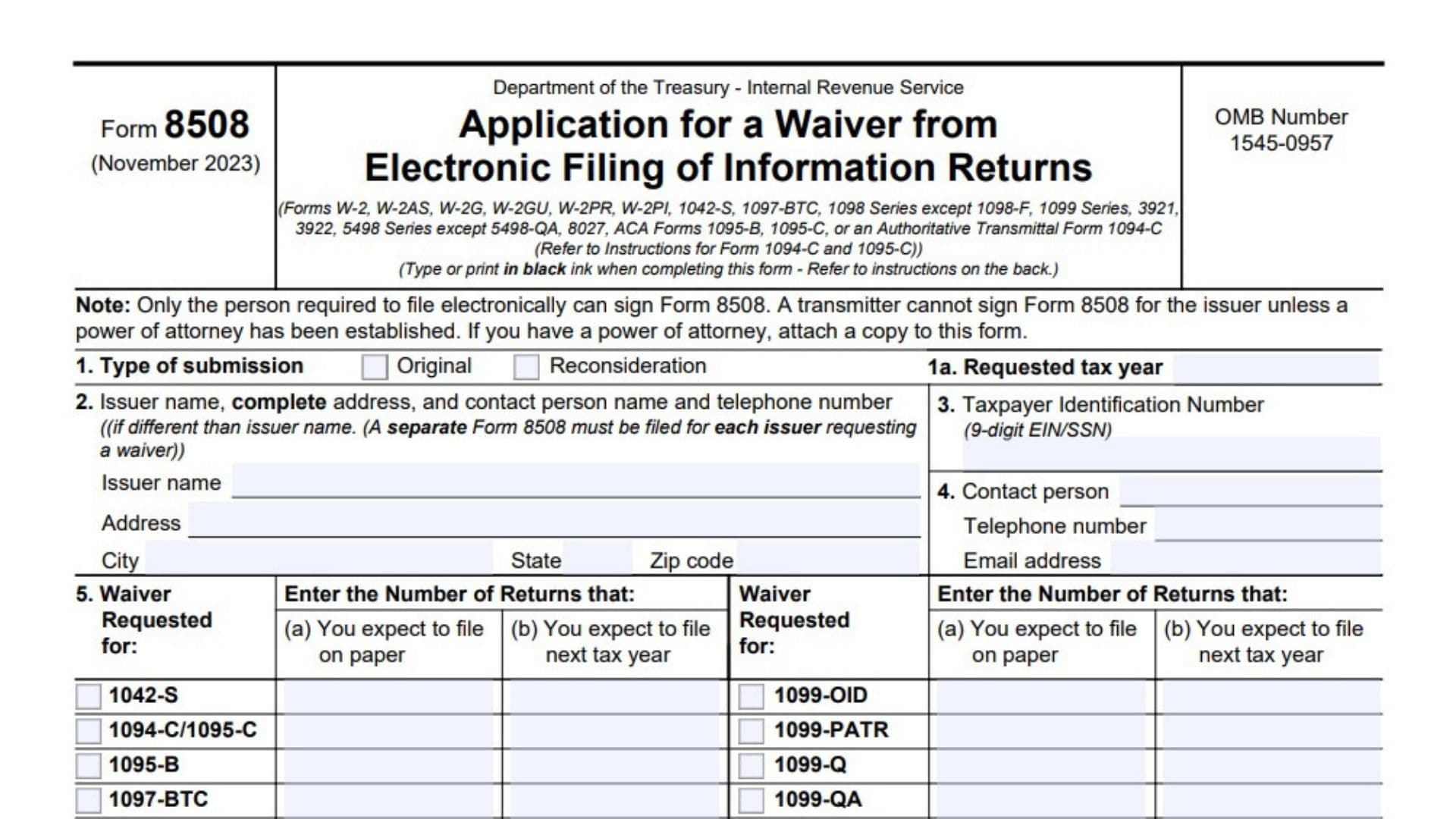

IRS Form 8508, “Application for a Waiver from Electronic Filing of Information Returns,” is a critical form for businesses and entities required to submit information returns (like Forms W-2, 1099, 1098, 1042-S, 5498 series, 8027, ACA Forms 1095, and more) electronically to the IRS. Some filers may face undue financial hardship, limited access to technology, religious beliefs, or circumstances like natural disasters that make electronic filing impractical or impossible. Form 8508 allows such issuers to formally request permission to file these information returns on paper for a given tax year. Filing IRS Form 8508 properly is essential for avoiding penalties for noncompliance if you cannot e-file as required. Once approved, the waiver often extends to multiple IRS forms and, in some cases, related filings like Form 8300. A separate IRS Form 8508 is required for each Taxpayer Identification Number, but you can request waivers for multiple types of returns in one submission.

How To File Form 8508

- When to File: File at least 45 days before the due date of the returns you’re requesting a waiver for (often January 31 for Forms W-2, 1099-NEC, etc.).

- How to File: Submit the signed form by mail or fax (but not both):

- Mail: Internal Revenue Service, Attn: Extension of Time Coordinator, 240 Murall Drive Mail Stop 4360, Kearneysville, WV 25430

- Fax (preferred): 1-877-477-0572 or 304-579-4105 (International)

- First-Time Waiver: Automatically granted, but you must file the form.

- Subsequent Requests: Justification and supporting documents required.

How To Complete Form 8508

Heading – OMB Number and General Notes

- Type or print in black ink. Only the person required to file electronically can sign, unless a power of attorney is attached.

Block 1 – Type Of Submission

- Original: Check this box if this is your first waiver request for the current tax year.

- Reconsideration: Check if submitting new information to reverse a denial.

- 1a. Requested Tax Year: Enter the year you need the waiver for (e.g., 2025). You cannot request a waiver for a prior or future year.

Block 2 – Issuer Name, Address, And Contact

- Issuer Name: Full legal name of your organization or business.

- Complete Address: Enter street, city, state, and ZIP code.

- Contact Person (if different): If someone other than issuer should be contacted, enter their name and phone.

