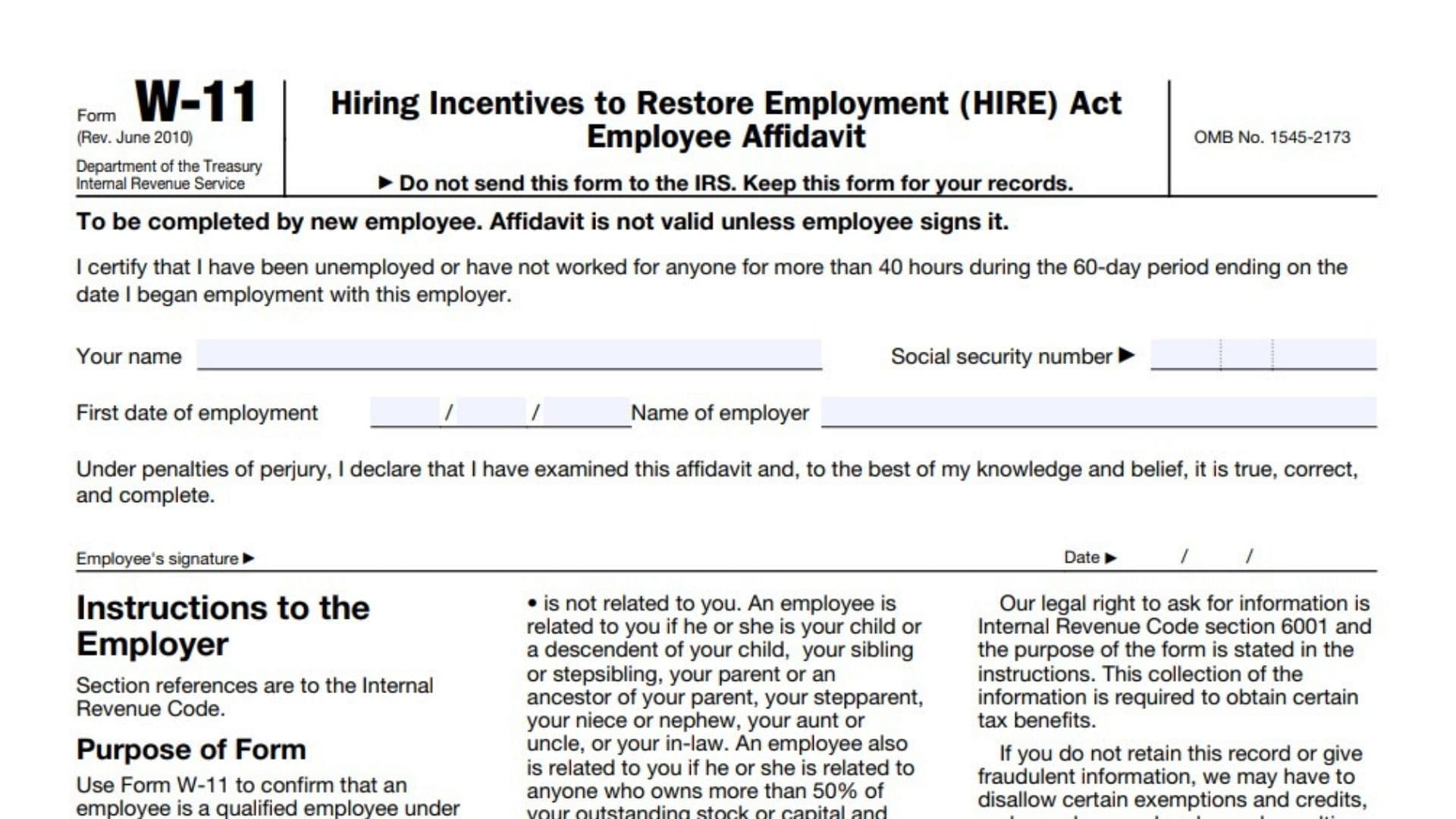

IRS Form W-11, also known as the Employee Affidavit under the Hiring Incentives to Restore Employment (HIRE) Act, is a declaration completed by new employees. It certifies that the employee has been unemployed or worked less than 40 hours within the 60-day period before beginning employment with the current employer. This form is crucial for employers to confirm that the employee qualifies under the HIRE Act for tax benefits such as payroll tax exemptions or new hire retention credits. Only employees meeting specific criteria can complete this affidavit, which must be signed under penalties of perjury. Employers should not send this form to the IRS but keep it for their payroll and tax records. The form helps employers establish eligibility for certain tax breaks aimed at incentivizing employment between February 3, 2010, and January 1, 2011. The affidavit includes declarations regarding the employee’s unemployment status, relatedness to the employer, and that they are not replacing an employee who left voluntarily or for cause.

How To File Form W-11

Form W-11 is completed by the new employee at the start of their employment. Employers do not file this form with the IRS; instead, they keep it for their records to substantiate claims for tax credits related to the HIRE Act. The employee must read the affidavit, certify the statements under penalty of perjury, and sign and date the form. Employers should maintain it along with other employment and payroll documentation. The form verifies employee eligibility and supports the employer’s tax reporting and compliance process.

How To Complete Form W-11

- Form Title and Rev Date: The top of the form identifies it as Form W-11, revised June 2010, for the HIRE Act Employee Affidavit. No action required.

- Header Information: Displays Department of the Treasury, Internal Revenue Service, and relevant act’s name (HIRE Act). No action required.

- Instruction Note: “Do not send this form to the IRS. Keep this form for your records.” This is very important—employers must retain the form; do not mail it.

- OMB Number: 1545-2173 appears as the form’s control number. No action needed by the employee.

- To Be Completed By New Employee Section: The employee must complete all fields below; the form is invalid without the employee’s signature.

- Statement: “I certify that I have been unemployed or have not worked for anyone for more than 40 hours during the 60-day period ending on the date I began employment with this employer.” This is the core certification by the employee under penalty of perjury.

- Your Name: Employee enters full legal name clearly.

- Social Security Number: Employee inputs their SSN.

- First Date of Employment: Employee enters the exact date employment begins in MM/DD/YYYY format.

- Name of Employer: The employer’s legal business name is entered here.

- Declaration Statement: “Under penalties of perjury, I declare that I have examined this affidavit and, to the best of my knowledge and belief, it is true, correct, and complete.” This reinforces the legal seriousness of the certification.

- Employee’s Signature: Employee must sign to validate the affidavit.

- Date of Signature: Employee enters the date they sign the form (MM/DD/YYYY).

Additional Information For Employers

- Employers should use this form to confirm an employee’s qualified status under the HIRE Act.

- A “qualified employee” is defined by specific criteria including employment dates, hours unemployed prior to hire, not being a replacement under certain conditions, and not being related to the employer by family or stock ownership.

- This form or a similar signed statement is mandatory for employers to claim payroll tax exemptions or new hire retention credits under the Act.

- The form must be kept with payroll records and not sent to the IRS.

- Employers should understand penalties for fraudulent claims, which include disallowed credits, penalties, and possible criminal prosecution.