IRS Form 973, Corporation Claim for Deduction for Consent Dividends, is used by corporations to claim a deduction for consent dividends under Internal Revenue Code section 565. A consent dividend is a notional dividend that shareholders agree to include in their taxable income, even though no cash or property is actually distributed. This mechanism allows certain corporations-such as those subject to the accumulated earnings tax, personal holding companies, foreign personal holding companies, regulated investment companies, and real estate investment trusts-to distribute taxable income to shareholders on paper, thereby qualifying for a dividend-paid deduction without making an actual payment. To claim this deduction, the corporation must receive a signed Form 972 from each consenting shareholder and attach both Form 973 and the corresponding Form(s) 972 to its income tax return for the year in which the deduction is claimed. The process ensures that the IRS recognizes both the corporation’s deduction and the shareholder’s inclusion of the consent dividend as income.

How to File IRS Form 973

- Complete Form 973 for the tax year in which the corporation claims the consent dividend deduction.

- Attach a signed Form 972 (or an unsigned copy with the same information, retaining the original signed version in your records) for each shareholder who agreed to the consent dividend.

- Attach Form 973 and the required Form(s) 972 to the corporation’s income tax return for the relevant tax year.

- If any shareholder is a nonresident alien or foreign entity, ensure proper withholding and reporting using Forms 1042, 1042-S, and 1042-T as required.

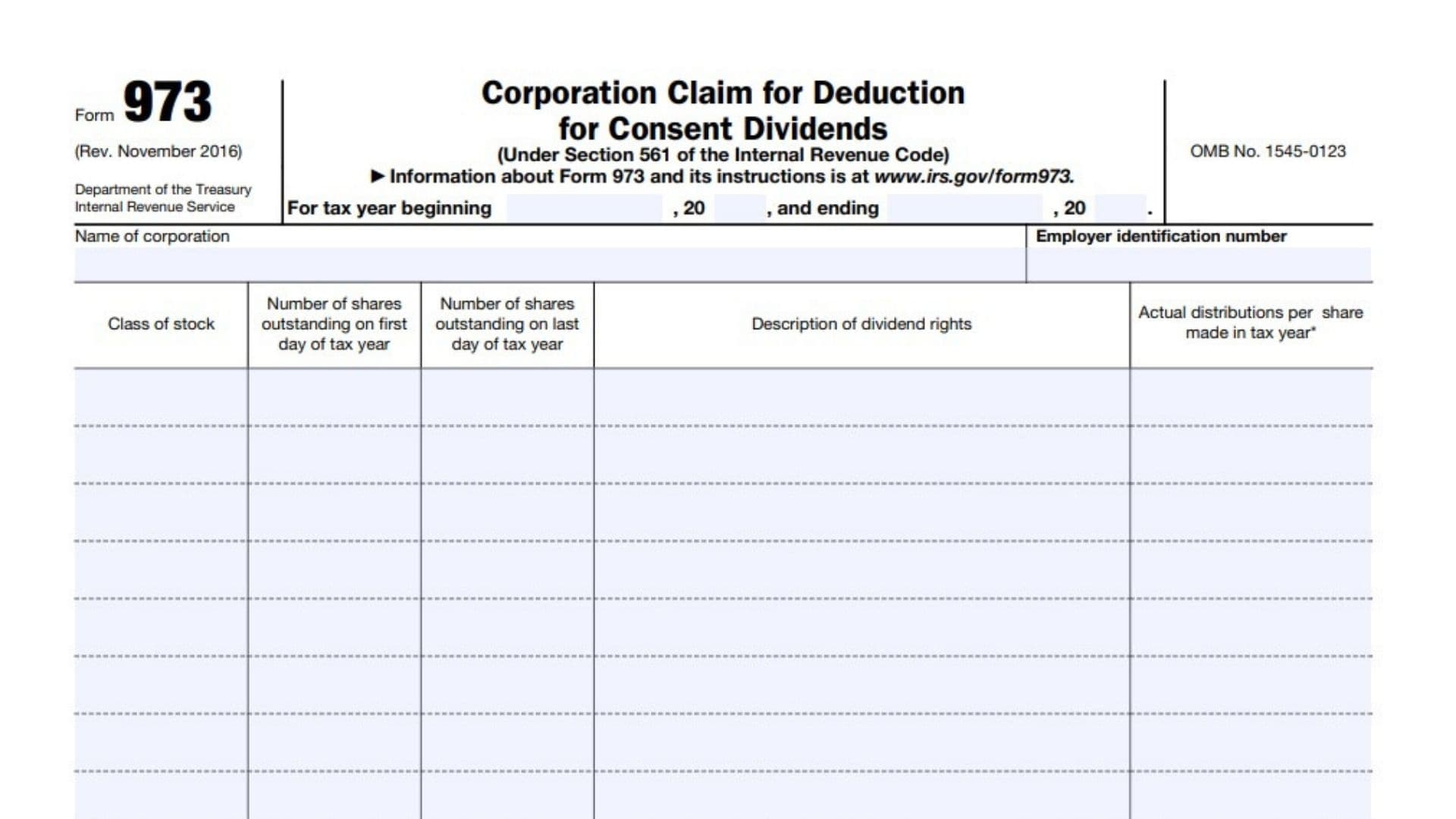

How to Complete Form 973?

Header Section

- For tax year beginning , 20 , and ending , 20

- Enter the starting and ending dates of the corporation’s tax year for which the consent dividend deduction is being claimed.

- Name of corporation

- Enter the full legal name of the corporation claiming the deduction.

- Employer identification number

- Enter the corporation’s Employer Identification Number (EIN).

Stock and Dividend Information Table

For each class of stock, complete the following columns:

- Class of stock

- Specify each class of stock outstanding during the tax year (e.g., common, preferred).

- Number of shares outstanding on first day of tax year

- Enter the number of shares of each class outstanding at the start of the tax year.

- Number of shares outstanding on last day of tax year

- Enter the number of shares of each class outstanding at the end of the tax year.

- Description of dividend rights

- Briefly describe the dividend rights attached to each class of stock (e.g., cumulative, non-cumulative, participating).

- Actual distributions per share made in tax year*

- Enter the actual amount distributed per share for each class during the tax year.

- *If a distribution was not made on all shares of any class, describe any unequal treatment in the space below the table.

Unequal Treatment and Stock Changes

- If a distribution was not made on all shares of any class, describe any unequal treatment:

- Provide details if any shares within a class were treated differently regarding distributions.

- Describe any other changes in outstanding stock during the tax year:

- List any other changes, such as new issuances, redemptions, conversions, or other events affecting the number or class of shares.

- Use additional sheets if necessary.

Cumulative Dividends (Page 2)

- If any stock outstanding on the last day of the tax year is entitled to cumulative dividends, show the amount for earlier years unpaid at the beginning of the tax year. Give the class or classes of stock involved.

- For each class of stock with cumulative dividend rights, state the amount of unpaid dividends from prior years that were outstanding at the beginning of the tax year.

- Use additional sheets if needed.

Signature Section

- Signature of officer

- The form must be signed by an authorized corporate officer, such as the president, vice president, treasurer, assistant treasurer, chief accounting officer, or tax officer.

- Title

- Enter the title of the signing officer.

- Date

- Enter the date the form is signed.

- Declaration

- By signing, the officer certifies under penalty of perjury that the return and any accompanying schedules/statements are true, correct, and complete.

Paperwork Reduction Act Notice

No action is required by the filer. This section provides information about the estimated time to complete the form and the IRS’s authority to collect the information.