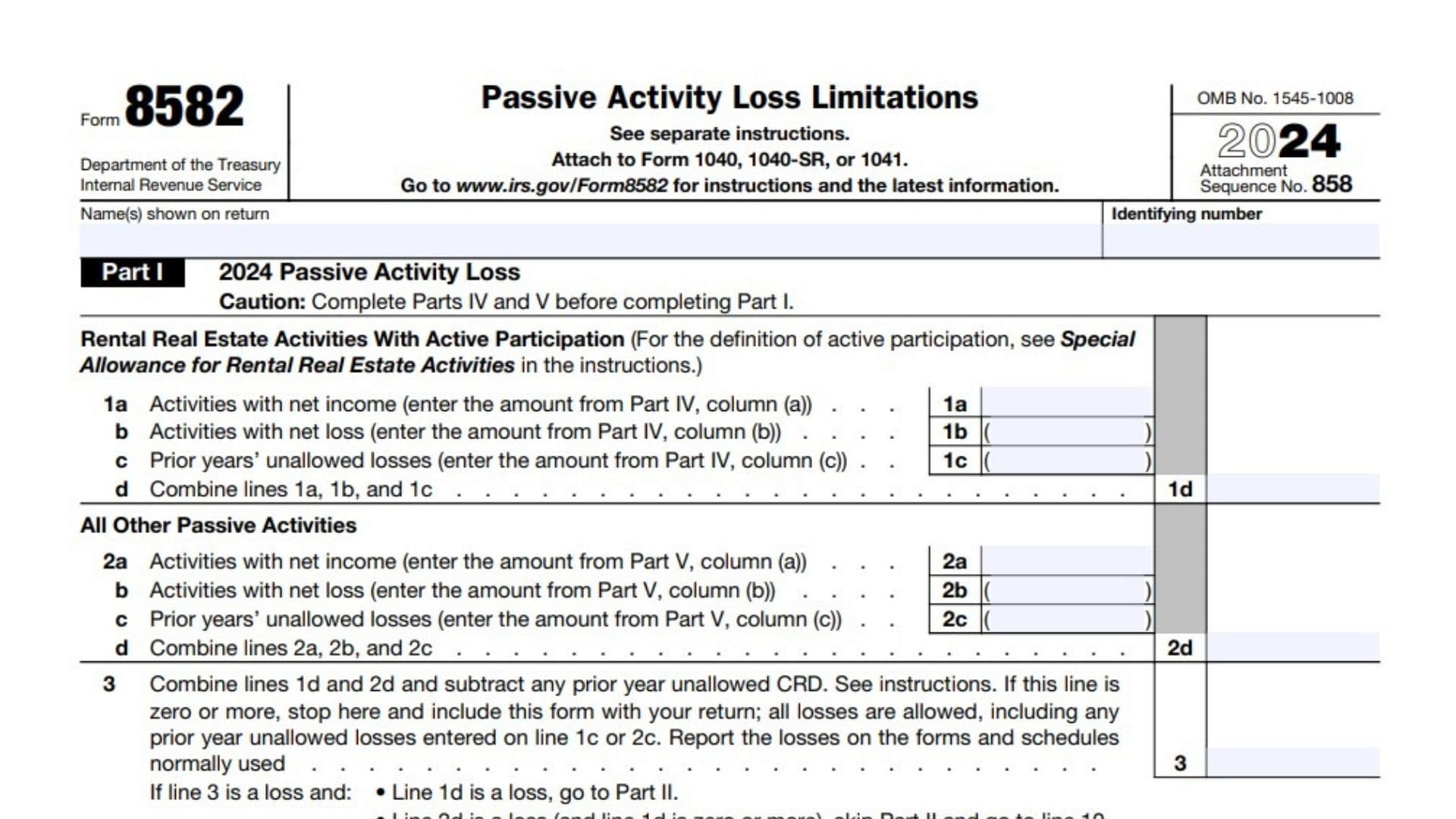

IRS Form 8582, Passive Activity Loss Limitations, is used by noncorporate taxpayers to calculate and report losses from passive activities (e.g., rental properties, limited partnerships) that cannot be fully deducted in the current tax year due to IRS restrictions. The form determines how much of these losses can offset passive income or must be carried forward to future years. It includes detailed sections for categorizing income/losses, applying special allowances for rental real estate, and allocating unallowed losses.

