Montana Form EST-PTI, titled Interest on Underpayment of Estimated Tax for Composite Tax and Pass-Through Entity Tax, is a specialized worksheet that pass-through entities like partnerships and S corporations use to determine if they owe interest for not making sufficient quarterly estimated payments toward their Montana composite tax or elective pass-through entity tax (PTET) obligations during the tax year. Introduced to align with Montana’s PTET regime and composite filing options, this form applies when an entity’s expected annual liability for these taxes exceeds $500 after credits, requiring 90% of the current-year tax or 100% of the prior-year tax (whichever is less) to be paid in timely installments to avoid interest charges calculated at a daily rate based on an 8% annual rate under 15-30-2512 MCA. The form offers a simplified short method for entities with even payments, a standard regular method for uneven or varied installments with due dates of April 15, June 15, September 15, and January 15 (adjusted for weekends/holidays and fiscal years), and references an optional annualized income installment method in Part IV for seasonal or irregular income patterns—though in most cases, the Montana Department of Revenue computes any underpayment interest automatically and bills the entity if owed, meaning Form EST-PTI is typically only submitted with Form PTE when using the annualized approach or self-reporting the calculation on line 31. Accurate completion helps entities avoid surprises while ensuring compliance with estimated payment rules that prevent interest accrual on shortfalls, promoting timely remittance of taxes on Montana-source income allocated to owners.

What Is Montana Form EST-PTI?

Form EST-PTI calculates interest charged on insufficient estimated payments for Montana’s composite tax (filed on behalf of consenting nonresident owners) or elective pass-through entity tax. Interest accrues daily from each installment due date until paid or the return due date (whichever is earlier), but no interest applies if the net liability after credits is under $500 or prior-year tax was zero. The Department often handles the computation itself unless the annualized method is elected.

When And How To File Form EST-PTI

In most situations, do not attach Form EST-PTI to your Form PTE—the Department calculates and assesses any interest later. Submit it only if using the annualized income installment method (complete Part IV, not included in the provided pages) or if self-reporting the interest amount on Form PTE line 31. File with your Montana Pass-Through Entity Tax Return (Form PTE) by the original or extended due date.

