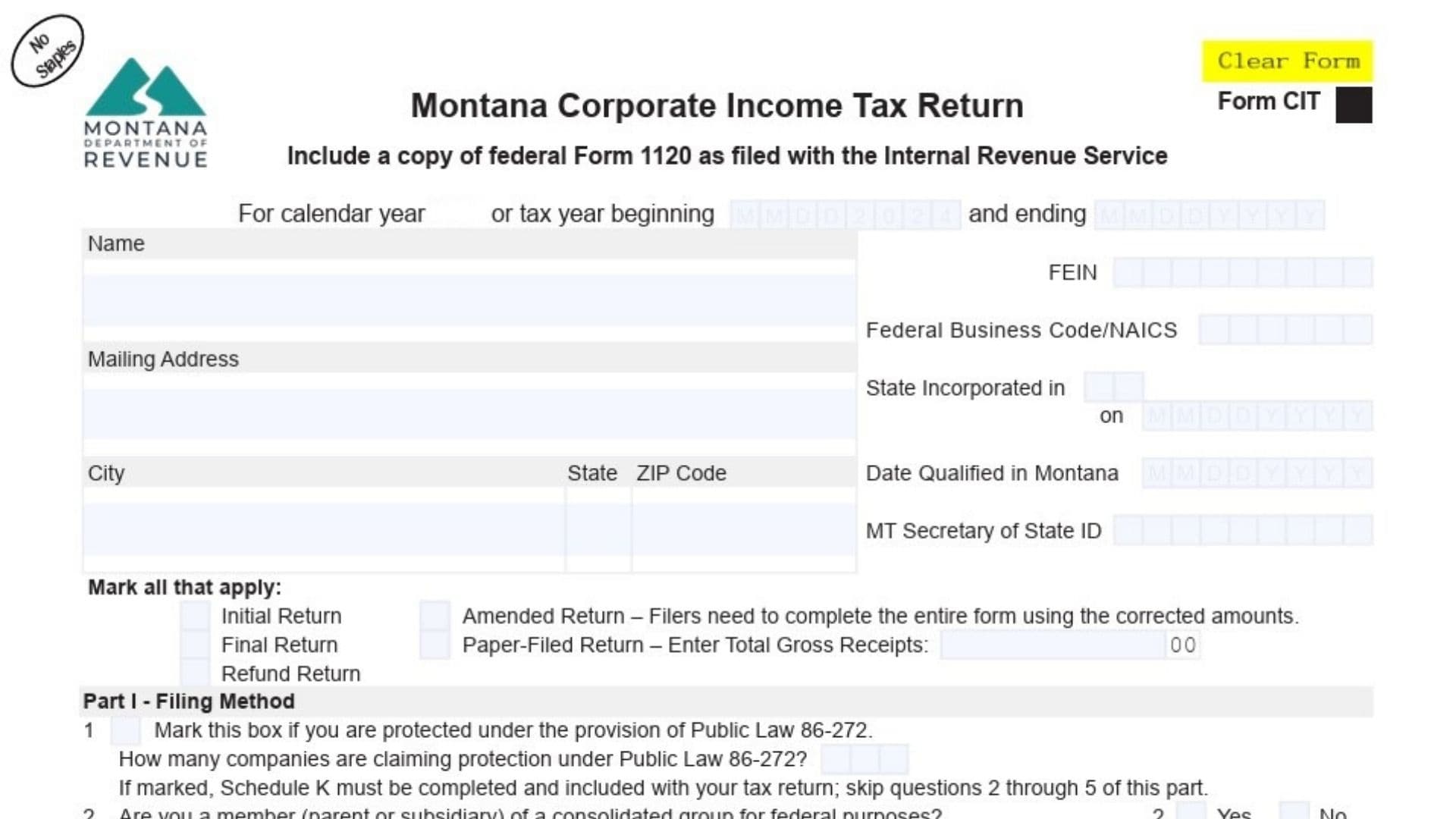

The Montana Corporate Income Tax Return (Form CIT) is a state-level tax form required for corporations conducting business in Montana. Corporations must file this form annually, reporting their income, deductions, credits, and taxable activities within the state. It is essential for corporations doing business in Montana to comply with this filing requirement to calculate their state income tax liability. The form integrates various schedules and specific questions that determine the company’s tax obligations, including apportionment factors, special transactions, and credits.

