Montana Form GEN REG, officially titled Business Registration, is the primary application new and existing businesses use to register with the Montana Department of Revenue for various state tax obligations, including withholding taxes, business income taxes, mineral royalty withholding, lodging and rental vehicle taxes, and other miscellaneous taxes. Required for any entity conducting business activity in Montana—whether a brand-new startup, a purchased company, a reopened business, a tax-exempt organization, or even a single-member LLC simply holding an asset like an RV—this multi-page form collects detailed information about the business structure, owners, physical locations, and specific tax types that apply. By completing and submitting Form GEN REG, businesses receive necessary account numbers, withholding IDs, and permissions to operate legally within the state, while also enabling the Department of Revenue to properly track and administer taxes such as W-2/1099 withholding, emergency 911 fees, lodging facility taxes, and business equipment reporting. The latest version (V5 2/2023) streamlines the process for sole proprietors, partnerships, corporations, LLCs, trusts, and disregarded entities, and it can be filed online, by mail, or fax, making compliance straightforward and helping avoid penalties for unregistered operations.

What Is Montana Form GEN REG?

Form GEN REG is the universal registration document that establishes your business tax accounts with the Montana Department of Revenue. It covers income tax filing requirements, payroll withholding, mineral royalties, accommodations taxes, and more in one submission. Tax-exempt entities use it alongside separate exemption applications, and all businesses must update information promptly if circumstances change.

Who Must File Form GEN REG?

Any individual or entity starting, purchasing, reopening, or maintaining business activity in Montana needs to submit this form, including out-of-state companies with Montana-source income, employees, or property. Even asset-holding single-member LLCs and tax-exempt organizations with employees or certain activities must register.

How To Submit Form GEN REG

You have three convenient filing options:

- Online — Fastest method through the TransAction Portal (TAP) at https://tap.dor.mt.gov

- Fax — Send to (406) 444-7723, Attention: Registration Unit

- Mail — Montana Department of Revenue, Attn: Registration Unit, PO Box 5805, Helena, MT 59604-5805