How to Complete Montana Form EST-PTI

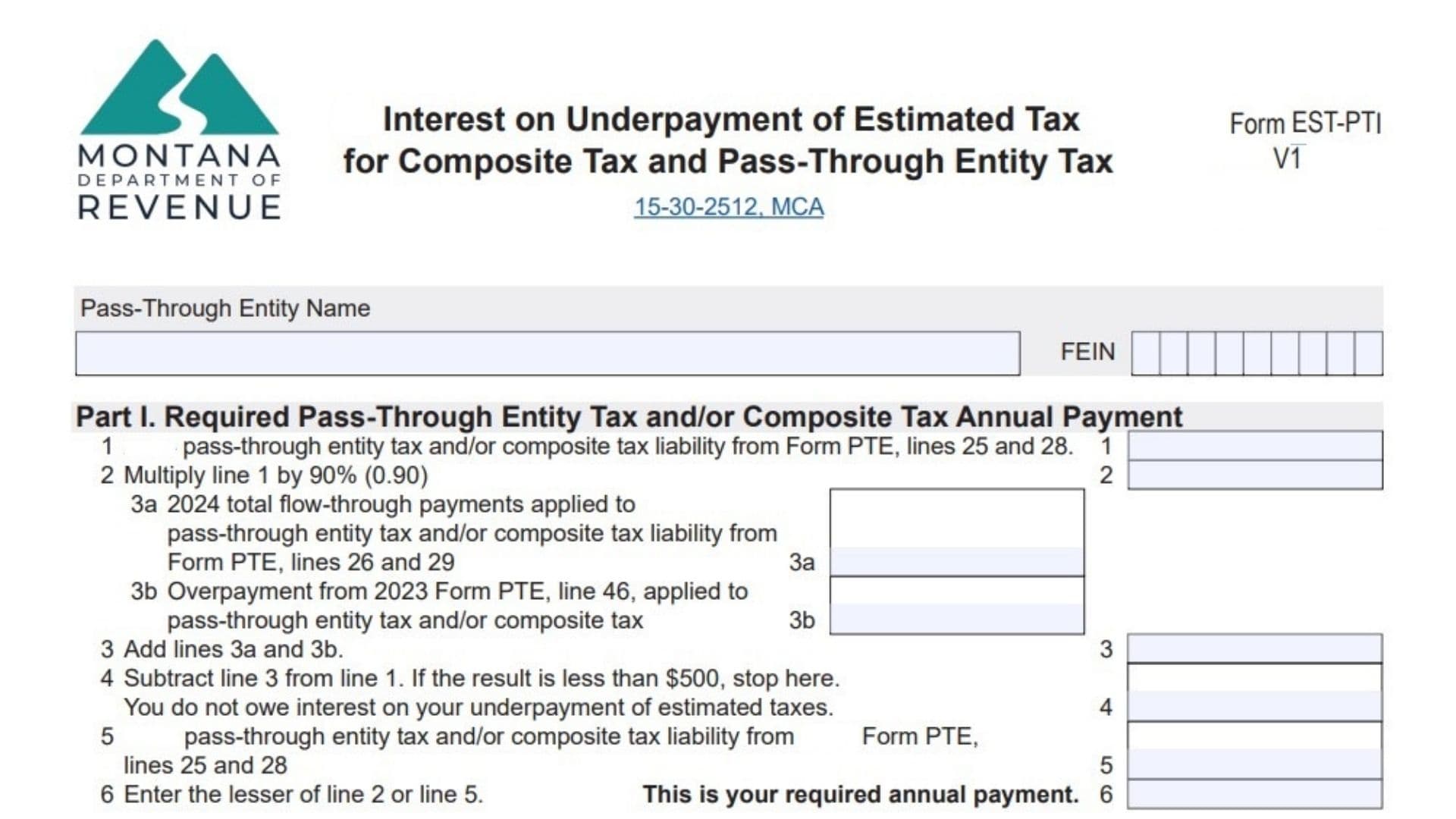

Start by entering the Pass-Through Entity Name and FEIN at the top for identification.

Part I. Required Pass-Through Entity Tax And/Or Composite Tax Annual Payment

This section determines your required annual estimated payment amount.

- Line 1 — Enter your total liability for pass-through entity tax and/or composite tax taken from Form PTE lines 25 and 28 combined.

- Line 2 — Take the amount from line 1 and multiply it by 90% (0.90) to find 90% of the current-year liability.

- Line 3a — Input the total flow-through payments credited toward your pass-through entity tax and/or composite tax from Form PTE lines 26 and 29.

- Line 3b — Enter any overpayment carried forward from your Form PTE line 46 that was applied to estimated taxes.

- Line 3 — Add the amounts on lines 3a and 3b for total credits applied.

- Line 4 — Subtract line 3 from line 1. If the result is below $500, no interest is due—stop here and enter zero on Form PTE line 31 if applicable.

- Line 5 — Report your pass-through entity tax and/or composite tax liability from the prior year’s Form PTE lines 25 and 28.

- Line 6 — Enter the smaller amount between line 2 and line 5—this becomes your required annual payment that needed to be covered through timely estimates.

Part II. Underpayment Of Estimated Tax – Short Method

Use this simpler calculation only if you made no estimated payments or exactly four equal installments by each required due date.

- Line 1 — Total all estimated tax payments submitted during specifically for pass-through entity tax and/or composite tax.

- Line 2 — Add line 1 to the total credits from Part I line 3.

- Line 3 — Subtract line 2 from Part I line 6. If zero or negative, no interest is owed—stop here.

- Line 4 — Multiply the underpayment on line 3 by 0.046685 (this factors in the full-year interest rate approximation).

- Line 5 — If the underpaid amount from line 3 was settled on or after March 17, 2025, enter 0. Otherwise, calculate days paid early before March 17, 2025, multiply by line 3, then by 0.000219 for a partial credit.

- Line 6 — Subtract line 5 from line 4—this final interest amount transfers to Form PTE line 31.

Part III. Regular Method

Switch to this detailed column-by-column approach if your payments were uneven or timed differently. Due dates for calendar-year filers are Column A —adjust for fiscal years.

Complete lines 1–4 across all columns first:

- Line 1 (each column) — Divide Part I line 6 by 4 for the standard quarterly requirement, or enter your annualized amount from Part IV line 22 if applicable.

