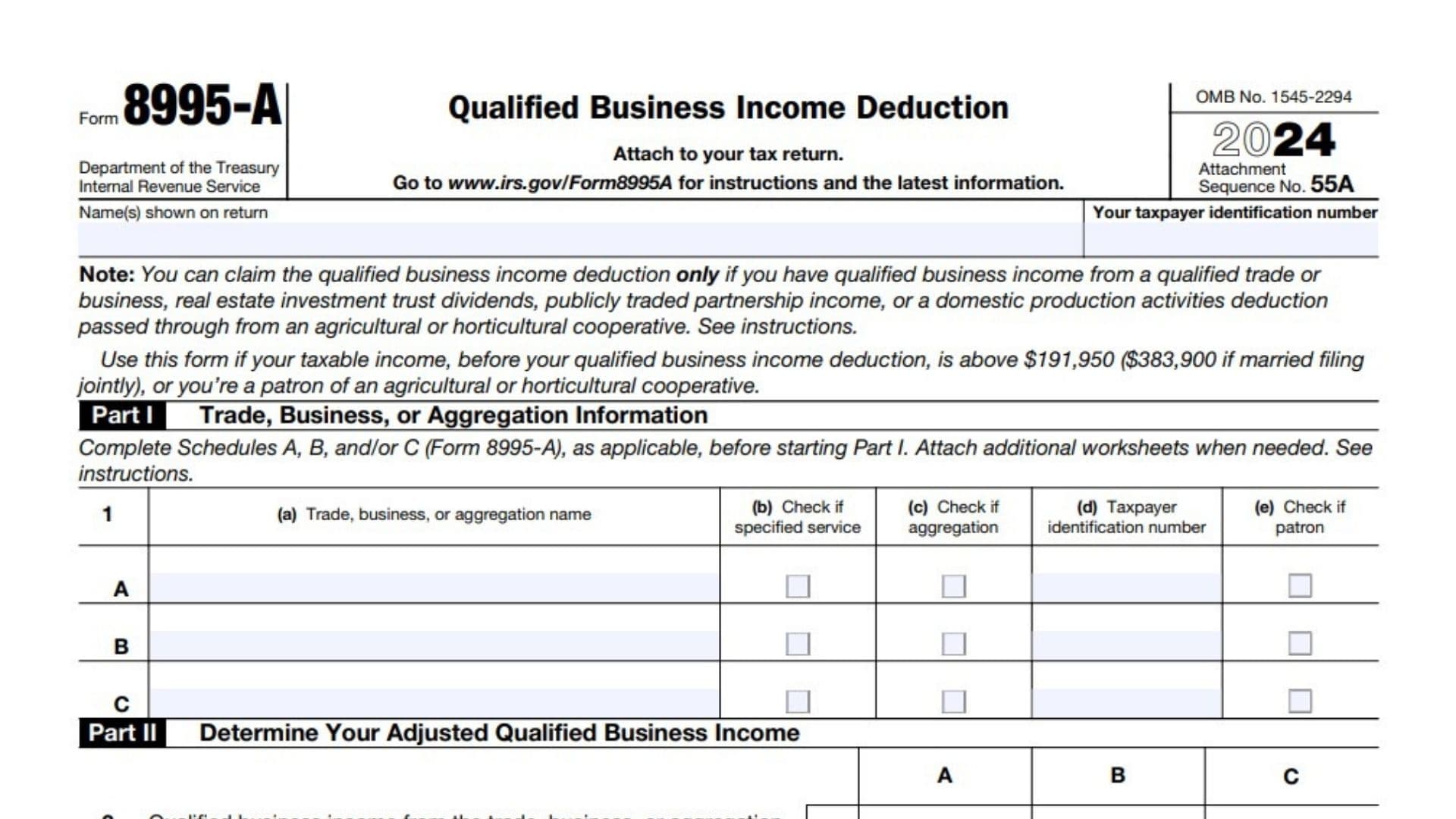

Form 8995-A, “Qualified Business Income Deduction,” is used to determine the QBI deduction for taxpayers whose taxable income exceeds certain thresholds—$191,950 for singles or $383,900 for married filing jointly for 2024. This form is required when income comes from multiple trades, businesses, or from specified service trades or businesses (SSTBs), agricultural cooperatives, or if the taxpayer income exceeds limits where wage and property bases affect deduction limits. It calculates allowable deductions by factoring in business income, wages paid, qualified property basis, any phased-in reductions, and income limitations, ensuring taxpayers properly claim up to 20% of qualified business income deductions on their returns. Taxpayers attach this form to their tax return to comply with IRS rules for business income deduction.

