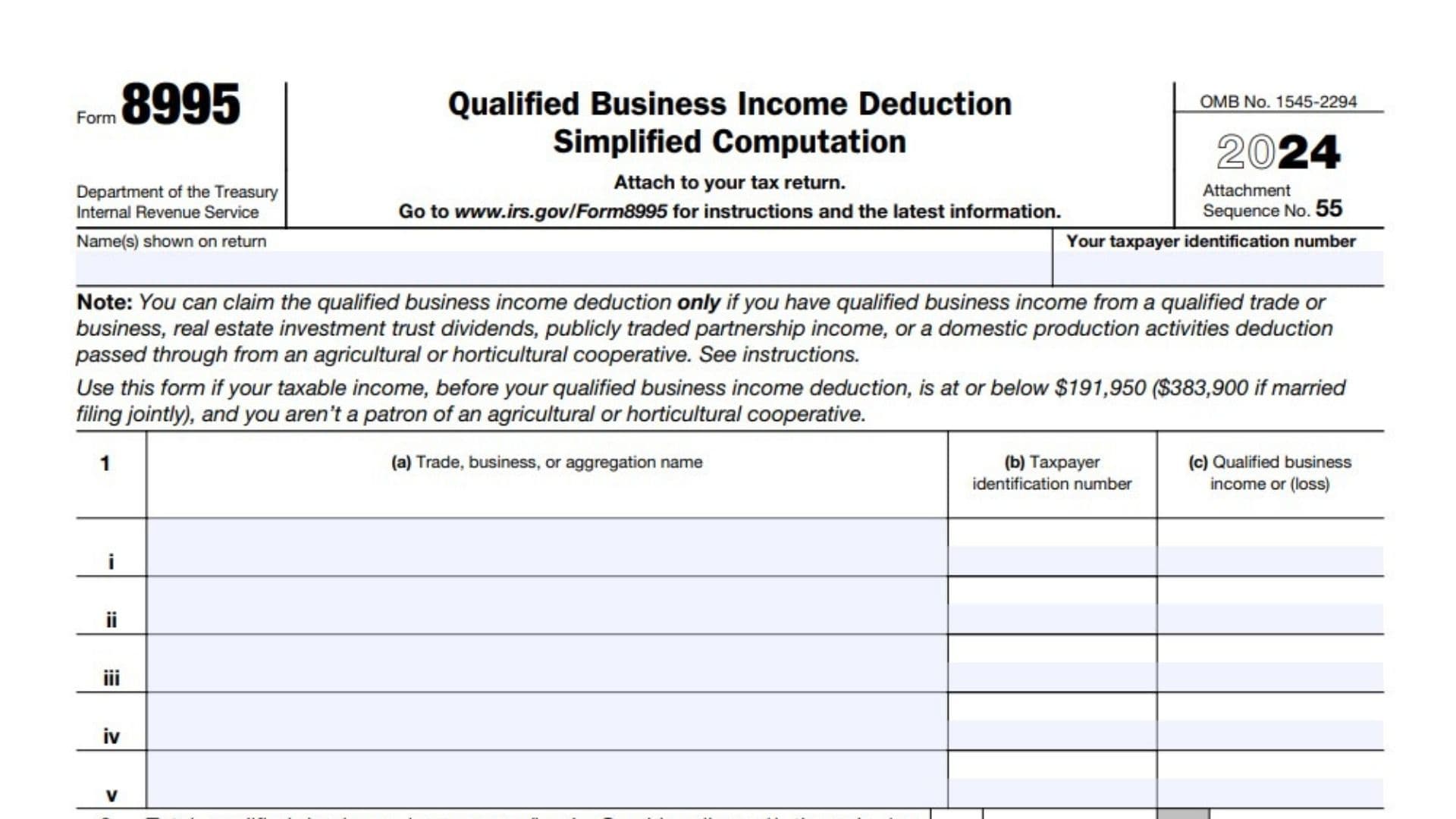

IRS Form 8995, titled “Qualified Business Income Deduction Simplified Computation,” is a tax form used by eligible taxpayers to calculate and claim the Qualified Business Income (QBI) Deduction. This deduction, established by the Tax Cuts and Jobs Act, allows individuals with income from qualified trades or businesses, real estate investment trust (REIT) dividends, or publicly traded partnership (PTP) income to potentially deduct up to 20% of their qualified business income from their taxable income. Form 8995 is designed for taxpayers whose taxable income (before the QBI deduction) is at or below $191,950 for single filers or $383,900 for those married filing jointly, and who are not patrons of agricultural or horticultural cooperatives. The form streamlines the calculation, ensuring that only eligible taxpayers can claim the deduction and that it is computed accurately based on IRS guidelines1.

How to File Form 8995?

- Attach Form 8995 to your federal tax return (Form 1040, 1040-SR, or 1041) when you file.

- Ensure your taxable income is within the eligibility limits.

- Gather all necessary documentation regarding your qualified business income, REIT dividends, PTP income, and any relevant carryforwards.

- Complete the form line by line, as detailed below, and transfer the final deduction amount to the appropriate line on your tax return1.

How to Complete Form 8995?

Header Section

- Enter your name as shown on your tax return.

- Enter your taxpayer identification number.

Line 1 (a-e): List of Businesses

- (a) Trade, business, or aggregation name: Enter the name of each qualified trade, business, or aggregation.

- (b) Taxpayer identification number: Enter the TIN for each business.

- (c) Qualified business income or (loss): Enter the QBI or loss for each business.

- (d) and (e): Repeat as needed for additional businesses (i-v).

Line 2: Total Qualified Business Income or (Loss)

- Combine all QBI or loss amounts from column (c) of lines 1i through 1v. Enter the total1.

Line 3: Qualified Business Net (Loss) Carryforward from Prior Year

