IRS Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business, is a joint IRS/FinCEN reporting form that businesses must file within 15 days when they receive more than $10,000 in “cash” in a single transaction or related transactions; it supports anti‑money‑laundering enforcement, builds an audit trail for large cash activity, and applies to virtually any trade or business including individuals, partnerships, corporations, trusts, or estates operating in the U.S. or its territories, with rules defining what counts as cash (for example, currency and, in some cases, combinations of money orders, cashier’s checks, or traveler’s checks) and requiring an annual written statement to customers whose information appears on the form.

How to File Form 8300?

- Who must file: Any person (individual or entity) in a trade or business receiving >$10,000 in cash in one or related transactions.

- When to file: Within 15 days after the cash transaction date or the date cumulative related payments exceed $10,000.

- How to file (e‑file mandate): If required to e‑file other information returns, you must e‑file Form 8300 beginning January 1, 2024; otherwise you may still e‑file or file paper to the IRS address noted in the instructions.

- Where to file: Electronic filing is through the BSA E‑Filing system; paper filing addresses and any territory guidance are in the official instructions/reference guide.

- Customer statement: Provide a written statement by January 31 of the year following the reportable transaction to each person named on the form, showing your business contact info and aggregate amount reported; do not send statements for voluntarily filed “suspicious” forms under the $10,000 threshold if box 1b is checked.

- Recordkeeping and penalties: Keep records per the instructions; penalties apply for failure to file, late filing, or failure to furnish customer statements (amounts indexed for inflation).

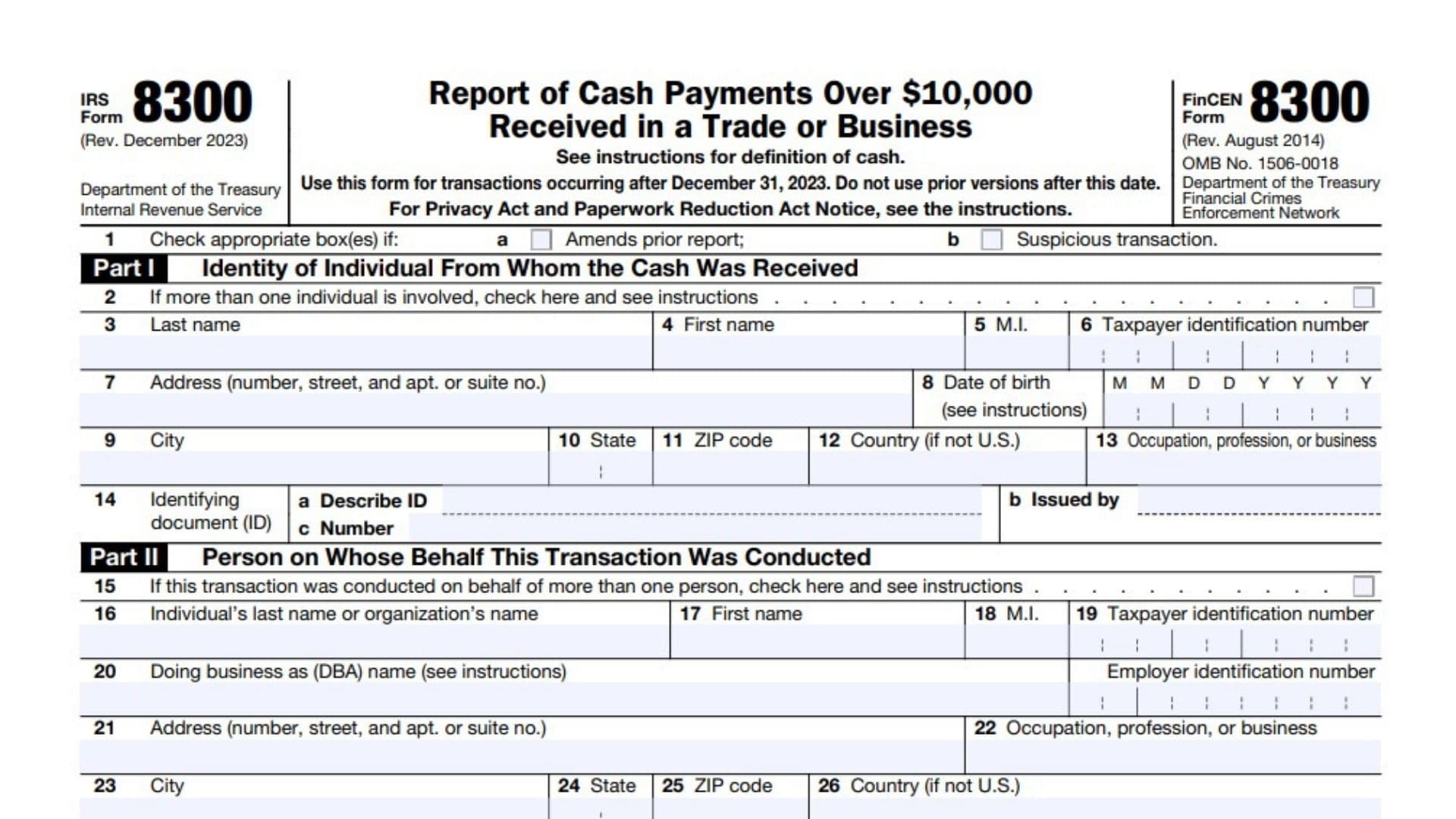

How to Complete Form 8300?

