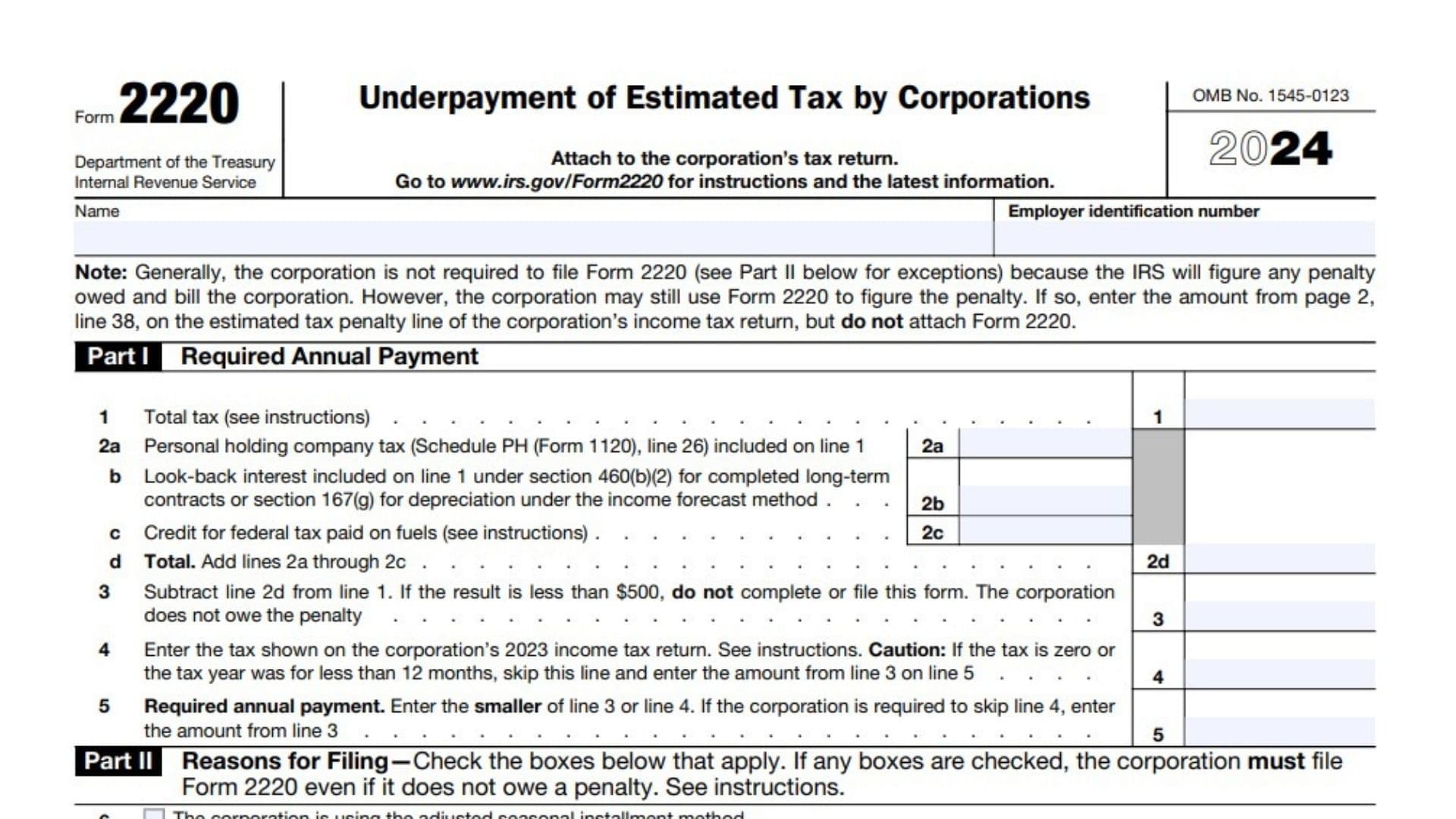

IRS Form 2220, titled “Underpayment of Estimated Tax by Corporations,” is a form used by corporations to calculate and report any penalties due for underpaying their estimated tax throughout the tax year. Generally, corporations are not required to file this form because the IRS calculates and bills any penalty owed. However, corporations can voluntarily use Form 2220 to figure their penalty and report it on their tax return. This form assists corporations in ensuring they have paid enough tax throughout the year to avoid penalties and helps calculate penalties based on installment payments made or not made. Key for corporations who suspect an underpayment or want to preemptively calculate their penalty, Form 2220 must be attached to the corporation’s income tax return when filed with the IRS. The form includes sections calculating required annual payments, reasons for filing, underpayment installments, and penalty figures.

