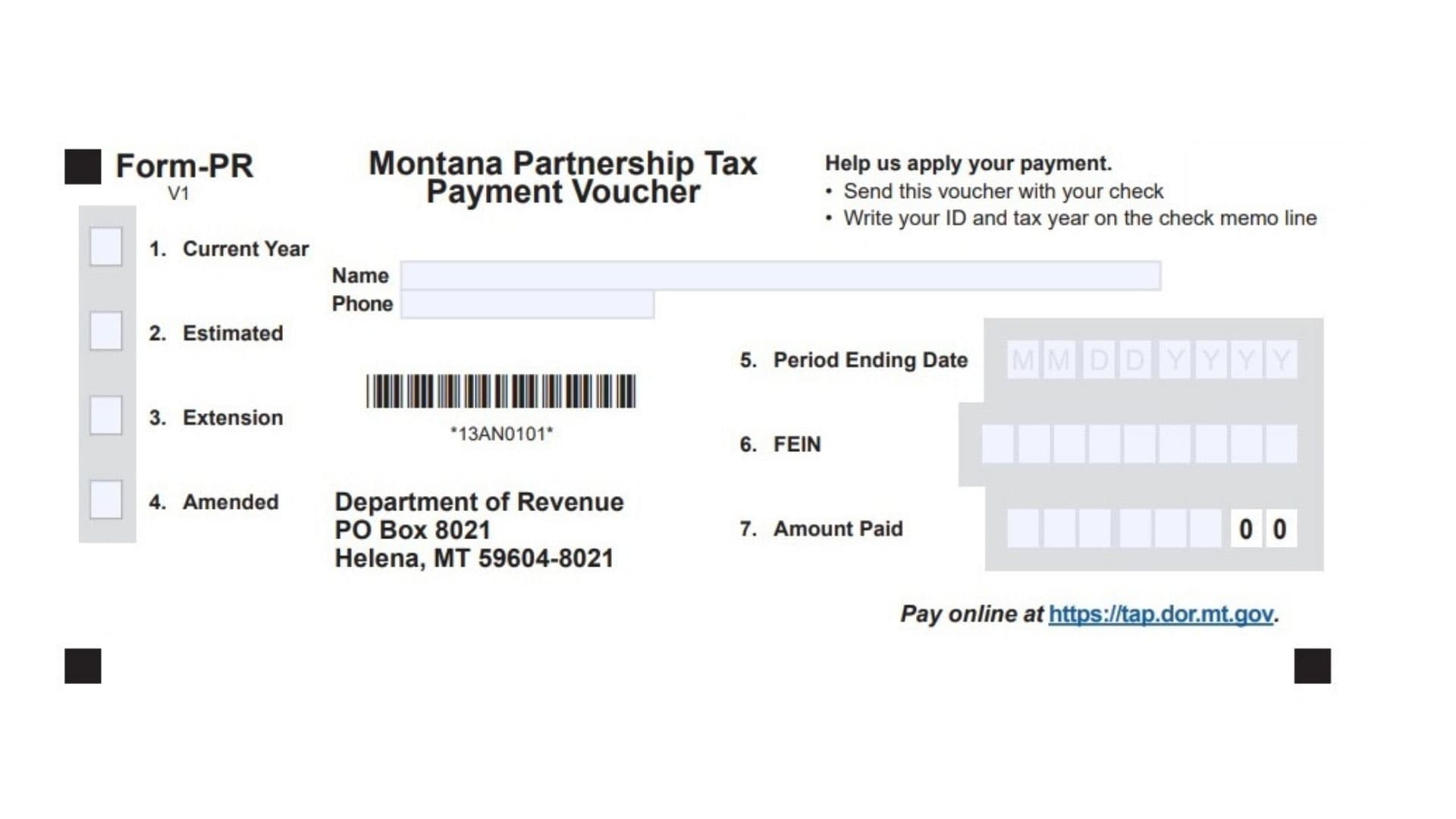

Montana Form PR, known as the Montana Partnership Tax Payment Voucher, is the official document partnerships use whenever they need to send a check payment to the Montana Department of Revenue for pass-through entity taxes. This simple but essential one-page voucher accompanies any payment related to the Montana Pass-Through Entity Tax Return (Form PTE), whether the amount is a balance due for the current tax year, an estimated tax payment, an extension payment, or a correction on an amended return. By including Form PR with your check, you help the Department quickly and accurately apply the funds to the correct partnership, tax year, and type of payment, reducing processing errors and avoiding unnecessary notices or penalties. The form is required only when paying by paper check (electronic payments through TAP or tax software do not need it), and it is especially important for partnerships that owe $500,000 or more must pay electronically instead. Using Form PR correctly ensures compliance with Montana tax rules while giving the state the information needed to credit your account properly.

What Is Montana Form PR?

Form PR is a detachable payment voucher that must be mailed with any check for Montana partnership-level taxes. It identifies the partnership, the tax period, the type of payment being made, and the exact amount enclosed. The voucher replaces writing detailed information directly on the check and helps prevent misapplied payments.

When Do You Need To Use Form PR?

You must include Form PR whenever you:

- Mail a check for a balance due on Form PTE

- Make estimated tax payments

- Submit a payment with an extension request

- Pay an amount due on an amended return

Do not use this voucher for electronic payments or if no payment is owed.

Payment Options For Montana Partnership Taxes

Montana offers two main ways to pay:

Electronic Payment (Recommended)

- Use the TransAction Portal (TAP) at https://tap.dor.mt.gov – pay by free e-check or by credit/debit card (small convenience fee).

- Most tax preparation software lets you pay directly when you file or schedule a future payment.

- Required for all payments of $500,000 or more.

Payment by Check

- Complete Form PR completely.

- Detach along the cut line.

- Mail the voucher and check (do not staple or tape them together) to:

