IRS Form 976 is used by personal holding companies (PHCs), regulated investment companies (RICs), and real estate investment trusts (REITs) to claim a deficiency dividend deduction under Internal Revenue Code sections 547 or 860. When a tax deficiency is determined-meaning the IRS or a court finds that additional tax is owed-these entities can distribute a “deficiency dividend” to shareholders. Filing Form 976 allows the entity to deduct this dividend, potentially reducing or eliminating the tax owed due to the deficiency. If the claim is allowed, the taxpayer may be relieved from paying certain taxes or may receive a credit or refund. For RICs and REITs, interest may be owed on the amount of the deficiency dividend deduction allowed, and the IRS will notify the entity of the interest due. The form must be filed within 120 days after the determination date (the date the deficiency is finalized by court decision, agreement, or other means), and the deficiency dividend must be distributed within 90 days after this date and before filing the form. The form requires detailed disclosures about the deficiency, the dividend distribution, and supporting documentation, ensuring the IRS can verify the deduction claim.

How to File Form 976?

- Timing: File Form 976 within 120 days after the determination date (when the tax deficiency becomes final).

- Where to File:

- PHCs: File with the IRS office where PHC status was determined.

- RICs and REITs: File with the IRS Service Center where the tax return for the relevant year was filed, unless special situations apply (e.g., self-determination under section 860(e)(4), then file with IRS Ogden, UT).

- Distribution Requirement: The deficiency dividend must be distributed within 90 days after the determination date and before filing the form.

- Documentation: Attach all required supporting documents, such as court decisions, agreements, and board resolutions.

