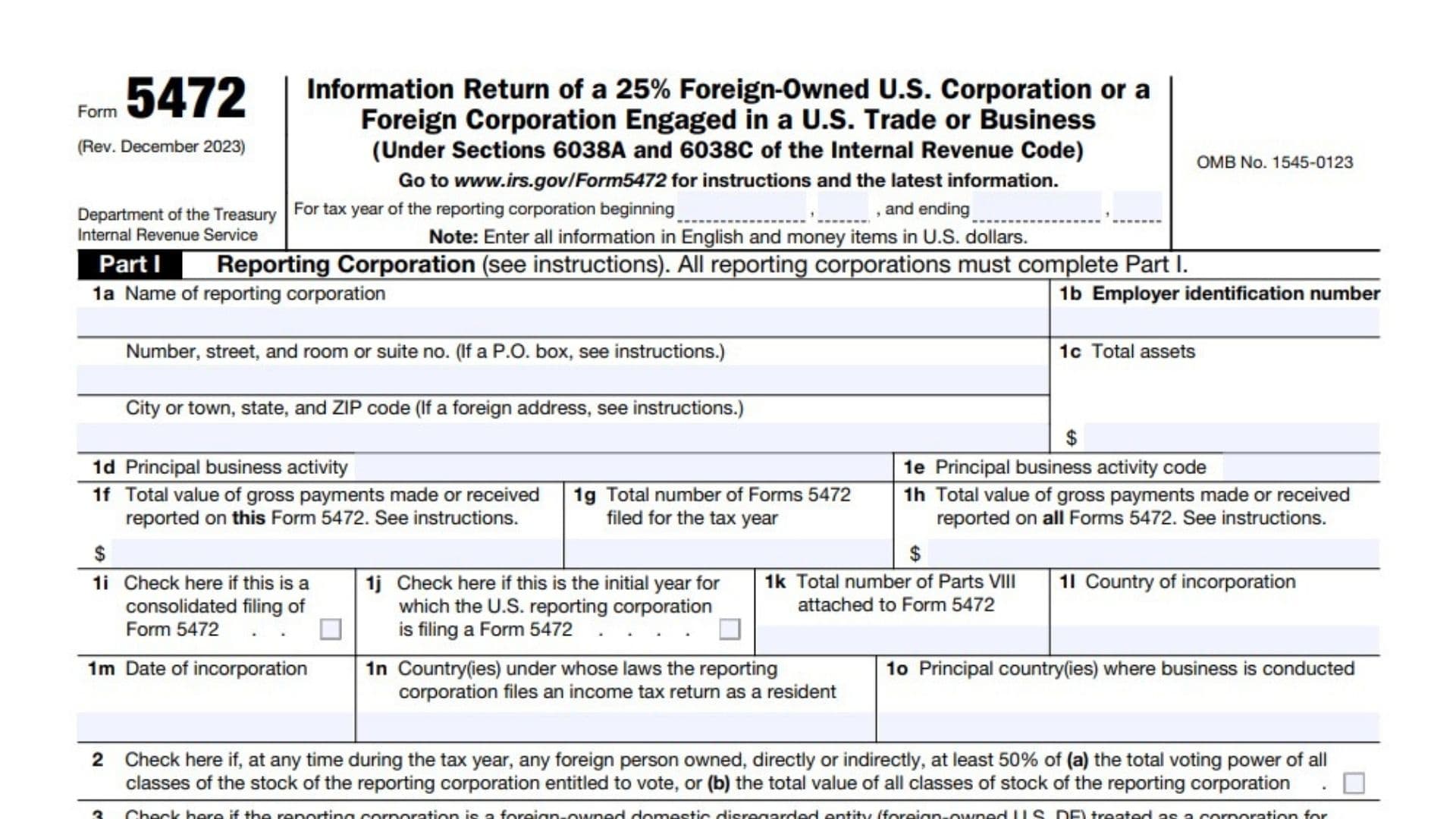

IRS Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, is a mandatory filing for reporting transactions between a U.S. reporting corporation and its foreign related parties. This form applies to entities subject to Sections 6038A and 6038C of the Internal Revenue Code, including foreign-owned U.S. disregarded entities (DREs) and foreign corporations operating in the U.S. Its purpose is to disclose financial transactions (e.g., sales, loans, royalties) to prevent tax avoidance and ensure compliance with transfer pricing rules. Failure to file can result in penalties of $25,000+ and suspension of the statute of limitations.

How to File Form 5472?