Montana Department of Revenue

PO Box 8021

Helena, MT 59604-8021 - If paying for multiple tax periods, use a separate voucher and check for each period.

How to Complete Form PR

Every field on the voucher helps the Department process your payment correctly – leave nothing blank.

1. Current Year

Check this box if the payment is for the balance due on your original or current-year Form PTE.

2. Estimated

Check this box if you are making a quarterly or annual estimated tax payment for the partnership.

3. Extension

Check this box if the payment accompanies a request for an automatic six-month extension (or if you are paying the amount due with an already-granted extension).

4. Amended

Check this box if the payment is for additional tax owed on an amended Montana Pass-Through Entity Tax Return.

Name

Enter the full legal name of the partnership exactly as it appears on your tax return and federal filings.

Phone

Provide a daytime phone number (including area code) where the Department can reach you or your preparer if questions arise about the payment.

5. Period Ending Date

Enter the last day of the tax year for which you are making the payment in MMDDYYYY format (for calendar-year filers this is usually 12/31/YYYY).

6. FEIN

Enter your nine-digit Federal Employer Identification Number (EIN) – this is the most important identifier for the Department.

7. Amount Paid

Write the exact dollar amount of the check you are enclosing. Include cents (for example, 1,250.00). Use numerals only; do not write the amount in words here.

Additional Required Actions

- On the memo line of your check, write your FEIN and the tax year (this serves as backup identification).

- Double-check that the name and FEIN on the voucher match the check exactly.

- Keep a copy of the completed voucher and your check for your records.

Common Mistakes To Avoid

- Stapling or taping the voucher to the check (this slows processing).

- Forgetting to sign the check.

- Using one voucher for multiple tax years.

- Sending the voucher without a payment or a payment without the voucher.

- Entering the wrong tax year or FEIN.

By following these instructions and using the most current version of Form PR (available at MTRevenue.gov), your partnership tax payment will be credited quickly and accurately, helping you stay in good standing with the Montana Department of Revenue.