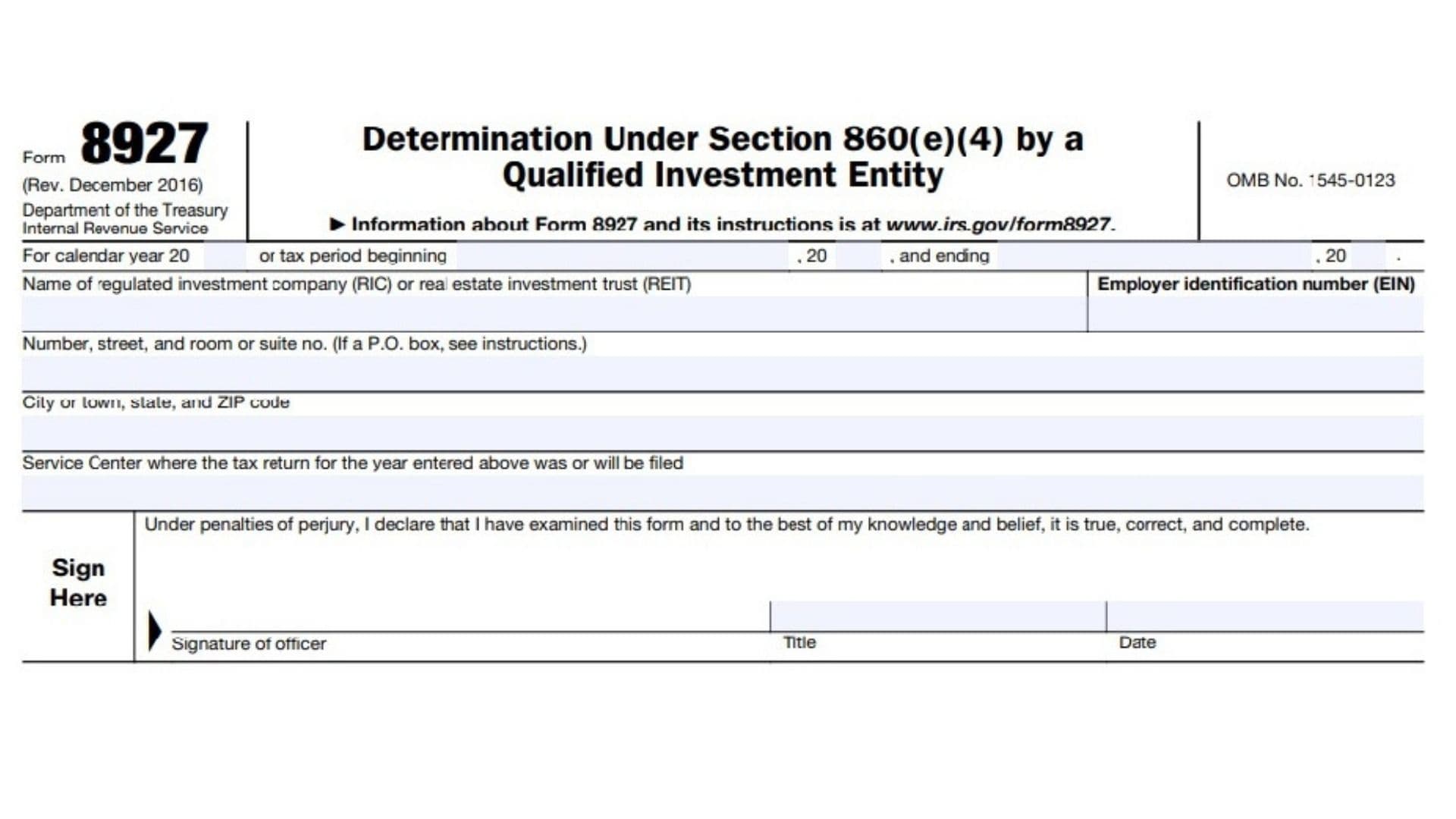

IRS Form 8927, officially titled “Determination Under Section 860(e)(4) by a Qualified Investment Entity,” is a tax document used by regulated investment companies (RICs) and real estate investment trusts (REITs) operating within the United States. Its primary purpose is to make an official self-determination under Section 860(e)(4) of the Internal Revenue Code concerning specific amendments or supplements to their tax returns for a particular tax year. This process is crucial for ensuring the accuracy of tax reporting, correcting any errors related to income distribution, and maintaining regulatory compliance. Filing Form 8927 allows these entities to provide the IRS with a formal statement regarding their amended or supplemented return positions, helping to avoid potential disputes, penalties, or further IRS scrutiny. The form includes identifying information, relevant tax periods, and a sworn declaration made under penalty of perjury that the filing is accurate and complete. Understanding and filing Form 8927 correctly ensures these organizations uphold transparency and fulfill their tax obligations in line with federal regulations

How to Complete Form 8927?

- Tax Year/Period

- At the very top, enter the tax year (e.g., 2025), or if not a full calendar year, fill out the “period beginning” and “ending” dates.

- Entity Information

- Enter the full legal name of your RIC or REIT.

- Enter your Employer Identification Number (EIN).

- Enter the complete mailing address: number and street (or P.O. box if mail is not delivered to your street address), city, state, ZIP code.

- If you receive mail via a third party (e.g., accountant), include “C/O” plus that person’s name and address.

- Service Center

- Write which IRS service center (city/location) you filed (or will file) your main tax return for the year listed above.

- Signature Section

- The authorized officer (like president, CFO, or another company officer) must:

- Sign the form.

- Enter their title.

- Fill in the date they sign.

- The authorized officer (like president, CFO, or another company officer) must:

- Mail the Form

- Send the completed form to:

- Internal Revenue Service

P.O. Box 9941

Mail Stop 4912

Ogden, UT 84409

- Internal Revenue Service

- Send the completed form to: