Montana Form ATL, officially titled Assumption of Montana Tax Liabilities, is a form used when one corporation agrees to take over the Montana tax responsibilities of another corporation. This situation most commonly arises during mergers, consolidations, dissolutions, withdrawals, or combined Montana tax filings. The purpose of the form is to formally notify the Montana Department of Revenue that Corporation 2 is legally accepting all existing and future Montana tax obligations—such as taxes, penalties, and interest—originally owed by Corporation 1. By filing Form ATL, the assuming corporation enables Corporation 1 to request either a tax clearance certificate or a dissolution/withdrawal certificate, which are often required to legally close, merge, or reorganize a business entity in Montana. This form is specifically designed for entities taxed as C corporations, including disregarded entities that are wholly owned by a C corporation and included in combined filings.

Who Needs To File Montana Form ATL?

You should file Montana Form ATL if:

- A corporation is assuming the Montana tax liabilities of another corporation

- A merger or consolidation has occurred

- A corporation is part of a combined Montana tax return and needs a tax certificate

- A disregarded entity owned by a C corporation is involved in restructuring

If none of these apply, this form is generally not required.

How To File Montana Form ATL

Montana Form ATL is filed by mailing a completed and signed paper form to the Montana Department of Revenue. Electronic filing is not currently available for this form. Once completed, the form must be mailed to the address listed at the end of the document. The form must be signed by an authorized officer of Corporation 2, as the state requires a legally binding affirmation of assumed tax liability.

How To Complete Montana Form ATL

Below is a detailed explanation of every line and section of Montana Form ATL, rewritten clearly without copying the original wording.