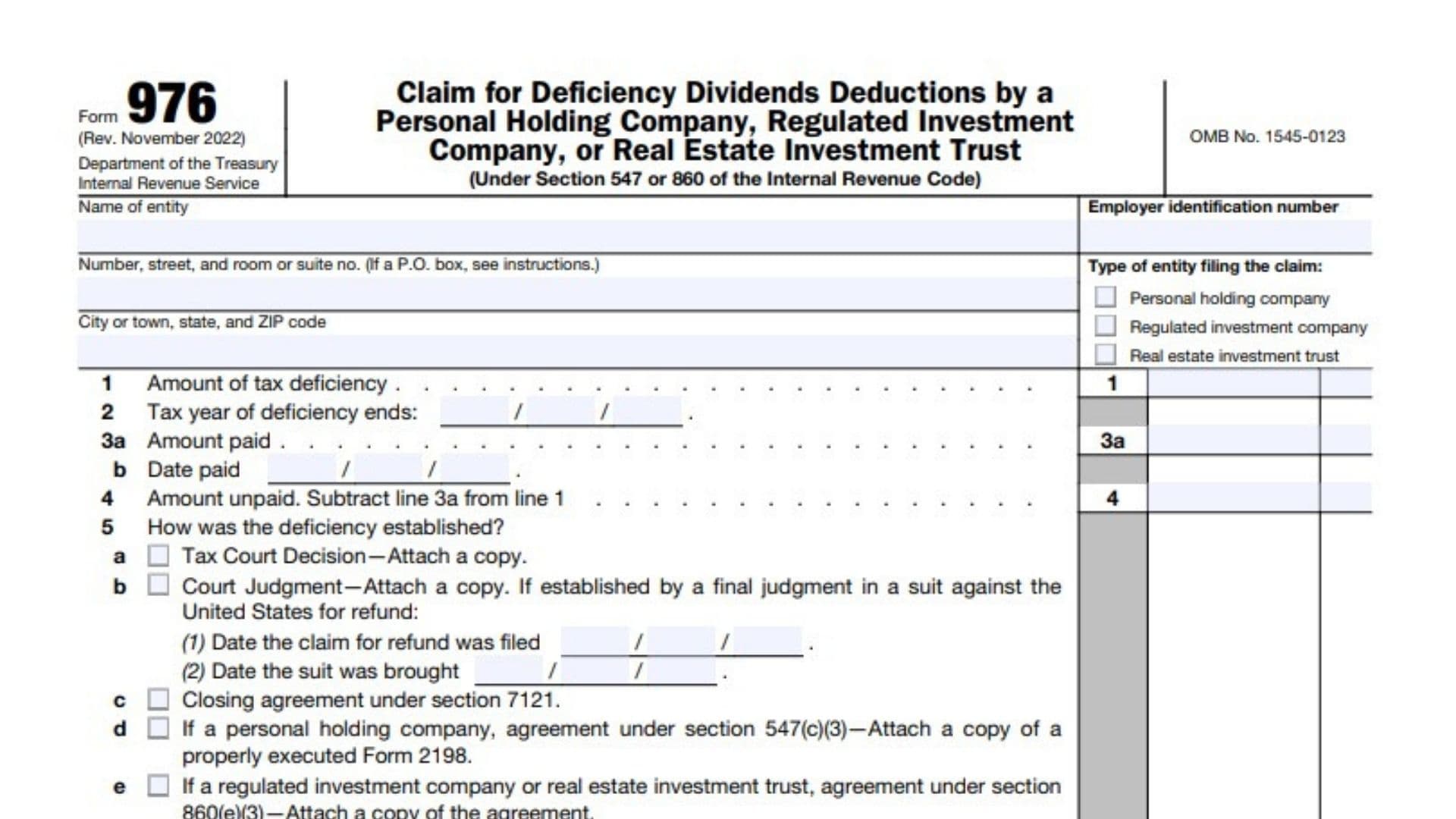

How to Complete Form 976?

Header Section: Entity Information

- Name of entity: Enter the full legal name of the PHC, RIC, or REIT.

- Number, street, and room or suite no.: Enter the complete address. If using a P.O. box, follow IRS instructions.

- City or town, state, and ZIP code: Enter the city, state, and ZIP code.

- Employer identification number: Enter the entity’s EIN.

- Type of entity filing the claim: Check the appropriate box for PHC, RIC, or REIT.

Line 1: Amount of tax deficiency

- Enter the amount of tax liability established by the determination, without considering the deficiency dividend deduction.

- Attach a detailed statement explaining how this amount was computed, including any changes to income, expenses, or credits from the original or amended tax return.

Line 2: Tax year of deficiency ends

- Enter the ending date (MM/DD/YYYY) of the tax year for which the deficiency dividend deduction is claimed.

- File a separate Form 976 for each tax year.

Line 3a: Amount paid

- Enter the amount already paid toward the tax liability shown on line 1, excluding any deficiency dividend deduction.

Line 3b: Date paid

- Enter the date (MM/DD/YYYY) that the amount on line 3a was paid.

Line 4: Amount unpaid

- Subtract line 3a from line 1 and enter the result. This is the remaining unpaid tax liability.

Line 5: How was the deficiency established?

- a. Tax Court Decision: Check if applicable and attach a copy of the Tax Court decision.

- b. Court Judgment: Check if applicable and attach a copy of the court judgment. If from a suit for refund:

- (1) Enter the date the claim for refund was filed.

- (2) Enter the date the suit was brought.

- c. Closing agreement under section 7121: Check if applicable.

- d. PHC agreement under section 547(c)(3): Check if applicable and attach Form 2198.

- e. RIC or REIT agreement under section 860(e)(3): Check if applicable and attach the agreement.

- f. RIC or REIT self-determination under section 860(e)(4): Check if applicable and attach Form 8927 or the required statement.

Line 6: Determination date

- Enter the determination date (MM/DD/YYYY) as defined in the instructions, based on how the deficiency was established.

Line 7: Date the deficiency dividend was distributed

- Enter the date (MM/DD/YYYY) the deficiency dividend was distributed.

- Attach a certified copy of the board resolution or other authority authorizing the payment4.

Line 8: Deficiency dividend was distributed as follows

- a. Cash: Enter the total amount of deficiency dividends distributed in cash.

- b. Other property: If distributed in property other than cash:

- (1) Enter the fair market value of the property.

- (2) Enter the adjusted basis of the property.

- Attach a description of the property distributed.

- For publicly traded RICs or REITs meeting certain requirements, only the fair market value may be required.

Line 9: Amount claimed as a deduction for deficiency dividends

- a. Enter the total amount claimed as a deduction for deficiency dividends.

- b. For RICs and REITs, enter the portion of line 9a designated or reported as capital gain dividends.

Line 10: (PHCs only) Shareholder information

- a. Name and address of each shareholder: List all shareholders as of the date of payment.

- b. Class of stock and number of shares: For each shareholder, specify the class and number of shares held.

- c. Amount of deficiency dividend paid: Enter the amount paid to each shareholder for each class of stock.

Signature Section

- The form must be signed and dated by an authorized officer (e.g., president, vice president, treasurer, assistant treasurer, chief accounting officer, or other authorized officer).

- If a paid preparer completed the form, they must fill in the “Paid Preparer Use Only” section, sign by hand, and provide their information. If not paid, do not sign this section.

Paperwork Reduction Act Notice

- The IRS requires this information to administer tax laws. Retain records as long as they may be material to tax administration.

- Estimated average time to complete: Recordkeeping (5 hr, 44 min), learning (53 min), preparing and sending (1 hr, 2 min).