- Enter any QBI net loss carryforward from the previous year. If none, enter zero1.

Line 4: Total Qualified Business Income

- Add lines 2 and 3. If the result is zero or less, enter -0-1.

Line 5: Qualified Business Income Component

- Multiply the amount on line 4 by 20% (0.20). Enter the result1.

Line 6: Qualified REIT Dividends and PTP Income or (Loss)

- Enter any qualified REIT dividends and PTP income or loss for the year. See the IRS instructions for definitions1.

Line 7: Qualified REIT Dividends and PTP (Loss) Carryforward from Prior Year

- Enter any carryforward of REIT dividends and PTP losses from the prior year. If none, enter zero1.

Line 8: Total Qualified REIT Dividends and PTP Income

- Add lines 6 and 7. If zero or less, enter -0-1.

Line 9: REIT and PTP Component

- Multiply the amount on line 8 by 20% (0.20). Enter the result1.

Line 10: QBI Deduction Before Income Limitation

- Add lines 5 and 9. This is your QBI deduction before applying the income limitation1.

Line 11: Taxable Income Before QBI Deduction

- Enter your taxable income before the QBI deduction, as calculated on your tax return1.

Line 12: Net Capital Gain (Including Qualified Dividends)

- Enter your net capital gain, increased by any qualified dividends. See the IRS instructions for details1.

Line 13: Taxable Income Minus Net Capital Gain

- Subtract line 12 from line 11. If zero or less, enter -0-1.

Line 14: Income Limitation

- Multiply the amount on line 13 by 20% (0.20). This is your income limitation1.

Line 15: Qualified Business Income Deduction

- Enter the smaller of line 10 or line 14. This is your allowable QBI deduction. Also, enter this amount on the applicable line of your tax return1.

Line 16: Total Qualified Business (Loss) Carryforward

- Combine lines 2 and 3. If the result is greater than zero, enter -0-. Otherwise, enter the negative amount as a carryforward to next year1.

Line 17: Total Qualified REIT Dividends and PTP (Loss) Carryforward

- Combine lines 6 and 7. If the result is greater than zero, enter -0-. Otherwise, enter the negative amount as a carryforward to next year1.