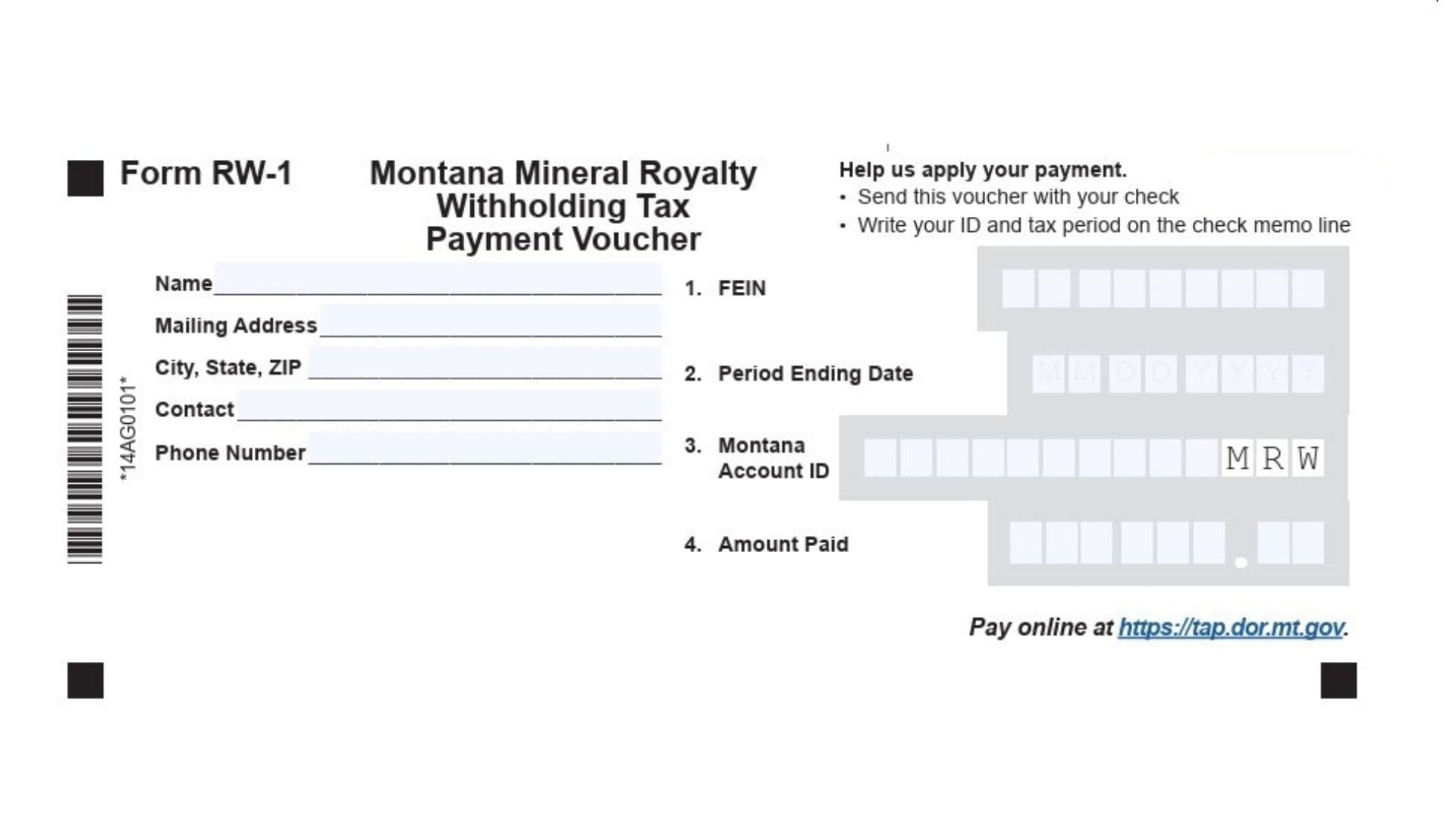

The Montana Mineral Royalty Withholding Tax Payment Voucher Form RW-1 is an essential form used by taxpayers who are required to remit withholding taxes on mineral royalties. This tax is applicable to individuals or businesses involved in the extraction and sale of mineral resources in Montana. The form serves as a voucher for submitting tax payments to the Montana Department of Revenue, ensuring that the payments are properly recorded and applied to the correct tax period. By filling out this form accurately, taxpayers can ensure that their mineral royalty withholding taxes are processed correctly, whether they are paying for the current year, an amended return, or an extension. The form provides detailed instructions for paying by check or electronically, including the Montana Department of Revenue’s online payment portal, which simplifies the payment process.

How to File the Montana Form RW-1?

Filing the Montana Mineral Royalty Withholding Tax Payment Voucher Form RW-1 is a crucial step in ensuring timely and accurate tax payments. The form allows taxpayers to submit their payments either by check or electronically, following the clear instructions provided. Here’s how you can complete the form and file it:

Pay by Check

- Complete the Payment Voucher:

- Name: Enter the name of the individual or entity responsible for the payment.

- Mailing Address: Provide the full mailing address of the taxpayer, including the city, state, and ZIP code.

- Contact Name: Enter the name of the contact person associated with the tax payment.

- Phone Number: Provide a phone number where you can be reached if there are any issues with your payment.

- FEIN (Federal Employer Identification Number): Enter your FEIN, if applicable. This helps the Department of Revenue match the payment to your account.

- Period Ending Date: Provide the ending date of the tax period for which you are making the payment.

- Montana Account ID: Enter your Montana Account ID, which helps identify your specific tax account.

- Amount Paid: Enter the total amount being paid with this voucher.

- Write a Memo on Your Check:

- Write your Montana Account ID and the tax period on the memo line of your check. This ensures that the payment is credited to the correct account.

- Mail the Voucher and Check:

- Complete the voucher and detach it from the form.

- Mail the voucher and check to the following address:

Montana Department of Revenue PO Box 6309 Helena, MT 59604-6309 - Note: Do not staple or attach the check to the voucher.

Pay Electronically

- Visit the Montana TransAction Portal (TAP):

- Go to the website https://tap.dor.mt.gov to pay your mineral royalty withholding tax electronically.

- Electronic Payment Options:

- You can pay by e-check (no fee) or by credit/debit card (for a small fee). The portal allows for easy and quick payments for both e-filed and paper-filed returns.

- Required Electronic Payments:

- Payments of $500,000 or more must be made electronically, as required by Montana law.

How to Complete Montana Form RW-1

- Name: Provide the name of the individual or business responsible for the payment.

- Mailing Address: Enter the complete address, including city, state, and ZIP code.

- Contact Name: Provide the name of the person who can be contacted regarding the payment.

- Phone Number: Enter a phone number where the contact person can be reached.

- FEIN: Enter the Federal Employer Identification Number (FEIN) if applicable.

- Period Ending Date: Specify the date that marks the end of the tax period you are making the payment for.

- Montana Account ID: Provide your Montana account ID to help ensure proper application of the payment.

- Amount Paid: Indicate the total amount being paid with this voucher.

Additional Payment Instructions

- Multiple Tax Periods: If you are making payments for more than one tax period, be sure to use a separate voucher for each period.

- Do Not Staple: Do not staple the voucher to the check or tax return.

- Mailing Address for Payment: The completed voucher and check should be mailed to:

Montana Department of Revenue PO Box 6309 Helena, MT 59604-6309 - Online Payment: For online payment, use the Montana TransAction Portal (TAP) at https://tap.dor.mt.gov.