IRS Form 2438, Undistributed Capital Gains Tax Return, is used by regulated investment companies (RICs) and real estate investment trusts (REITs) to report and pay tax on undistributed capital gains that are designated under section 852(b)(3)(D) or 857(b)(3)(C) of the Internal Revenue Code. When a RIC or REIT realizes capital gains but does not distribute them to shareholders, it may elect to designate these gains as “undistributed capital gains.” The entity is then responsible for paying the tax on these gains at the corporate rate, while shareholders may receive a tax credit for their share. Each fund within a RIC must file a separate Form 2438 if it has more than one portfolio of assets. The form ensures that the IRS receives accurate information on the calculation, designation, and taxation of these undistributed gains, and it must be filed within 30 days after the end of the fund’s or REIT’s tax year. A copy of Form 2438 must also be attached to the entity’s annual tax return (Form 1120-RIC or Form 1120-REIT).

How to File Form 2438?

- When to File: Submit Form 2438 by the 30th day after the end of the RIC’s or REIT’s tax year.

- Where to File: Mail the original form to:

- Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999 - Attach a copy to Form 1120-RIC or Form 1120-REIT.

- Department of the Treasury

- Who Must Sign: The form must be signed and dated by an authorized corporate officer (e.g., president, vice president, treasurer, chief accounting officer) or, if applicable, a fiduciary such as a receiver or trustee.

- Tax Payment: Tax due must be deposited electronically using the Electronic Federal Tax Payment System (EFTPS).

- Late Filing and Payment Penalties: Penalties may apply for late filing (5% per month, up to 25%) and late payment (0.5% per month, up to 25%), unless reasonable cause is shown.

How to Complete Form 2438?

