettes reported on Schedule A (purchases)

- Line 3: Add Line 1 + Line 2 for total available cigarettes

- Line 4: Subtract total stamped cigarettes distributed in Montana

- Line 5: Deduct total wholesaler and exempted sales of unstamped cigarettes (Part 1, Schedule B total)

- Line 6: Deduct total out-of-state retail sales (Part 2, Schedule B total)

- Line 7: Calculate ending unstamped cigarette inventory (Line 3 minus Lines 4, 5, and 6)

Section 2: Cigarette Decals Reconciliation

Decal Package Types (Columns A, B, C)

- Column A: 20/pack decals ($1.70 tax value)

- Column B: 20/pack decals ($1.70 tax value)

- Column C: 25/pack decals ($2.125 tax value)

- Column D: Total decals (A + B + C)

Decal Inventory Calculation

- Line 8: Beginning of period inventory for each decal type

- Line 9: Total decals purchased during the period for each type

- Line 10: Total decals available (Line 8 + Line 9)

- Line 11: Damaged decals deducted for each type

- Line 12: Period ending inventory for each type

- Line 13: Total taxable decals affixed (Line 10 minus Lines 11 and 12)

- Line 14: Decal taxable value per type ($1.70, $1.70, $2.125)

- Line 15: Total tax value (Line 13 × Line 14 rates)

- Line 16: Total tax value of all decals (add Line 15A + 15B + 15C)

Final Tax Calculation

- Line 17: Total distribution into Montana (Line 4 from Section 1 × $0.085/cigarette)

- Line 18: Difference (Line 16 minus Line 17)

- Line 19: Exempted sales value (Schedule C total × $0.085/cigarette)

- Line 20: Total Montana cigarette tax collected (Line 18 minus Line 19)

Certification And Signature

- Statement: Affirm under penalty of false swearing that all information and attachments are accurate

- Print Name of Principal or Agent: Legible printed name

- Date: Submission date

- Signature: Authorized principal or agent signature

Required Schedules

Schedule A: Cigarette Wholesaler Purchasing Recap

In-state wholesalers: Detail ALL purchases

Out-of-state wholesalers: List ONLY Montana shipments

Columns for each entry:

- Date Rec’d: Receipt date

- Invoice No: Invoice/bill number

- Manufacturer Columns (A-F): Cigarettes by brand (in thousands)

- Qty (F): Other manufacturer quantities

- Total Sticks: Sum of all columns G (in thousands)

Totals:

- Total this page: Column G sum for current page

- Total all pages: Grand total flows to CT-205 Line 2

Schedule B: Wholesaler And Exempted Sales (Montana Wholesalers Only)

Part 1 – Wholesaler/Exempted Unstamped Sales:

- Sales Invoice/Date/Number

- Sold To: Name, Address, City, State, ZIP

- Number of Cigarettes

Part 2 – Out-of-State Retail Sales:

Same format as Part 1

Totals flow to: CT-205 Lines 5 and 6

Schedule C: Exempted Stamped Cigarette Sales

Reconciliation of CT-206 Exemption Certificates (attach all CT-206 forms)

Columns:

- Sales Invoice/Date/ID

- Sold To: Business name, Phone

- Column A: 200 sticks/carton

- Column B: 250 sticks/carton

- Column C: Total sticks (A + B)

Total flows to: CT-205 Line 19

Submission Checklist

☐ CT-205 completed in duplicate

☐ All schedules attached (A, B, C)

☐ All CT-206 exemption certificates attached

☐ Tax payment enclosed (if applicable)

☐ Postmarked by 15th of month

☐ Copy retained for records

Important Compliance Notes

- Monthly Deadline: 15th of each month for prior month activity

- Tax Rate: $0.085 per cigarette

- Decal Values: $1.70 (20/pack), $2.125 (25/pack)

- Audit Retention: Keep duplicate copy for field examinations