How to File the Montana Form CIT

- Download the Form:

- You can access the Montana Corporate Income Tax Form CIT from the official Montana Department of Revenue website or directly through the tax portal.

- Complete the Form:

- Ensure that you have all necessary supporting documents, including your federal Form 1120, as you will need to reference this for information about your business’s income and tax position.

- Filing Methods:

- Initial Return: If this is your corporation’s first return.

- Amended Return: If you’re correcting a previously filed return, you must complete the entire form with corrected amounts.

- Final Return: If your corporation is dissolving or ceasing operations in Montana.

- Refund Return: If you are seeking a refund from overpayments in previous years.

- Choose the Appropriate Filing Status:

- On Part I, you’ll need to check whether you’re a part of a consolidated group for federal tax purposes or filing a combined return.

- Answer General Questions:

- On Part III, the form asks a series of questions, including whether this is the first return or if you’ve had any changes in business operations (e.g., mergers, reorganizations).

- Special Transactions (Schedule M):

- If your corporation has special transactions, you need to provide additional details. This may include things like foreign income, changes in tax credits, or federal changes (refer to Schedule M for specifics).

How to Complete Montana Form CIT

- Part I: Filing Method

- Mark the appropriate box: Indicate if your business is claiming protection under Public Law 86-272 (which allows businesses engaged in interstate commerce but with limited presence in Montana to avoid filing taxes in Montana).

- If you’re part of a consolidated group, indicate whether you’re filing a combined return for Montana, which will require Schedule M.

- Part II: Amended Return (if applicable)

- Complete this section only if you are amending a previously filed return. Include any necessary documents, such as a federal revenue agent’s report or an amended federal tax return (Form 1120X).

- Part III: General Questions

- Answer whether this is your first Montana tax return, if the corporation has any activities in Montana, and provide specific information if any IRS notices have been issued regarding your tax returns.

- Part IV: Reporting Special Transactions

- Schedule M will be required to report any special transactions, such as foreign income or other complex transactions that may impact your tax filing.

- Computation of Montana Taxable Income

- In Part III, report your federal taxable income from Form 1120, making any necessary additions or subtractions. This includes federal tax-exempt interest, state or local taxes, and contributions to qualified endowment credits.

- Net Operating Loss (NOL) Carryover: Report any carryover of NOLs from previous years to reduce your taxable income. Refer to Schedule NOL for additional instructions on carrying over losses.

- Tax Liability Calculation

- On Page 3, calculate your Montana tax liability by multiplying your taxable income by the appropriate tax rate (6.75% for most corporations, or 7% for those with a valid Water’s Edge election).

- Ensure that your calculated tax liability is at least $50, as that is the minimum liability.

- Schedule K: Apportionment for Multi-State Taxpayers

- If your corporation operates in multiple states, you must complete Schedule K, which calculates the apportionment of income based on property, payroll, and receipts within Montana.

- Property Factor, Payroll Factor, and Receipts Factor: For each factor, report the amounts associated with your Montana operations and total receipts.

- Tax Payments and Credits (Schedule C)

- Report any payments made, such as quarterly estimated payments or Montana tax withheld from pass-through entities. Additionally, report nonrefundable and refundable credits, such as the Montana Dependent Care Assistance Credit and the Biodiesel Blending and Storage Credit.

- Final Steps

- Sign and Date: The corporate officer or authorized representative must sign the return.

- Payment: If you owe taxes, you can submit your payment through the online Montana Department of Revenue portal or include a check with your mailed return.

- Submission:

- Submit the completed form along with all required schedules, such as Schedule M (for special transactions) and Schedule K (for apportionment).

What to Include with the CIT Form

- Federal Form 1120: A copy of the complete federal return must be attached.

- Supporting Schedules: Depending on your filing type, attach the relevant schedules (e.g., Schedule K, Schedule M, Schedule NOL).

- Payment: If applicable, include a check or arrange for an electronic payment.