Montana Form ADPT is a tax form used by Montana residents to claim the Montana Adoption Tax Credit. This credit is designed to provide financial relief for families who adopt children. The credit offers $5,000 per adopted child, or $7,500 for each adopted child from the Montana foster care system. The tax credit can only be claimed in the tax year in which the adoption is finalized, and it applies to children who are under the age of 18 or physically or mentally incapable of self-care at the time of adoption.

To qualify for the foster care adoption credit, the child must have been under the custody of the Montana Department of Health and Human Services (DPHHS) at the time of adoption, and you must attach a certification letter from DPHHS to your tax return. For all adoptions, you must also include court documents confirming the adoption was finalized. Montana Form ADPT must be submitted alongside your Montana income tax return (Form 2) to claim the credit for eligible children. Now, let’s dive into the step-by-step instructions for completing the form.

How to File Montana Form ADPT

Filing Montana Form ADPT requires careful attention to detail to ensure all information is accurate and complete. Here’s an overview of the process:

- Gather all relevant adoption documents, including court documents and, if applicable, a certification letter from DPHHS for foster care adoptions.

- Complete each section of Montana Form ADPT (Parts I, II, and III) as outlined below.

- Attach Form ADPT and the required supporting documents to your Montana income tax return (Form 2).

- Submit your tax return to the Montana Department of Revenue.

