The Montana Form EXPT, officially titled the “Tax-Exempt Status Request Form for Income Taxes,” is a critical document used by various organizations to formally request immunity from filing and paying Montana corporate income tax. While many entities might assume their federal tax-exempt status automatically applies at the state level, Montana requires a specific application to grant this privilege officially. This form is designed for a wide range of entities, including non-profit corporations, homeowners associations (HOAs), religious groups, and certain unincorporated entities like pension trusts or IRAs. It is important to distinguish this form’s purpose from other tax reliefs; specifically, it is strictly for income tax exemption and cannot be used to request relief from property taxes (which requires Form AB-30R). Without this approved status, entities doing business in the state generally remain liable for filing an annual Montana Business Income Tax Return.

How To File Montana Form EXPT

Once you have completed the form and gathered all necessary attachments, you have two primary methods for submission. You can mail the physical application package to the Montana Department of Revenue, Corporate Income Tax Unit, PO Box 5805, Helena, MT 59604-5805. Alternatively, if you prefer a faster method, you may fax your application to (406) 444-0750.

How To Complete Montana Form EXPT

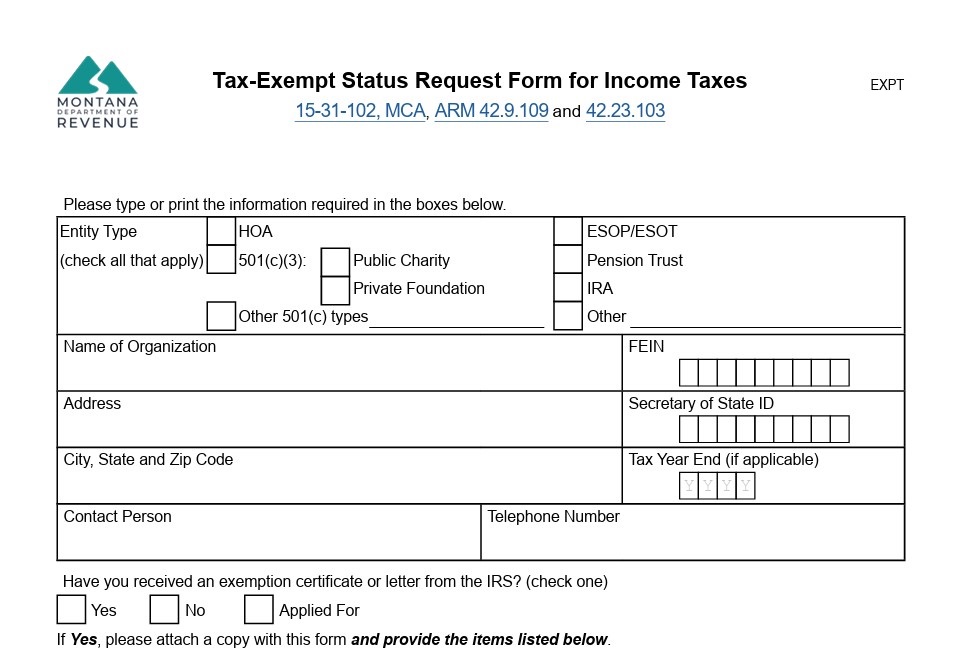

This section breaks down the form line-by-line. Please type or print legibly to ensure your application is processed without delay.

1. Organization Information

- Name Of Organization: Enter the full legal name of the entity requesting the exemption.

- FEIN (Federal Employer Identification Number): Input your entity’s federal tax ID number here. While most incorporated entities have one, some religious groups or small entities might not. If you do not have an FEIN, you may leave this blank, though you must provide one if you are ever claiming a refund. Note for IRAs: Use the IRA’s specific FEIN, not the number belonging to the trustee or custodian.

- Address: Provide the mailing address where the department should send correspondence.

- Secretary Of State ID: This is your Montana-specific identification number, often called a Certified File Number. It starts with a letter followed by six to eight digits (e.g., D123456). You can find this on your certificate of authority or by searching the Montana Secretary of State’s website.