This section follows the December 2023 revision (Rev. 12‑2023). Keep the official Instructions for Form 8300 open while completing the form to confirm any state/territory addresses, definitions, and special cases.

Top of Form and Checkboxes (Part I Header Area)

- Check the box if you are filing due to a cash payment over $10,000 in a trade or business; check box 1b if this is a suspicious transaction being filed voluntarily even if at or below the threshold, per the instructions’ guidance on suspicious filings.

- If more than one person is involved as payers for the same transaction, check the “Multiple parties (individuals)” box to trigger completion of the “Multiple Parties” continuation section later.

- If more than one business/entity is involved as payers (agents on behalf of others), check the analogous box for multiple parties under the entity section and complete the continuation pages as instructed.

Part I. Person From Whom the Cash Was Received (Individual)

- Line 3. Last name of the individual payer.

- Line 4. First name.

- Line 5. Middle initial (if any).

- Line 6. Taxpayer Identification Number (TIN); if unavailable, see TIN rules and alternate ID documentation later (Item 27 in the instructions covers non‑TIN scenarios).

- Line 7. Street address (number, street, and apt./suite).

- Line 8. Date of birth (MM/DD/YYYY), per instructions.

- Line 9. City.

- Line 10. State.

- Line 11. ZIP code.

- Line 12. Country (if not U.S.).

- Line 13. Occupation/profession/business of the payer.

- Line 14. Identification description, issuing authority/country, and ID number (for example, passport; follow the instruction to enter ID without special characters).

Part II. Person on Whose Behalf This Transaction Was Conducted (Individual or Entity)

Use Part II if one person is paying on behalf of someone else (for example, an agent paying for a principal).

- Line 15. Check if there are multiple “on whose behalf” individuals/entities; complete the continuation section if so.

- Lines 16–18. Name fields for the person on whose behalf (last, first, MI for an individual, or organization name if an entity).

- Line 19. TIN for that person/entity.

- Line 20. Doing‑Business‑As (DBA) name and EIN, if applicable (for entities).

- Line 21. Street address.

- Lines 22–26. City, state, ZIP, country (if not U.S.), and occupation/profession/business for the “on whose behalf” person/entity.

- Line 27. If the person is not required to furnish a TIN, complete 27a–27c with ID description, issuing country, and ID number; you must complete all three to ensure processing.

Part III. Description of the Transaction and Method of Payment

- Line 28. Date cash was received; if multiple payments, enter the date the combined amount exceeded $10,000.

- Line 29. Total cash received as of the date the amount exceeded $10,000 within a 12‑month period; if a previous Form 8300 was filed, follow the instruction to report cumulative totals correctly.

- Line 30. Describe the transaction (for example, sale of goods/services, real property, loan repayment); use clear, specific terms consistent with instruction categories.

- Line 31. Method of payment details: indicate whether currency, money order, cashier’s check, bank draft, or traveler’s check was received; apply “cash” definitions including combined instruments under $10,000 when part of a >$10,000 single/related transaction per guidance.

- Line 32. If multiple payments, detail each payment amount, date, and instrument per instruction; maintain documentation for audit support.

- Line 33. Any additional narrative needed to explain related transactions, aggregation within 12 months, or agent/principal arrangements per the definitions in the instructions/reference guide.

Part IV. Business that Received the Cash

- Lines 34–36. Name of your business (and DBA, if any), and EIN; match your legal name and EIN as on IRS records.

- Line 37. Type of business (brief description, for example, auto dealer, jeweler, contractor).

- Line 38. Street address of the business location receiving the cash.

- Lines 39–41. City, state, ZIP.

- Line 42. Business telephone number.

- Line 43. Name and title of the person completing the form (your contact for IRS/FinCEN).

- Line 44. Signature and date; signing officer/authorized person must certify accuracy; date must reflect filing timeline (within 15 days of the reportable event).

Multiple Parties continuation (complete if you checked the applicable box in Part I or II)

For each additional individual payer (continuation of Part I):

- Repeat Lines 3–14 for each additional individual: last, first, MI, TIN, address, DOB, city/state/ZIP/country, occupation, and ID description/issuer/number as instructed.

For each additional “on whose behalf” individual/entity (continuation of Part II):

- Repeat Lines 16–27 for each additional person/entity, including TIN or, if not required to furnish a TIN, the full 27a–27c ID set (all three items required).

How to Avoid Common Errors

- Match names, TINs, and addresses to official documents; incomplete 27a–27c fields or missing DOBs delay processing.

- Describe the transaction specifically on Line 30 rather than generically; reference the guide’s transaction types (for example, pre‑existing debt payment, escrow contribution).

- For multiple payments, ensure Line 28 is the date the threshold was crossed and Line 29 reflects the cumulative total through that date; attach continuation details if needed.

- Keep copies and supporting documents (invoices, receipts, ID copies as permitted) to satisfy recordkeeping rules and audit inquiries.

Filing Checklist

- Identify if the payment exceeds $10,000 in cash in a single/related transaction and confirm the 15‑day clock.

- Determine e‑file obligation and submit via BSA E‑Filing (or mail paper per instructions).

- Complete all applicable Parts I–IV and any continuation pages—do not leave required fields blank (complete 27a–27c if TIN not required).

- Prepare and send the customer statement(s) by January 31 (unless suspicious under threshold).

- Retain records per the instructions and your compliance program.