How to File Form 8582?

- Download the form: Available on the IRS website.

- Complete all parts (I–IX) as instructed below.

- Attach to your tax return: Submit with Form 1040, 1040-SR, or 1041.

How to Complete Form 8582?

Part I: 2024 Passive Activity Loss

Complete Parts IV and V first.

- Line 1a: Enter total net income from Part IV, column (a).

- Line 1b: Enter total net loss from Part IV, column (b). Use parentheses for losses.

- Line 1c: Enter total prior years’ unallowed losses from Part IV, column (c).

- Line 1d: Combine lines 1a, 1b, and 1c. If ≥ $0, stop here.

Part IV: Activities With Net Income or Loss

List all rental real estate activities.

| Column | Instruction |

|---|---|

| (a) Net income | Enter current-year income per activity. |

| (b) Net loss | Enter current-year loss per activity. |

| (c) Unallowed loss | Enter prior years’ disallowed losses. |

| (d) Gain | Enter overall gain (if applicable). |

| (e) Loss | Enter overall loss (if applicable). |

- Total row: Sum columns (a), (b), and (c). Transfer totals to Part I, lines 1a, 1b, and 1c.

Part V: Other Passive Activities

List non-rental passive activities (e.g., limited partnerships).

| Column | Instruction |

|---|---|

| (a) Net income | Enter current-year income per activity. |

| (b) Net loss | Enter current-year loss per activity. |

| (c) Unallowed loss | Enter prior years’ disallowed losses. |

| (d) Gain | Enter overall gain (if applicable). |

| (e) Loss | Enter overall loss (if applicable). |

- Total row: Sum columns (a), (b), and (c). Transfer totals to Part I, lines 2a, 2b, and 2c.

Part II: Special Allowance for Rental Real Estate

For active participants only.

- Line 4: Enter the smaller of Part I, line 1d or line 3.

- Line 5: Enter $150,000 ($75,000 if married filing separately).

- Line 6: Enter modified AGI (MAGI).

- Line 7: Subtract line 6 from line 5. If ≤ $0, enter $0 on line 9.

- Line 8: Multiply line 7 by 50% (max $25,000 or $12,500).

- Line 9: Enter the smaller of line 4 or line 8.

Part III: Total Losses Allowed

- Line 10: Add Part I, lines 1a and 2a.

- Line 11: Add lines 9 and 10. This is your total allowed loss.

Part VI: Special Allowance Allocation

If line 9 > $0, allocate the allowance across activities.

| Column | Instruction |

|---|---|

| (a) Loss | Enter each activity’s loss from Part IV, column (b). |

| (b) Ratio | Divide column (a) by total losses. |

| (c) Special Allowance | Multiply line 9 by column (b). |

| (d) Unallowed Loss | Subtract column (c) from column (a). |

Part VII: Allocation of Unallowed Losses

Allocate remaining losses to carry forward.

| Column | Instruction |

|---|---|

| (a) Loss | Enter each activity’s loss from Part IV, column (b). |

| (b) Ratio | Divide column (a) by total losses. |

| (c) Unallowed Loss | Multiply total unallowed loss by column (b). |

Part VIII: Allowed Losses

| Column | Instruction |

|---|---|

| (a) Total Loss | Enter total loss per activity. |

| (b) Allowed Loss | Subtract Part VII, column (c) from column (a). |

| (c) Unallowed Loss | Enter Part VII, column (c). |

Part IX: Activities With Losses on Multiple Forms

For activities reported across forms/schedules.

- Line 1a: Enter net loss + prior unallowed loss from each form.

- Line 1b: Enter net income from each form.

- Line 1c: Subtract line 1b from line 1a. If ≤ $0, enter $0.

- Total: Sum all column (c) entries. Ratio must equal 1.00.

FAQs

Q: What happens if I skip Part IV or V?

A: Your Form 8582 will be incomplete, leading to IRS errors or penalties.

Q: How do I report prior-year unallowed losses?

A: Enter them in Part IV/V, column (c), and carry forward per Part VII.