- City, State, And Zip Code: Complete these fields for your mailing address.

- Tax Year End: If your organization operates on a fiscal year rather than a calendar year, indicate the month and day your tax year ends.

- Contact Person And Telephone Number: List the name and direct phone number of the individual the department should contact if they have questions about this application.

2. Federal IRS Status

You must indicate your current standing with the Internal Revenue Service by checking one of the three boxes:

- Yes: Check this if you have already received a determination letter from the IRS granting you federal tax-exempt status. Requirement: You must attach a copy of this determination letter to your application. Note that your EIN assignment letter does not count as proof of exemption.

- No: Check this if you have not applied for federal exemption. You can still qualify in Montana by following the specific instructions below for your entity type.

- Applied For: Check this if you have submitted paperwork to the IRS but are still waiting for a decision. Requirement: You must note the date you submitted your federal application and agree to send the Montana Department of Revenue a copy of the IRS letter once it arrives.

3. Required Attachments (The “General Rule”)

Most applicants must verify their eligibility by attaching four specific documents. Unless your entity type has special instructions (see Section 4 below), submit copies of:

- Affidavit Of Activities: A written statement describing your organization’s character, purpose, actual daily activities, income sources, and how money is spent. You must explicitly state whether any income benefits a private individual or shareholder. This document does not need to be notarized.

- Articles Of Incorporation: The legal document establishing your corporation.

- By-Laws: The internal rules governing your organization.

- Financial Statement: A recent report showing your assets, liabilities, money coming in (receipts), and money going out (disbursements). A simple bank statement or spreadsheet is often sufficient.

4. Entity-Specific Instructions And Exceptions

Some organizations have different documentation requirements. Check if you fall into one of these categories:

- Religious Organizations: If you do not have an IRS letter, you must state this in your application. In addition to the standard four attachments above, include your federal Form 990 if you file one.

- Homeowners Associations (HOAs): Montana generally considers HOAs tax-exempt even if the IRS does not. You must submit the standard attachments plus your federal Form 1120-H. Warning: Commercial HOAs do not qualify. If you file a standard federal Form 1120, your approval is not guaranteed, but the department will review it.

- Unincorporated Entities (ESOP/ESOT, Pensions, IRAs): Instead of the Affidavit and Financial Statement (Items 1 and 4 above), you must submit documents related to the plan’s adoption and administration, along with any relevant IRS filings (like Form 5309 or 5500).

- Other “Exempt Purpose” Entities: If you don’t fit the categories above and lack an IRS letter, you may still apply if you are organized for exempt purposes defined in IRC 501(c)(3). Provide the standard four attachments or explain why they are unavailable.

5. Entity Type Selection

Check every box that applies to your organization to help the department classify you correctly:

- HOA (Homeowners Association)

- ESOP/ESOT (Employee Stock Ownership Plans)

- 501(c)(3) Categories: Check if you are a Public Charity or Private Foundation.

- Pension Trust or IRA

- Other 501(c) Types: Specify the subsection (e.g., 501(c)(4)).

- Other: Describe your entity if it does not fit the list.

6. Signature And Certification

To finalize the form, an authorized representative must sign it.

- Print Name: Clearly write the name of the signer.

- Title: Enter the signer’s official role (e.g., President, Treasurer, Trustee).

- Signature: The authorized person must sign here.

- Date: Enter the date the application is signed.

7. Important Post-Filing Notes

- Unrelated Business Taxable Income (UBTI): Even with tax-exempt status, if your organization generates more than $100 in federal unrelated business taxable income, you must file a Montana Corporate Income Tax Return (Form CIT) and pay taxes on that specific income.

- Pass-Through Owners: If a tax-exempt entity owns part of a partnership, the partnership must withhold tax for them unless the exempt entity files Form PT-AGR (Pass-Through Entity Owner Tax Agreement) to waive this requirement.