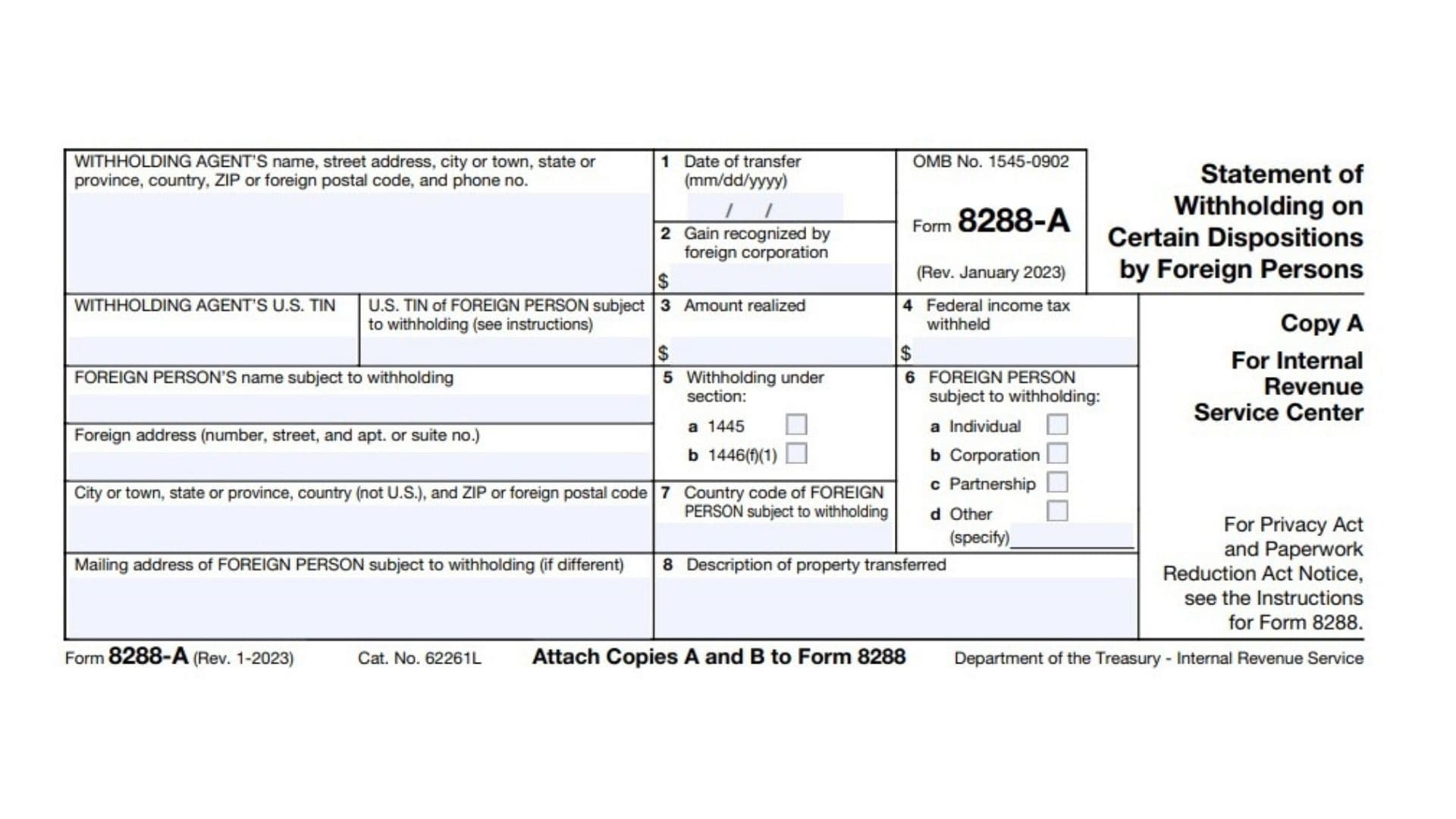

IRS Form 8288-A is a mandatory attachment to Form 8288 that documents federal income tax withheld under sections 1445 (FIRPTA withholding on U.S. real property sales) or 1446(f)(1) (withholding on partnership interest transfers). It serves as a transaction-specific record for foreign sellers/transferors to claim tax credits or refunds and enables the IRS to verify compliance. Each Form 8288-A corresponds to one foreign person subject to withholding, requiring precise details about the property, parties involved, and tax calculations. The form has three copies:

- Copy A: Filed with the IRS

- Copy B: Stamped by the IRS and sent to the foreign person for tax return attachment

- Copy C: Retained by the withholding agent.

How to File Form 8288-A?

- Prepare one Form 8288-A per foreign person involved in the transaction.

- Attach Copies A and B to Form 8288 when submitting withholding tax.

- Mail to:

Ogden Service Center | P.O. Box 409101 | Ogden, UT 84409. - Deadline: File within 20 days of the property transfer date.

- Retain Copy C for your records.

How to Complete Form 8288-A?

Withholding Agent Section (Top Section)

- WITHHOLDING AGENT’S name, street address, city or town, state or province, country, ZIP/foreign postal code, and phone no.:

Provide the legal name and non-P.O. box address of the buyer/transferee responsible for withholding. Include a phone number (optional). - WITHHOLDING AGENT’S U.S. TIN:

Enter the withholding agent’s Employer Identification Number (EIN) or Social Security Number (SSN).

Foreign Person Subject to Withholding

- U.S. TIN of FOREIGN PERSON:

Input the foreign person’s Taxpayer Identification Number (ITIN, EIN, or SSN). If unavailable, write “Foreign” but note this delays IRS processing. - FOREIGN PERSON’S name subject to withholding:

Use the legal name as shown on tax documents. - Foreign address (number, street, apt./suite no.):

Provide the foreign person’s home address (individuals) or office address (entities) outside the U.S.. - City/town, state/province, country, ZIP/foreign postal code:

Include full international address details. If no foreign address exists, list their country of residence. - Mailing address of FOREIGN PERSON (if different):

Optional field for an alternate mailing address.

Transaction Details

- 1. Date of transfer (mm/dd/yyyy):

Enter the actual transfer date or distribution date if withholding under sections 1445(e) or 1446(f)(1). - 2. Gain recognized by foreign corporation:

Complete only for foreign corporations subject to section 1445(e)(2) withholding. - 3. Amount realized:

Specify the total proceeds from the disposition before expenses. - 4. Federal income tax withheld:

Enter the actual tax withheld (e.g., 15% of amount realized for section 1445). - 5. Withholding under section:

Check 5a for section 1445 (real property) or 5b for section 1446(f)(1) (partnership interests).

Foreign Person Classification

- 6. FOREIGN PERSON subject to withholding:

Check the applicable entity type:- 6a: Individual

- 6b: Corporation

- 6c: Partnership

- 6d: Other (specify trust/estate).

- 7. Country code:

Use the two-letter IRS country code (e.g., CA for Canada) from www.irs.gov/countrycodes.

Property Description

- 8. Description of property transferred:

Provide the physical address (for real estate) or partnership interest details (e.g., “% ownership in XYZ Partnership”).

Critical Notes for Compliance

- Missing TINs: The IRS will not issue a stamped Copy B without the foreign person’s TIN, complicating refund claims.

- Early refunds: Available only for section 1445 withholding. Submit Form 8288-B and a refund request statement to the Ogden Service Center.

- Section 1446(f): Early refunds are not permitted for partnership interest transfers.