How to Complete Montana Form ADPT

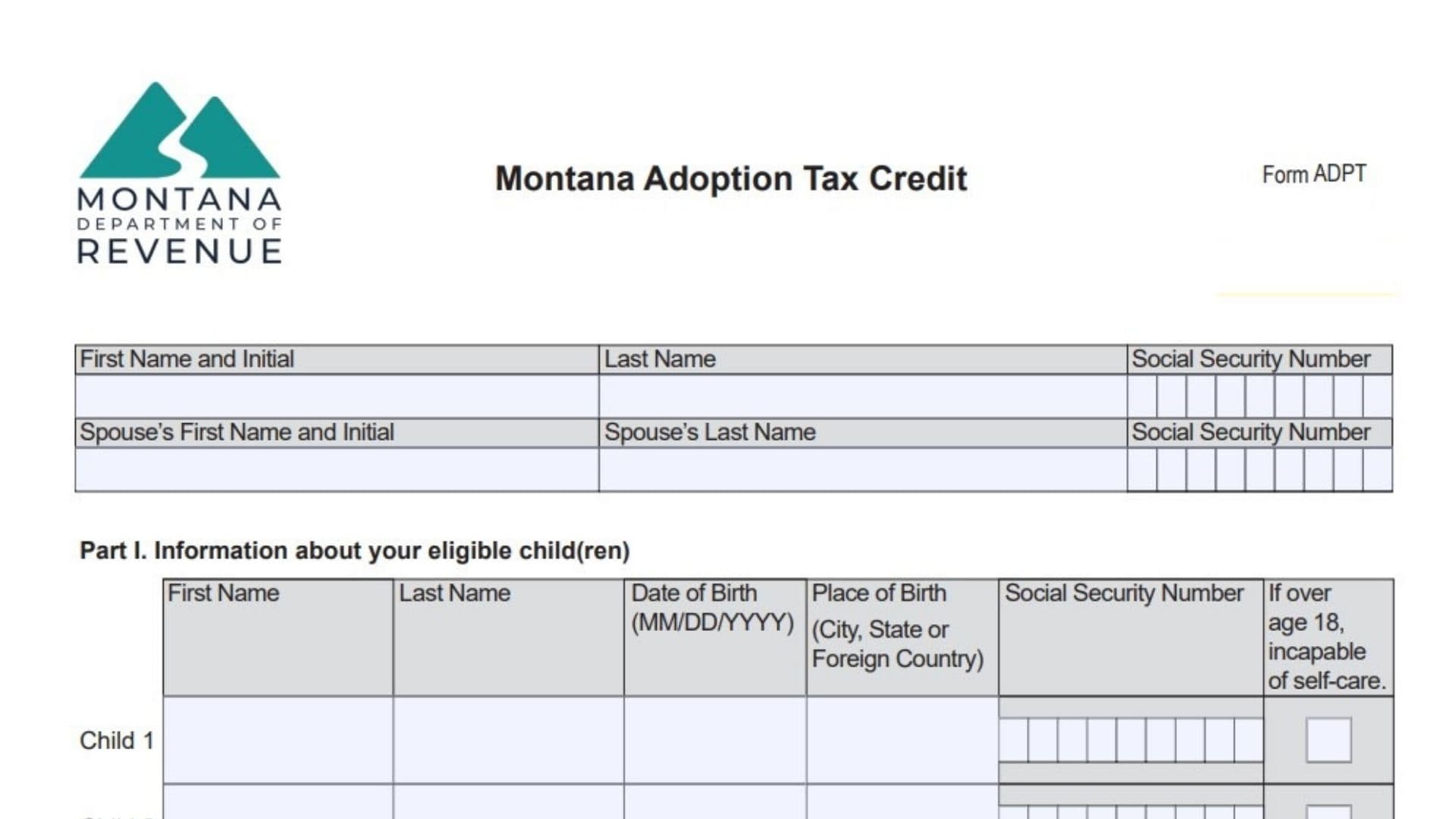

Part I: Information About Your Eligible Child(ren)

This section collects basic details about each child you adopted. Follow these steps:

- First Name and Last Name: Enter the first and last name of each adopted child.

- Date of Birth: Provide the child’s date of birth in MM/DD/YYYY format.

- Place of Birth: Indicate the child’s place of birth. If the child was born in the United States, enter the city and state. If born outside the United States, enter the name of the foreign country.

- Social Security Number: Enter the child’s Social Security Number, if known. If the number is unavailable, leave this field blank.

- If Over Age 18, Incapable of Self-Care: If the adopted child was 18 or older at the time of adoption and physically or mentally incapable of self-care, check the box in this column.

Complete this section for each child you adopted. If you adopted more than three children, you may need to use additional forms.

Part II: Credit Information

This section is where you calculate the adoption tax credit for each child. Follow these steps:

- Adoption Credit Amount:

- If the adoption qualifies as a Montana foster care adoption, enter $7,500.

- For all other types of adoptions, enter $5,000.

- Date Adoption Was Finalized: Provide the date when the adoption was finalized for each child in MM/DD/YYYY format.

- Agent Assisted Adoption: If an adoption was assisted by an adoption agent or agency, check the box in this column. You’ll need to complete Part III with the agent’s details.

- Total Credit: Add the credit amounts for all children listed in Part II and enter the total in the designated box. This is the total adoption credit you are claiming. Report this amount on Montana Form 2, Schedule III, line 15.

If the adoption was not a qualifying foster care adoption, attach court documents confirming the adoption was finalized. If it was a qualifying foster care adoption, include the DPHHS certification letter instead.

Part III: Agent Information

This section requires information about any adoption agent or agency that assisted in the adoption process. If you used multiple agents or agencies, you must complete a separate Form ADPT for each.

- Agent Name: Enter the full name of the adoption agent who assisted with the adoption.

- Agency Name: Provide the name of the agency the agent works for, if applicable.

- Phone: Enter the agent’s or agency’s phone number.

- Email: Include the agent’s or agency’s email address.

- Assisted With Adoption Of: Check the box corresponding to the child(ren) the agent assisted with.

Supporting Documents to Include

When submitting Montana Form ADPT, you must include the following supporting documents:

- Court Documents: For all adoptions, attach legal documents confirming the adoption was finalized.

- DPHHS Certification Letter: For foster care adoptions, include the letter from DPHHS certifying the adoption.

- Form ADPT: Ensure the form is fully completed and attached to your Montana income tax return (Form 2).