- Attach Form 5472 to your federal income tax return (e.g., Form 1120 for corporations).

- File a separate Form 5472 for each foreign-related party and/or disregarded entity.

- Submit by the due date of your tax return, including extensions.

- Report all amounts in U.S. dollars and provide information in English.

- Retain supporting documentation for 7 years.

How to Complete Form 5472?

Part I: Reporting Corporation

1a

- Name of reporting corporation: Legal name of the U.S. or foreign corporation.

1b - Employer identification number (EIN): Enter the corporation’s EIN. If none, leave blank.

1c - Total assets: Enter total assets from the corporation’s balance sheet.

1d - Principal business activity: Describe the primary business (e.g., manufacturing, consulting).

1e - Principal business activity code: Use the IRS 6-digit NAICS code.

1f - Total value of gross payments: Report all payments made/received with the related party on this form.

1g - Total number of Forms 5472 filed: Count all Forms 5472 submitted for the tax year.

1h - Total value of gross payments across all forms: Aggregate payments from all related parties.

1i - Consolidated filing: Check if filing a consolidated return for multiple entities.

1j - Initial year filing: Check if this is the first year the corporation files Form 5472.

1k - Number of Parts VIII attached: Count CSA (Cost Sharing Arrangement) schedules.

1l - Country of incorporation: Legal jurisdiction (e.g., “United States” or “Germany”).

1m - Date of incorporation: Use MM/DD/YYYY format.

1n - Residency countries: List countries where the corporation files as a tax resident.

1o - Principal business countries: Primary operational locations.

Checkboxes 2–3

- Box 2: Check if any foreign person owns ≥50% of voting power or stock value.

- Box 3: Check if the corporation is a foreign-owned U.S. disregarded entity (DRE).

4a–7e

- Name, address, and IDs: For each direct/indirect 25% foreign shareholder:

- 4b(1)/5b(1)/6b(1)/7b(1): U.S. tax ID (if applicable).

- 4b(2)/5b(2)/6b(2)/7b(2): Reference ID number (assign if no U.S. ID).

- FTIN: Foreign taxpayer identification number.

- Principal business countries: Operational jurisdictions.

- Country of incorporation: Legal domicile.

- Residency countries: Tax residency jurisdictions.

Part III: Related Party

8a–8g

- Name, address, and IDs: For each related party (foreign or domestic):

- 8b(1): U.S. tax ID.

- 8b(2): Reference ID.

- 8c: Business activity description.

- 8d: NAICS code.

- 8e: Check relationship type (e.g., “Related to reporting corporation”).

- 8f–8g: Business and tax residency countries.

Part IV: Monetary Transactions

Report all transactions with foreign related parties in U.S. dollars:

- Lines 9–22: Income/receipts (e.g., sales, rents, interest).

- Lines 23–36: Expenses/payments (e.g., purchases, royalties, loans).

- Estimates: Check the box if estimates are used.

Example:

- Line 17 (Amounts borrowed): Report beginning/ending balances for loans.

- Line 22/36: Totals must match amounts in 1f and 1h.

Part V: Reportable Transactions for Foreign-Owned U.S. DEs

- Describe non-monetary transactions (e.g., entity formation, distributions) on an attached statement.

Part VI: Nonmonetary Transactions

- Attach a statement detailing transactions with less-than-full consideration (e.g., asset swaps).

Part VII: Additional Information

37–43b

- Imports (37–38c): Disclose if goods are imported from related parties and if basis exceeds customs value.

- Cost Sharing Arrangements (39): Check if involved in a CSA and complete Part VIII.

- Section 267A (40a–b): Report disallowed interest/royalty deductions.

- FDII (41a–d): Detail foreign-derived intangible income deductions.

- Loans (42a–b): Disclose safe-haven interest rate compliance.

- Debt Instruments (43a–b): Report covered debt transactions under Section 385.

Part VIII: Cost Sharing Arrangement (CSA)

44–49b

- 44: Describe the CSA (e.g., R&D collaboration).

- 45–46: Indicate participation start date and pre-2009 status.

- 47: Report the corporation’s share of anticipated benefits (%).

- 48a–c: Stock-based compensation deductions and allocations.

- 49a–b: Intangible development costs and allocations.

Part IX: Base Erosion Payments

50–53

- Line 50: Base erosion payments under Section 59A(d).

- Line 51: Base erosion tax benefits under Section 59A(c)(2).

- Line 52: Qualified derivative payments under Section 59A(h).