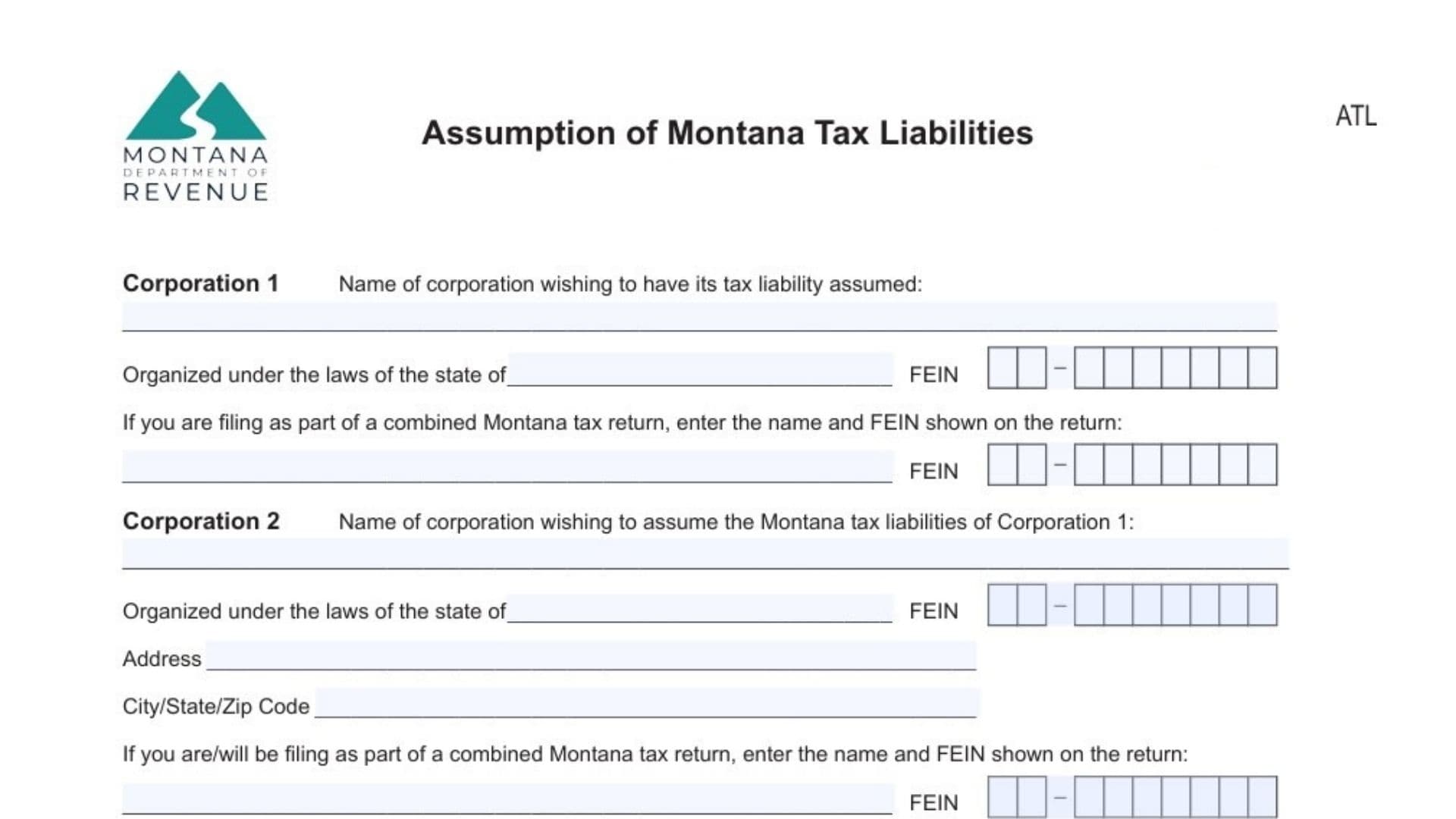

Corporation 1 Section

Name Of Corporation Wishing To Have Its Tax Liability Assumed

Enter the full legal name of the corporation whose Montana tax responsibilities will be transferred. This name must exactly match state and federal records.

Organized Under The Laws Of The State Of

Write the U.S. state where Corporation 1 was legally formed or incorporated.

FEIN

Provide the Federal Employer Identification Number assigned to Corporation 1 by the IRS.

Combined Montana Tax Return Information (If Applicable)

If Corporation 1 is included in a combined Montana tax return, enter the name and FEIN of the company that files the combined return. This is typically the parent or reporting entity.

Corporation 2 Section

Name Of Corporation Assuming The Montana Tax Liabilities

Enter the full legal name of the corporation that is agreeing to take responsibility for Corporation 1’s Montana tax obligations.

Organized Under The Laws Of The State Of

List the state in which Corporation 2 was legally organized.

FEIN

Enter Corporation 2’s Federal Employer Identification Number.

Address

Provide the complete mailing address for Corporation 2, including street address or P.O. box.

City, State, Zip Code

Fill in the city, state, and ZIP code corresponding to Corporation 2’s address.

Combined Montana Tax Return Information (If Applicable)

If Corporation 2 is included in a combined Montana tax filing, enter the name and FEIN of the entity under which the combined return is filed.

Mergers Or Consolidations Only Section

Entity Type Of Corporation 2

If Corporation 1 merged or consolidated into Corporation 2, describe what type of entity Corporation 2 is for federal tax purposes. For example, an LLC taxed as a C corporation should be clearly identified as such.

Will You Continue To File Montana Tax Returns?

Check “Yes” if Corporation 2 will continue filing Montana tax returns after the merger or consolidation. Check “No” if it will not.

Montana Filing Name And FEIN (If Yes)

If you answered “Yes,” enter the name and FEIN under which future Montana tax returns will be filed.

Certificate Type Section

Tax Clearance Certificate For Corporation 1

Check this box if Corporation 1 is requesting a tax clearance certificate from the Montana Department of Revenue.

Dissolution Or Withdrawal Certificate For Corporation 1

Check this box if Corporation 1 is requesting authorization to dissolve or withdraw from Montana.

Only select the option(s) that apply to Corporation 1’s situation.

Affidavit And Signature Section

Agreement Statement

By completing this section, Corporation 2 confirms that it:

- Has authorized representation signing the form

- Will file all required Montana tax documents for Corporation 1

- Will pay all existing and future Montana tax liabilities of Corporation 1

- Accepts that enforcement actions will be handled in Montana courts

This agreement is legally binding.

Declaration Statement

The signer confirms, under penalty of false swearing, that all information provided is accurate and complete.

Signature Of Officer

An authorized officer of Corporation 2 must sign here.

Date

Enter the date the form is signed.

Title

Provide the official job title of the signing officer.

Telephone Number

Enter a direct phone number where the signing officer can be reached.

Mailing Instructions

Mail the completed form to:

Montana Department of Revenue

PO Box 5805

Helena, MT 59604-5805

This address should be used exactly as written to avoid processing delays.