How to File Form 2220

To file Form 2220, the corporation should complete the form fully, attaching it to the corporation’s income tax return for the tax year. It is important to check if the corporation is required to file the form—generally, if the penalty is less than $500, filing is not necessary. However, if any of the conditions in Part II (such as using the adjusted seasonal installment method, annualized income installment method, or being a large corporation) apply, filing is required even if a penalty is not owed. Once completed, the penalty amount calculated on line 38 of page 2 should be entered as the estimated tax penalty on the corporation’s income tax return (but the form itself is not attached in that case). The form should be filed by the corporation’s tax return due date, including extensions.

How to Complete Form 2220

Part I: Required Annual Payment

Line 1: Enter the corporation’s total tax for the year, following IRS instructions.

Line 2a: Enter any personal holding company tax included on Schedule PH (Form 1120), line 26.

Line 2b: Enter “look-back interest” related to completed long-term contracts or depreciation under specific accounting methods.

Line 2c: Enter any credit for federal tax paid on fuels.

Line 2d: Add lines 2a through 2c and enter the total.

Line 3: Subtract line 2d from line 1. If the result is less than $500, the corporation does not owe a penalty and does not need to file Form 2220.

Line 4: Enter the tax amount shown on the corporation’s prior year (2023) income tax return. If the tax was zero or the tax year was less than 12 months, skip this line.

Line 5: Enter the smaller of line 3 or line 4. If line 4 was skipped, enter line 3’s amount.

Part II: Reasons for Filing

Check any boxes that apply:

Line 6: Corporation uses the adjusted seasonal installment method.

Line 7: Corporation uses the annualized income installment method.

Line 8: Corporation is a large corporation figuring the first required installment based on prior year’s tax.

If any boxes are checked, the corporation must file Form 2220 even if no penalty is owed.

Part III: Figuring the Underpayment

Complete columns (a) through (d) related to installment due dates and payments:

Line 9: Enter installment due dates for the 4th, 6th, 9th, and 12th months of the tax year (alternative months apply for some filers).

Line 10: Enter required installment amounts:

- If lines 6 or 7 above are checked, use Schedule A, line 38 amounts.

- If line 8 is checked without lines 6 or 7, follow instructions for amounts.

- If none are checked, enter 25% (0.25) of line 5 above in each column.

Line 11: Enter estimated tax paid or credited for each period. For column (a), also enter this amount on line 15.

Proceed by completing lines 12 through 18 by column:

Line 12: Enter any amount from line 18 of the preceding column.

Line 13: Add lines 11 and 12.

Line 14: Add amounts on lines 16 and 17 of the preceding column.

Line 15: Subtract line 14 from line 13. If zero or less, enter zero.

Line 16: If line 15 is zero, subtract line 13 from line 14; otherwise, enter zero.

Line 17: If line 15 is less than or equal to line 10, subtract line 15 from line 10 and move to line 12 of the next column. Otherwise, go to line 18.

Line 18: If line 10 is less than line 15, subtract line 10 from line 15 and move to line 12 of the next column.

If no entries exist on line 17, stop here as no penalty is owed.

Part IV: Figuring the Penalty

Complete columns (a) through (d):

Line 19: Enter the date of payment or the 15th day of the 4th month after tax year-end, whichever is earlier. Use adjustments for certain filers (C corporations with tax years ending June 30, S corporations, Form 990-PF, and 990-T filers).

Line 20: Enter the number of days from the installment due date (line 9) to the date on line 19.

Lines 21–36: Calculate penalty interest for underpayment amounts over specific date ranges, multiplying underpayment amounts by the number of days divided by 366 or 365, then by applicable interest rates as outlined.

Line 37: Add all amounts from lines 22, 24, 26, 28, 30, 32, 34, and 36.

Line 38: Add columns (a) through (d) on line 37 and enter the penalty total here and on the corporation’s income tax return penalty line.