How to Complete Montana Form GEN REG

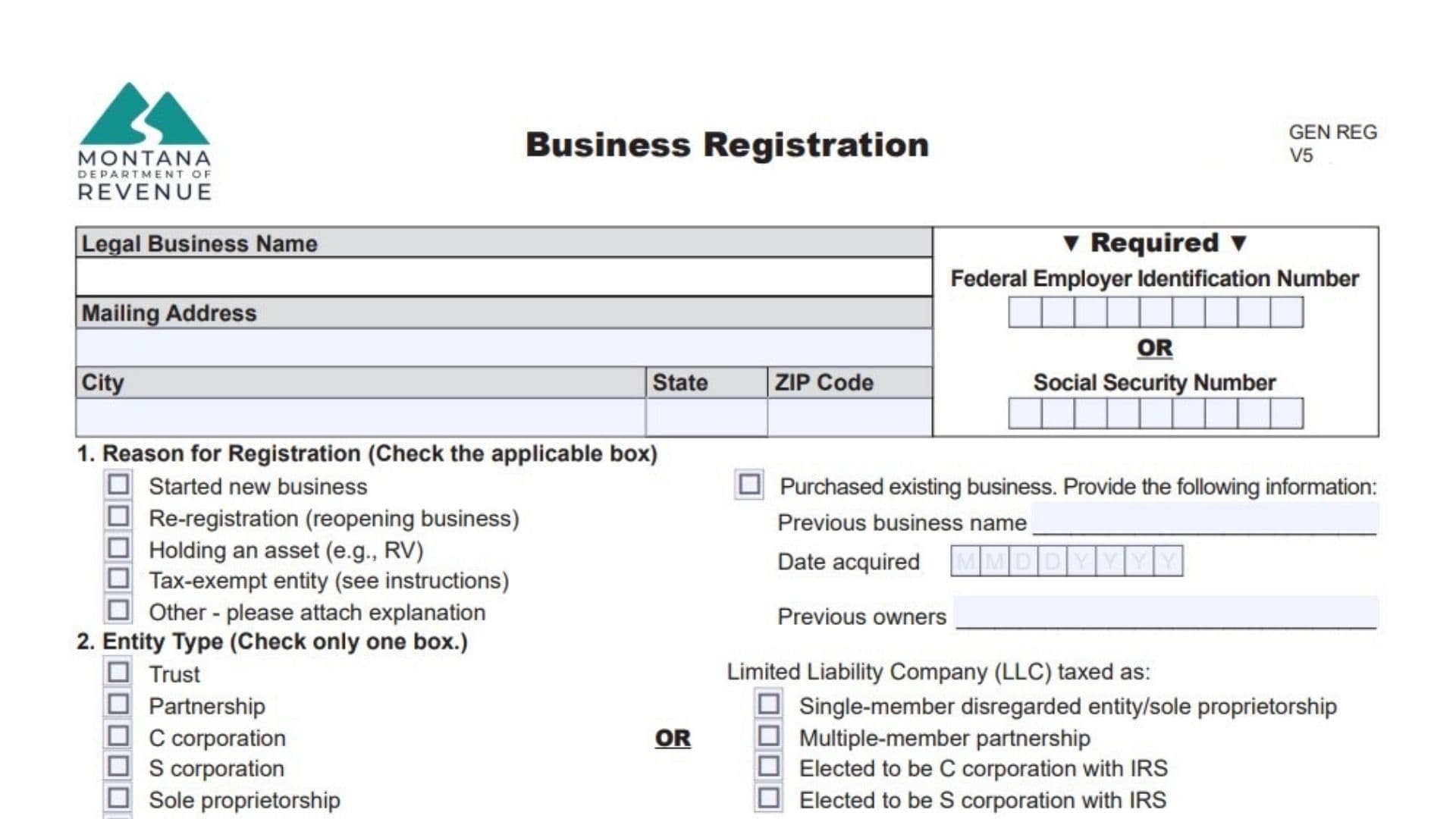

Legal Business Name

Enter the exact legal name of the business as registered with the IRS and/or Montana Secretary of State.

Federal Employer Identification Number (FEIN)

Provide your nine-digit FEIN. Required for most entities.

OR Social Security Number (SSN)

Sole proprietors without an FEIN enter their SSN here instead.

Mailing Address, City, State, ZIP Code

List the complete mailing address where the Department should send correspondence.

1. Reason for Registration

Check the box that best describes why you are submitting the form:

- Started new business

- Purchased existing business (include previous owner name and acquisition date)

- Re-registration (reopening business) — provide prior business name

- Holding an asset (e.g., RV)

- Tax-exempt entity (additional Form EXPT may be required)

- Other — attach a separate explanation

2. Entity Type

Select only one option that matches your federal tax classification:

- Trust

- Limited Liability Company (LLC) taxed as: Partnership, Single-member disregarded entity/sole proprietorship, Multiple-member partnership, C corporation, S corporation, Elected to be C corporation with IRS, or Elected to be S corporation with IRS

- Partnership

- C corporation

- S corporation

- Sole proprietorship

- Disregarded entity

3. Date of First Business Activity in Montana

Enter the month, day, and year (MM DD YYYY) you began or plan to begin operations in the state.

4. Secretary of State ID

Input your Montana Secretary of State filing number (letter followed by 6–8 digits, no hyphens; look it up at sosmt.gov if needed).

5. Federal Business Code (NAICS Code)

Provide the six-digit North American Industry Classification System code that best describes your primary activity (search naics.com).

6. Describe Business Activity in Montana

Write a clear, concise description of what your business does within Montana.

7. Owner Information

For Partnerships, S corporations, or Disregarded Entities, list up to three owners (attach extra pages if more):

- Owner’s Name

- R/NR (Resident or Nonresident — only for individuals, estates, trusts)

- Entity Type Code: I (Individual), E (Estate), T (Trust), C (C corporation), P (Partnership), S (S corporation), L (LLC), O (Other)

- Owner’s FEIN/SSN

8. Contact Information

Name and Title of the person the Department can call with questions

Phone (include area code)

Fax Number

Email Address

9. Business Income Taxes

Choose filing period:

- Calendar Year End (most common)

- Fiscal Year End — enter the ending month

If your Montana income tax return will be filed under a different name/FEIN than listed on page 1 (e.g., combined filing), provide that name and FEIN here.

10. W-2 and 1099 Withholding

Enter the date (MM DD YYYY) you began Montana-source payroll and/or 1099-reportable payments.

Check the Agricultural box if you have farm employees.

11. Mineral Royalty Withholding

Enter the start date (MM DD YYYY) for Montana-source royalty payments.

Select type: Oil, Gas, Coal, or Other mineral (specify).

12. Miscellaneous Tax

Check every applicable tax and enter the start date:

- Emergency 911

- Retail Telecom Excise Tax (RTE)

- Telecommunications Service Fee (TDD)

- Nursing Facility Bed Tax (NFB)

- Hospital Utilization Fee (HUF)

- Public Service Regulation Fee (PSR)

- Consumer Council Fee (CCT)

- Lodging Facility Sales and Use Tax (short-term lodging)

- Rental Vehicle Tax

For multiple locations, copy the table and complete separately.

Doing Business As (DBA) Name

Enter any trade name different from the legal name.

DBA Business Address (Physical Location), City, State, ZIP Code

Provide the actual street address where business occurs (not a PO box).

Is This Facility Within City Limits?

Yes or No

Is This a Seasonal Business?

Yes or No

If yes, list operating months.

Contact Person and Phone Number

Additional location-specific contact if different from section 8.

Attention New Montana Accommodations

Check Yes or No to allow the Department of Revenue to share your lodging information with the Montana Office of Tourism for free promotional listing on visitmt.com.

13. Business Equipment Tax

Answer:

- Is the acquired/installed cost of business equipment over $1,000,000? Yes/No

- Is 50% or more owned by a parent company? Yes/No (if yes, provide parent name and FEIN)

Then list County and full Physical Location address.

Declaration

An authorized person must sign and date the form (officer, partner, member, owner, or fiduciary depending on entity type).

Print name and title.

By following these instructions and using the current version from MTRevenue.gov, your Montana business registration will be processed quickly and accurately, getting you compliant right away. For questions, call (406) 444-6900.