Form 4137 is a tax form you must complete along with your federal income tax return. It should be submitted by the due date. The IRS Form 4137 deadline is the same as the federal income tax deadline. If an employee earns over $20 per month in tips, the IRS will require them to report them on Form 4137. If they do not report the tips, the employer will withhold the amount of tax. You should file separate Form 4137s for each spouse.

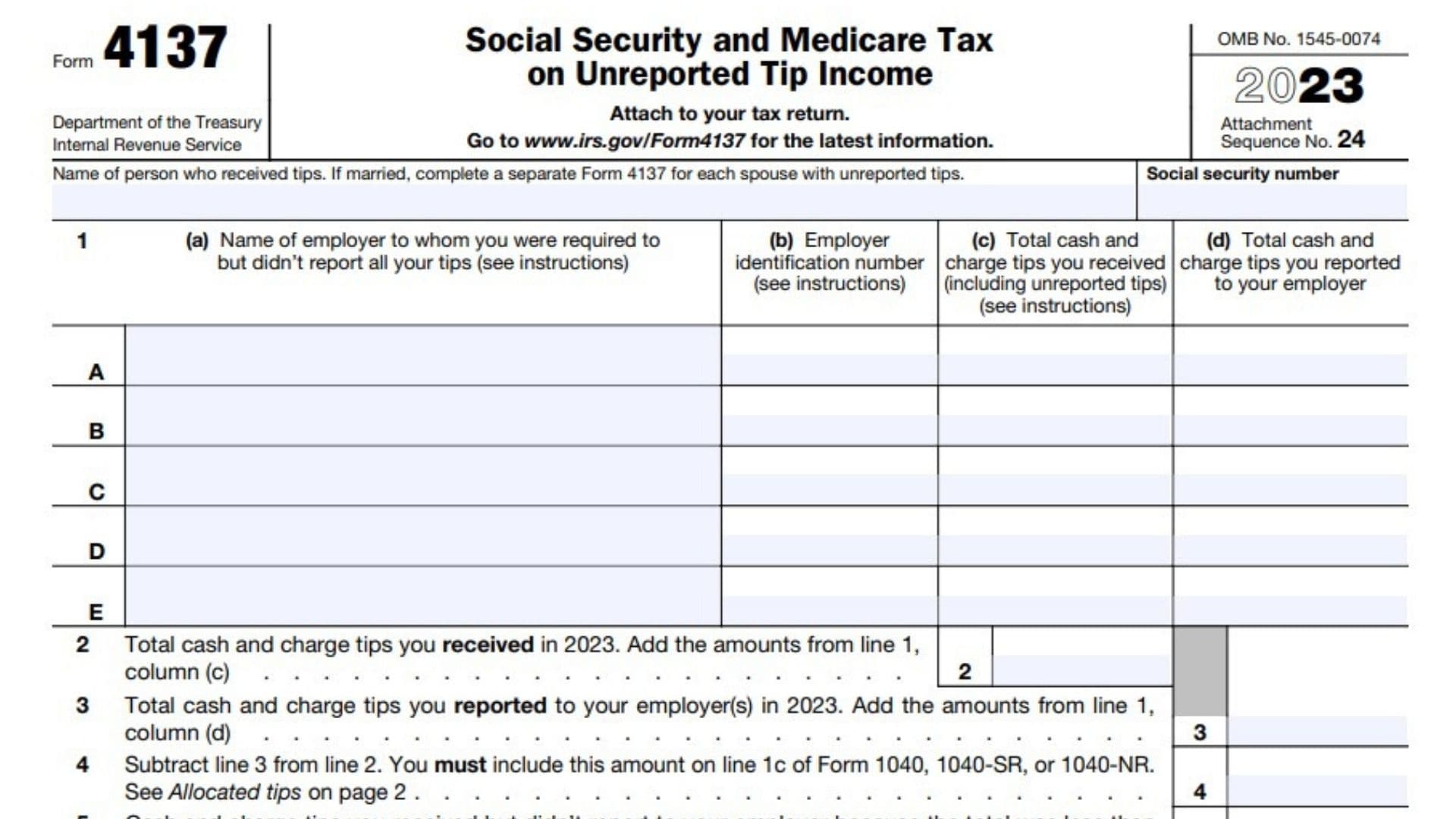

The amount of tips you earn from your job must be reported to the IRS. To avoid penalties, you must enter your employer and the tips amount in the proper boxes on Form 4137. You must also calculate the Social Security and Medicare taxes on your tips. Here are the line-by-line fillout instructions for Form 4137:

How to Complete Form 4137?

Line 1 Columns A, B, C, D, E:

a: Name of employer to whom you were required to report your tips, but you should have reported all of them.

b: Enter employer identification number ( EIN )

c: Enter the total cash and charge tips you received (including unreported tips)

d: Enter the total cash and charge tips you reported to your employer.

Line 2: Total cash and charge tips you received in 2022. Add the amounts from line 1, column (c).

Line 3: Total cash and charge tips you reported to your employer(s) in 2022. Add the amounts from line 1, column (d)

Line 4: Subtract line 3 from line 2. Include this amount on line 1c of Form 1040, 1040-SR, or 1040-NR

Line 5: Cash and charge tips you received but didn’t report to your employer because the total was less than $20 in a calendar month

Line 6: Unreported tips subject to Medicare tax. Subtract line 5 from line 4

Line 7: Maximum amount of wages (including tips) subject to social security tax

Line 8:

- Total social security wages

- Social security tips

- Railroad retirement (RRTA) compensation

Line 9: Subtract line 8 from line 7. If line 8 is more than line 7, enter -0-.

Line 10: Unreported tips subject to social security tax. Enter the smaller of line 6 or line 9.

Line 11: Multiply line 10 by 0.062 (social security tax rate).

Line 12: Multiply line 6 by 0.0145 (Medicare tax rate)

Line 13: Add lines 11 and 12. Enter the amount here and include as tax on Schedule 2 (Form 1040), line 5; Form 1040-PR, Part I, line 6; or Form 1040-SS, Part I, line 6