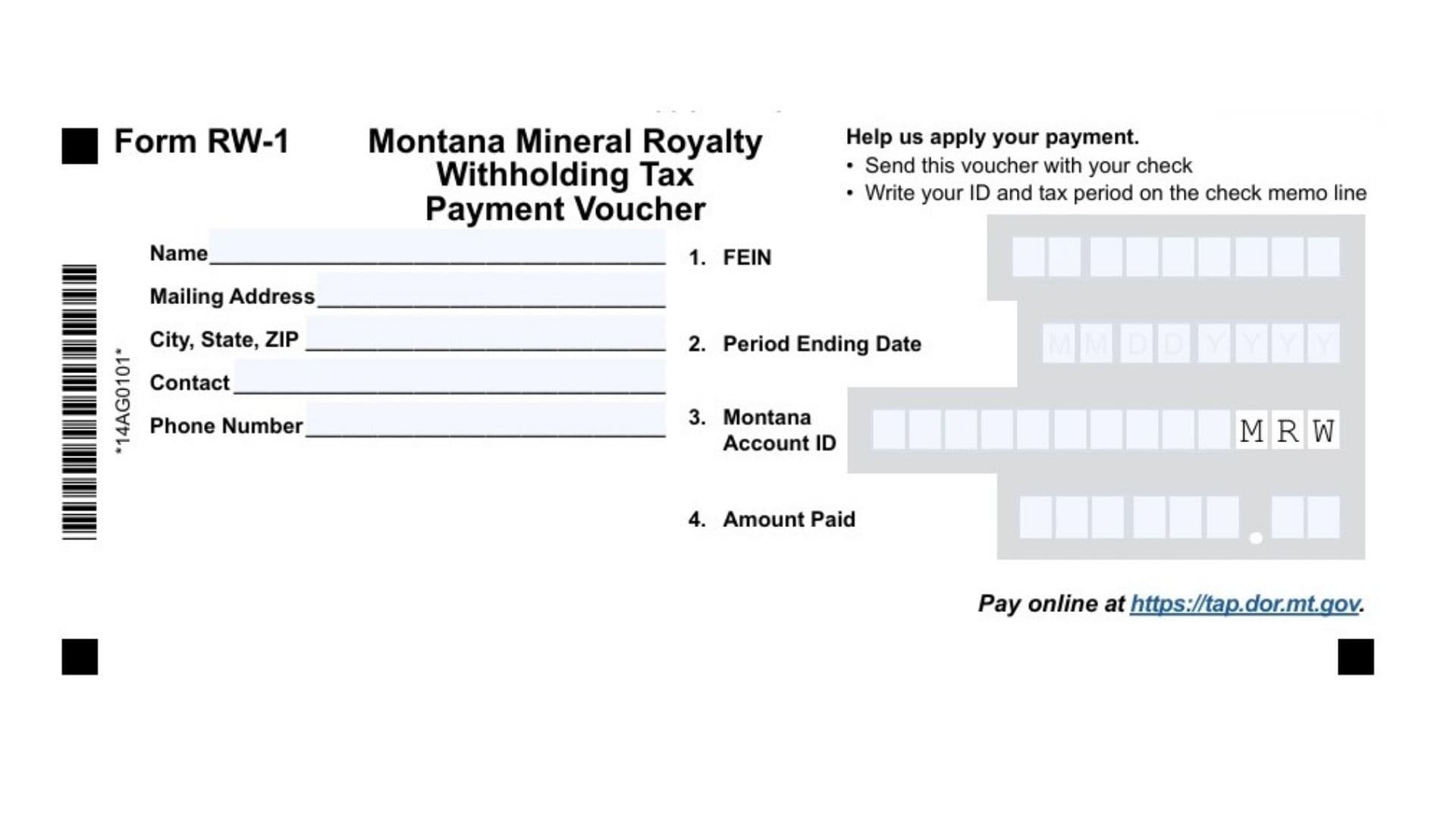

Montana Form RW-1, officially titled the Mineral Royalty Withholding Tax Payment Voucher, is a specific remittance document used by remitters of mineral royalties to pay the state tax withheld from royalty payments. If you are responsible for distributing mineral royalties from Montana sources, state law often requires you to withhold a portion of those payments for tax purposes. This voucher serves as the physical companion to your check payment, ensuring the Montana Department of Revenue can accurately identify your business and apply the funds to the correct tax period. While the department encourages electronic payments through its TransAction Portal (TAP)—and mandates them for amounts of $50,000 or more—Form RW-1 is the required standard for those who choose or need to mail a paper check. It is typically used for quarterly payments or whenever a withholding payment is due outside of an electronic filing.

How To File Montana Form RW-1

Filing Form RW-1 correctly prevents processing errors. You have two primary methods:

- Online (Preferred): You can pay electronically via the TransAction Portal (TAP) at

https://tap.dor.mt.gov. You can use e-check (free) or a credit/debit card (for a small fee). Note: If your payment is $50,000 or greater, you must pay electronically; you cannot use the paper voucher. - By Mail: If paying by check, complete the voucher and mail it along with your payment.

- Do not staple or tape the voucher to your check.

- Separate vouchers must be used if you are paying for multiple tax periods.

- Write your ID and tax period on the check’s memo line.

Mailing Address:

Montana Department of Revenue

PO Box 6309

Helena, MT 59604-6309

How To Complete Montana Form RW-1

Follow these simple steps to fill out the voucher accurately before detaching and mailing it.

- Name: Enter the legal name of the remitter or business entity responsible for the tax.

- Mailing Address: Provide the full mailing address for the business.

- City, State, ZIP: Enter the city, state, and ZIP code.

- Contact: Write the name of the person the department should contact if they have questions.

- Phone Number: Provide a valid phone number for the contact person.

- Line 1: FEIN: Enter your 9-digit Federal Employer Identification Number. This is critical for matching the payment to your account.

- Line 2: Period Ending Date: Enter the specific Tax Period Ending Date for which this payment is being made. Use the format MM/DD/YYYY.

- Line 3: Montana Account ID: Enter your specific Montana Mineral Royalty Withholding Account ID.

- Line 4: Amount Paid: Enter the exact dollar amount of the payment you are enclosing.

Final Step: Cut the form along the dotted line labeled “Cut line” and place the bottom voucher portion in the envelope with your check.