How To File Form 8995-A

File Form 8995-A by completing all applicable parts and attaching it when you submit your federal tax return. Gather all related documents such as Schedules A, B, C, and D before starting. Use electronic filing or paper submission as per your tax return method. Consult a tax professional if your situations involve complex aggregations or multiple businesses.

How To Complete Form 8995-A

Part I: Trade, Business, or Aggregation Information

Line 1(a): Enter the name of the trade, business, or aggregation.

Line 1(b): Check this box if the business is a specified service trade or business (SSTB), which affects deduction eligibility.

Line 1(c): Check if this entry is an aggregation of multiple trades or businesses combined for deduction calculation.

Line 1(d): Enter the taxpayer identification number (TIN) for the business or aggregation.

Line 1(e): Check this box if you are a patron of an agricultural or horticultural cooperative related to income on this form.

Part II: Determine Your Adjusted Qualified Business Income

Line 2: Enter the qualified business income (QBI) amount from this trade or aggregation.

Line 3: Multiply line 2 by 20% (0.20). If taxable income is $191,950 or less ($383,900 if married filing jointly), skip lines 4-12 and enter this result on line 13.

Line 4: Enter the allocable share of W-2 wages paid by this trade or business.

Line 5: Multiply line 4 by 50% (0.50).

Line 6: Multiply line 4 by 25% (0.25).

Line 7: Enter the allocable share of the unadjusted basis immediately after acquisition (UBIA) of all qualified property.

Line 8: Multiply line 7 by 2.5% (0.025).

Line 9: Add line 6 and line 8 together.

Line 10: Enter the greater amount between line 5 or line 9.

Line 11: Enter the smaller amount between line 3 or line 10; this applies the wage and property limitation to the deduction.

Line 12: Enter the phased-in reduction amount calculated in Part III, line 26, if applicable.

Line 13: Enter the greater amount between line 11 or line 12; this is the QBI deduction before patron reduction.

Line 14: Enter the patron reduction amount from Schedule D (Form 8995-A), line 6, if any.

Line 15: Subtract line 14 from line 13. This is the qualified business income component.

Line 16: Add all amounts reported on line 15 for multiple trades or businesses to determine total qualified business income component.

Part III: Phased-In Reduction (Complete only if applicable)

Line 17: Enter line 3 amount from Part II.

Line 18: Enter line 10 amount from Part II.

Line 19: Subtract line 18 from line 17.

Line 20: Enter taxable income before QBI deduction.

Line 21: Enter the applicable threshold: $191,950 for singles or $383,900 for married filing jointly.

Line 22: Subtract line 21 from line 20.

Line 23: Enter phase-in range: $50,000 for singles or $100,000 for married filing jointly.

Line 24: Divide line 22 by line 23 to find the phase-in percentage.

Line 25: Multiply line 19 by line 24 to get total phase-in reduction.

Line 26: Subtract line 25 from line 17. This amount is entered here and on line 12 in Part II.

Part IV: Determine Your Qualified Business Income Deduction

Line 27: Enter total qualified business income component from line 16.

Line 28: Enter qualified real estate investment trust (REIT) dividends and publicly traded partnership (PTP) income or loss.

Line 29: Enter any carryforward from prior years of qualified REIT dividends and PTP loss.

Line 30: Add lines 28 and 29; if less than zero, enter zero.

Line 31: Multiply line 30 by 20% (0.20); this is the REIT and PTP component.

Line 32: Add lines 27 and 31 for total QBI deduction before income limitation.

Line 33: Enter taxable income before QBI deduction.

Line 34: Enter net capital gain increased by qualified dividends, if any.

Line 35: Subtract line 34 from line 33; if zero or less, enter zero.

Line 36: Multiply line 35 by 20% (0.20); this is the income limitation.

Line 37: Enter the smaller of line 32 or line 36; this is QBI deduction before domestic production activities deduction (DPAD).

Line 38: Enter DPAD allocated from an agricultural or horticultural cooperative (don’t exceed line 33 minus line 37).

Line 39: Add lines 37 and 38 to get total QBI deduction.

Line 40: Enter total qualified REIT dividends and PTP loss carryforward; if zero or positive, enter zero.