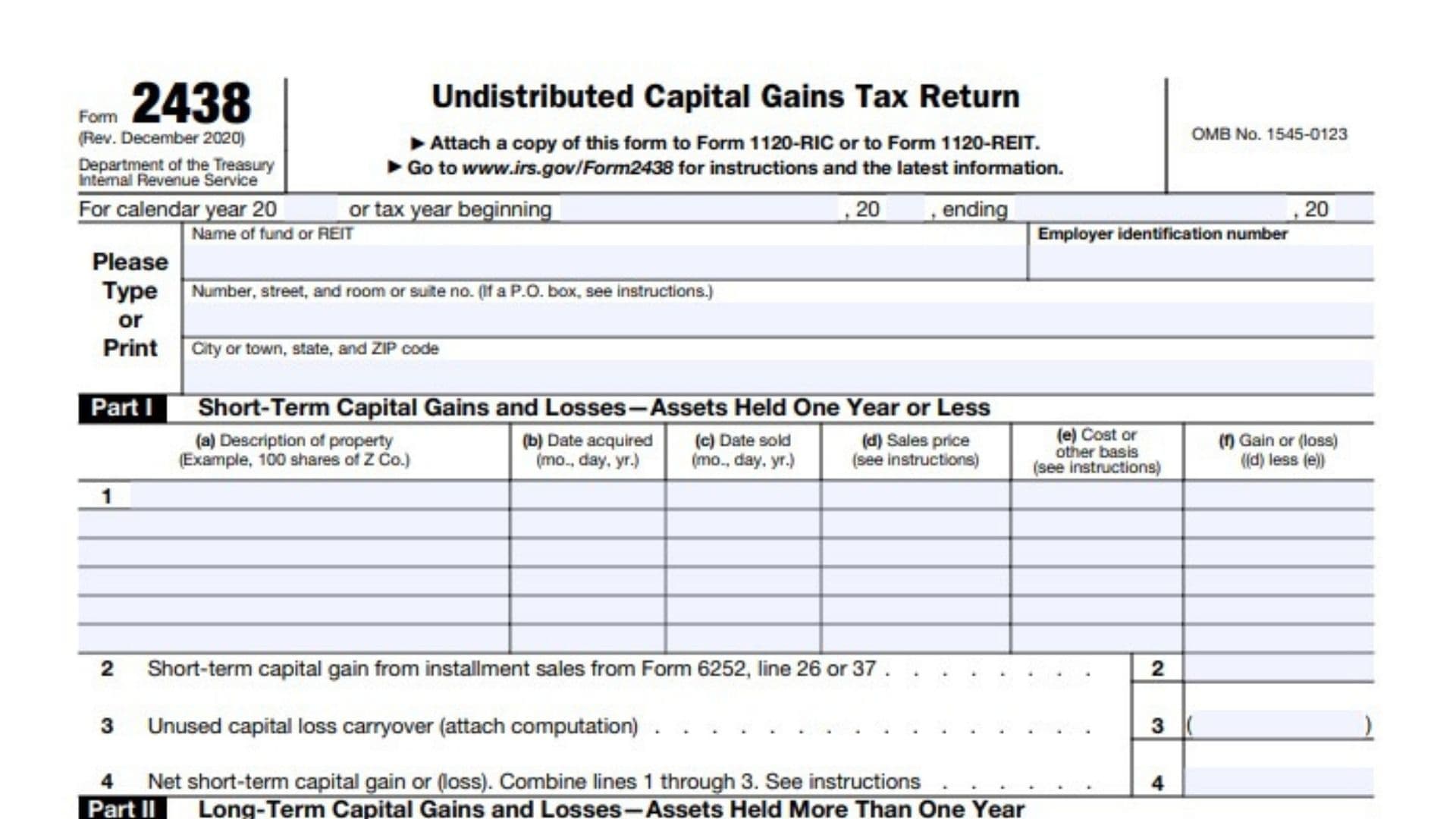

Heading Section

- For calendar year or tax year beginning/ending:

Enter the tax year for which the form is being filed. - Name of fund or REIT:

Enter the full legal name of the RIC fund or REIT. - Employer identification number:

Enter the entity’s EIN. - Address:

Provide the complete mailing address, including suite, room, or unit number. If mail is not delivered to the street address, use the P.O. box.

Part I: Short-Term Capital Gains and Losses-Assets Held One Year or Less

- Line 1, Columns (a)-(f):

For each short-term capital asset sold:- (a) Description of property (e.g., “100 shares of Z Co.”)

- (b) Date acquired (month, day, year)

- (c) Date sold (month, day, year)

- (d) Sales price (gross or net; if net, do not adjust basis for expenses already deducted)

- (e) Cost or other basis (increase by any sales expenses, if gross sales price is used)

- (f) Gain or (loss): Subtract (e) from (d) for each asset.

- Line 2:

Enter short-term capital gain from installment sales reported on Form 6252, line 26 or 37. - Line 3:

Enter unused capital loss carryover from prior years (attach computation). - Line 4:

Net short-term capital gain or (loss): Combine lines 1, 2, and 3.

Report this amount on Part I of Form 8949, identifying it as “Net short-term capital gain from line 4, Form 2438” in column (a).

Part II: Long-Term Capital Gains and Losses-Assets Held More Than One Year

- Line 5, Columns (a)-(f):

For each long-term capital asset sold:- (a) Description of property

- (b) Date acquired

- (c) Date sold

- (d) Sales price

- (e) Cost or other basis (adjust as in Part I)

- (f) Gain or (loss): Subtract (e) from (d) for each asset4

- Line 6:

Enter gain from Form 4797, column (g), line 7 or 9. - Line 7:

Enter long-term capital gain from installment sales reported on Form 6252, line 26 or 37. - Line 8:

Net long-term capital gain: Combine lines 5, 6, and 7.

Part III: Summary of Parts I and II

- Line 9a:

Net capital gain: Enter the excess of net long-term capital gain (line 8) over net short-term capital loss (line 4). - Line 9b:

Enter any capital gain distributions made to shareholders. - Line 10:

Undistributed capital gains: Subtract line 9b from line 9a. - Line 11:

Enter the amount of undistributed capital gains on line 10 that is designated under section 852(b)(3)(D) or 857(b)(3)(C). - Line 12:

Amount of undistributed capital gains not designated: Subtract line 11 from line 10.

Report this amount in Part II of Form 8949, identifying it as “Undistributed capital gains not designated (from Form 2438)” in column (a). - Line 13:

Capital gains tax: Multiply line 11 by 21% (0.21).

Deposit the tax due by the 30th day after the end of the tax year using EFTPS.

Signature Section

- Signature of officer:

The form must be signed and dated by an authorized officer or, if applicable, a fiduciary. Include the officer’s title.

Paid Preparer Use Only

- If the form is prepared by a paid preparer, they must complete this section, including name, signature, firm’s name, EIN, address, and phone number. If prepared by a corporate officer or an unpaid preparer, leave this section blank.