- Line 2 (each column) — Divide Part I line 3a credits by 4.

- Line 3 (each column) — Subtract line 2 from line 1 in the same column.

- Line 4 (each column) — Enter actual estimated payments made by that column’s due date; place the full Part I line 3b overpayment credit only in Column A.

Then fill lines 5–11 column by column sequentially:

- Line 5 — Carry forward any overpayment from the prior column’s line 11.

- Line 6 — Add lines 4 and 5 for total available for the period.

- Line 7 — Add underpayments from the previous column’s lines 9 and 10.

- Line 8 — Subtract line 7 from line 6—if zero or less, enter 0 (this is timely coverage).

- Line 9 — If line 8 is zero, subtract line 6 from line 7 (prior underpayment carries forward); otherwise enter 0.

- Line 10 — If line 8 ≤ line 3, subtract line 8 from line 3 for current underpayment; if line 8 > line 3, skip to line 11.

- Line 11 — If line 3 < line 8, subtract line 3 from line 8 for overpayment to carry forward.

For columns showing underpayment on line 10:

- Line 12 — Note the actual payment date for the line 10 shortfall or March 17, whichever comes first.

- Line 13 — Count days from the column’s installment due date up to the date on line 12.

- Line 14 — Multiply line 10 by line 13, then by the daily rate of 0.000219.

- Line 15 — Sum all column amounts from line 14—this total interest goes to Form PTE line 31.

Part IV: Annualized Income Installment Method Worksheet

Montana Form EST-PTI’s Part IV provides an optional worksheet for pass-through entities with uneven or seasonal Montana-source income throughout the year. This method calculates required estimated payments based on actual income earned in each cumulative period, potentially reducing or eliminating underpayment interest when income is concentrated in later quarters. Complete this section only if it results in lower required installments than the standard method (Part I line 6 divided by 4). If used, transfer the final required installment from line 22 (each column) to Part III line 1 in the corresponding column (A–D), and attach the full Form EST-PTI (including Part IV) to your Form PTE when filing.

The worksheet features four columns corresponding to the cumulative periods for calendar-year filers (adjust dates and months for fiscal years):

- Column A — First 3 months (Jan 1–Mar 31)

- Column B — First 5 months (Jan 1–May 31)

- Column C — First 8 months (Jan 1–Aug 31)

- Column D — Full year (Jan 1–Dec 31)

- Montana-source distributive share income — Enter cumulative Montana-source income of affected owners subject to PTET/composite tax for the period in each column.

- Annualization amounts — Multiply line 1 by the annualization factor for the period:

- Column A: ×4 (12/3)

- Column B: ×2.4 (12/5)

- Column C: ×1.5 (12/8)

- Column D: ×1 (12/12)

- Annualized Montana-source income — Enter the result from line 2 (estimated full-year income based on the period).

- Modifications/additions to income — Enter prorated or annualized Montana additions (e.g., from Form PTE Schedule II) applicable to the annualized amount.

- Modifications/subtractions from income — Enter prorated or annualized Montana subtractions (e.g., from Form PTE Schedule I).

- Adjusted annualized Montana-source income — Subtract line 5 from the sum of lines 3 and 4.

- Tax on annualized income — Compute the PTET/composite tax on line 6 using the current-year rate (highest individual marginal rate, generally applied at entity level).

- Applicable credits — Enter prorated nonrefundable credits available against the annualized tax (prorate based on period).

- Net annualized tax — Subtract line 8 from line 7.

- Applicable percentage — Multiply line 9 by:

- 22.5% (0.225) for Column A

- 45% (0.45) for Column B

- 67.5% (0.675) for Column C

- 90% (0.90) for Column D

- Required payment for period — Enter the amount from line 10.

12–21. Subtract required installments from prior periods (step-down lines):

– Line 12 (Column B): Subtract Column A line 11

– Line 13 (Column C): Subtract Column B line 11

– Line 14 (Column D): Subtract Column C line 11

– Continue this pattern if more intermediate lines exist for additional adjustments (e.g., credits or overpayments from prior periods specific to annualized). If the result is zero or negative, enter 0.

- Required installment for the period — Enter the positive amount after subtracting prior required installments (or the full line 11 amount for Column A). This is the quarterly required payment under the annualized method. Transfer line 22 from each column to Part III line 1 in the matching column.