- A separate Form 8508 is needed per issuer/TIN.

Block 3 – Taxpayer Identification Number

- Nine-Digit EIN/SSN: Enter the appropriate EIN or SSN for your business/entity.

Block 4 – Contact Person Information

- Contact Person: Type the full name of the person IRS should call for more info.

- Telephone Number: Include the area code.

- Email Address: For quick IRS communication.

Block 5 – Waiver Requested For (Return Types And Quantities)

For each return type you’re requesting the waiver for, fill out both columns:

- (a) You Expect To File On Paper: Enter the number of each specific form you plan to file by paper for the current tax year.

- (b) You Expect To File Next Tax Year: Indicate how many of these forms you expect to file next year.

Check all the relevant return types (e.g., 1042-S, 1099-MISC, 1099-NEC, W-2, etc.) and enter the expected numbers.

Block 6 – Religious Exemption

- Yes: Check if you’re unable to e-file due to religious beliefs. This records your exemption with the IRS. (Filing is not required but recommended for IRS notification.)

- No: Check if not claiming a religious exemption.

Block 7 – Corrections Only

- Yes: Check if waiver is needed only for corrections (not originals). (If you’ll file originals electronically, but not corrections.)

- No: Check if not for corrections only.

- If using IRIS, leave box 7 blank.

Block 8 – Previous Waiver Requests

- Yes: If this is your first waiver request for any of the forms in block 5, check “Yes” and go directly to Block 10 (your signature).

- No: Check “No” if you have filed for a waiver in any prior year for these forms, and move to Block 9. Attach all required justifications and documentation (e.g., cost estimates, disaster statements).

Block 9 – Undue Financial Hardship (If Applicable)

- If your request is due to financial hardship, enter two current cost estimates from third parties for e-filing software/upgrades or for preparing files for you.

- Cost Estimates: Write the actual dollar values as provided by service bureaus or vendors (e.g., $2,000 and $3,200). Attach both estimates to the form.

- Failure to include estimates will result in denial.

Block 10 – Signature

- Signature: The taxpayer or authorized official must sign. If a power of attorney is in effect, attach it to this form.

- Title: Write your job title or official capacity.

- Date: Add the date you sign.