IRS Form 8821, also known as Tax Information Authorization, allows you to designate an individual, corporation, firm, or organization to inspect and/or receive your confidential tax information for specific tax matters and periods. Unlike Form 2848, which grants representation rights, Form 8821 does not authorize the designee to act on your behalf or advocate for you before the IRS. Instead, it is used for purposes like retrieving transcripts, researching account details, or receiving copies of IRS notices.

This form is particularly useful for taxpayers working with accountants, tax preparers, or legal professionals who need access to their records. It can also be used to revoke or modify prior authorizations. However, it cannot be used to request copies of tax returns or authorize someone to represent you in disputes with the IRS.

How to File Form 8821?

You can file Form 8821 by mailing it to the appropriate IRS address (listed in the instructions) or faxing it to the number provided for your region. The form must be completed in full and signed by the taxpayer to be valid. Digital or typed signatures are not accepted for mailed or faxed submissions.

Filing Methods:

- Mail: Send the completed form to the IRS office based on your location.

- Fax: Use the designated fax number for faster processing.

How to Complete Form 8821?

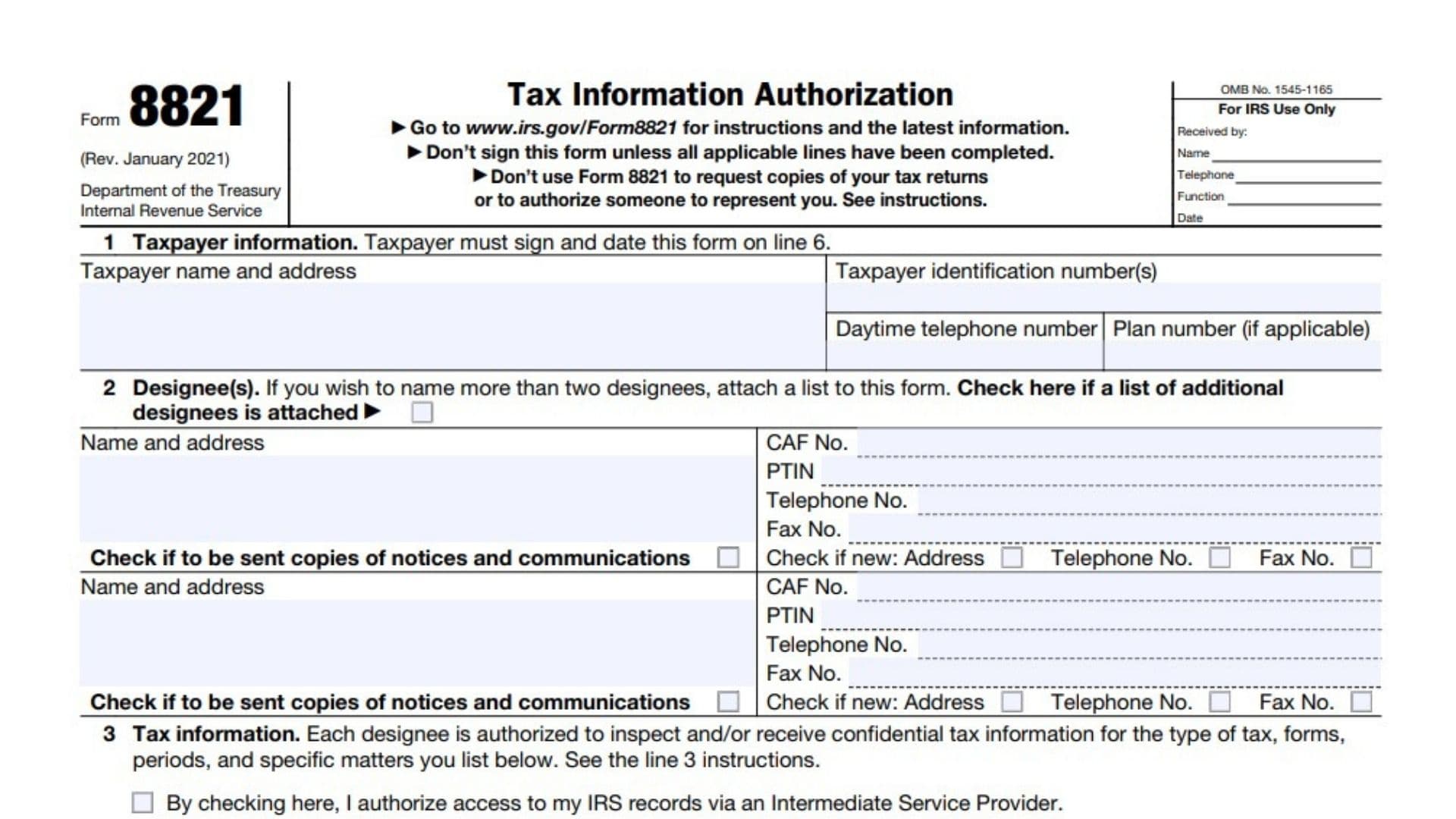

Line 1: Taxpayer Information

- Enter your full name as it appears on your most recent tax return.

- Provide your complete address.

- Include your Taxpayer Identification Number (TIN) (e.g., Social Security Number or Employer Identification Number).

- Add a daytime telephone number where you can be reached.

- If applicable, include a plan number (e.g., for retirement plans).

Line 2: Designee(s)

- Enter the full name and address of the individual(s) or organization(s) you are authorizing.

- Provide their Centralized Authorization File (CAF) number if they have one. If not, write “NONE” (the IRS will assign one).

- Include their Preparer Tax Identification Number (PTIN), telephone number, and fax number.

- Check the box if you want them to receive copies of notices and communications from the IRS.

- If there are multiple designees, attach a list with their details and check the box indicating an attachment.

Line 3: Tax Information

Specify the type of tax information your designee is authorized to access:

- Column (a): List the type of tax information (e.g., income, employment, payroll).

- Column (b): Enter specific tax form numbers (e.g., 1040, 941).

- Column (c): Indicate the tax years or periods covered.

- Column (d): Describe any specific tax matters if applicable.

If you want to authorize access through an Intermediate Service Provider (ISP), check the box provided.

Line 4: Specific Use Not Recorded on CAF

Check this box if the authorization is for a one-time use that will not be recorded in the Centralized Authorization File (CAF). If this box is checked, skip Line 5.

Line 5: Retention/Revocation of Prior Authorizations

If Line 4 is not checked:

- The IRS will revoke all prior authorizations unless you check this box and attach copies of previous Forms 8821 that you want to retain.

To revoke prior authorizations without submitting a new one, follow instructions provided in Line 5 of the official guide.

Line 6: Taxpayer Signature

- Sign and date the form.

- If signing on behalf of an entity (e.g., corporation, trust), include your title and certify that you have legal authority.

Important Notes:

- Do not sign a blank or incomplete form.

- Ensure all applicable lines are filled out before signing.

Tips for Completing Form 8821

- Double-check all information for accuracy before submission.

- Attach additional pages as needed for multiple designees or detailed tax matters.

- Use clear handwriting if completing by hand.

- Keep a copy of the completed form for your records.

Common Uses of Form 8821

- Authorizing accountants or attorneys to access transcripts and account details.

- Allowing third parties to receive notices about audits or other tax matters.

- Revoking outdated authorizations when switching representatives.