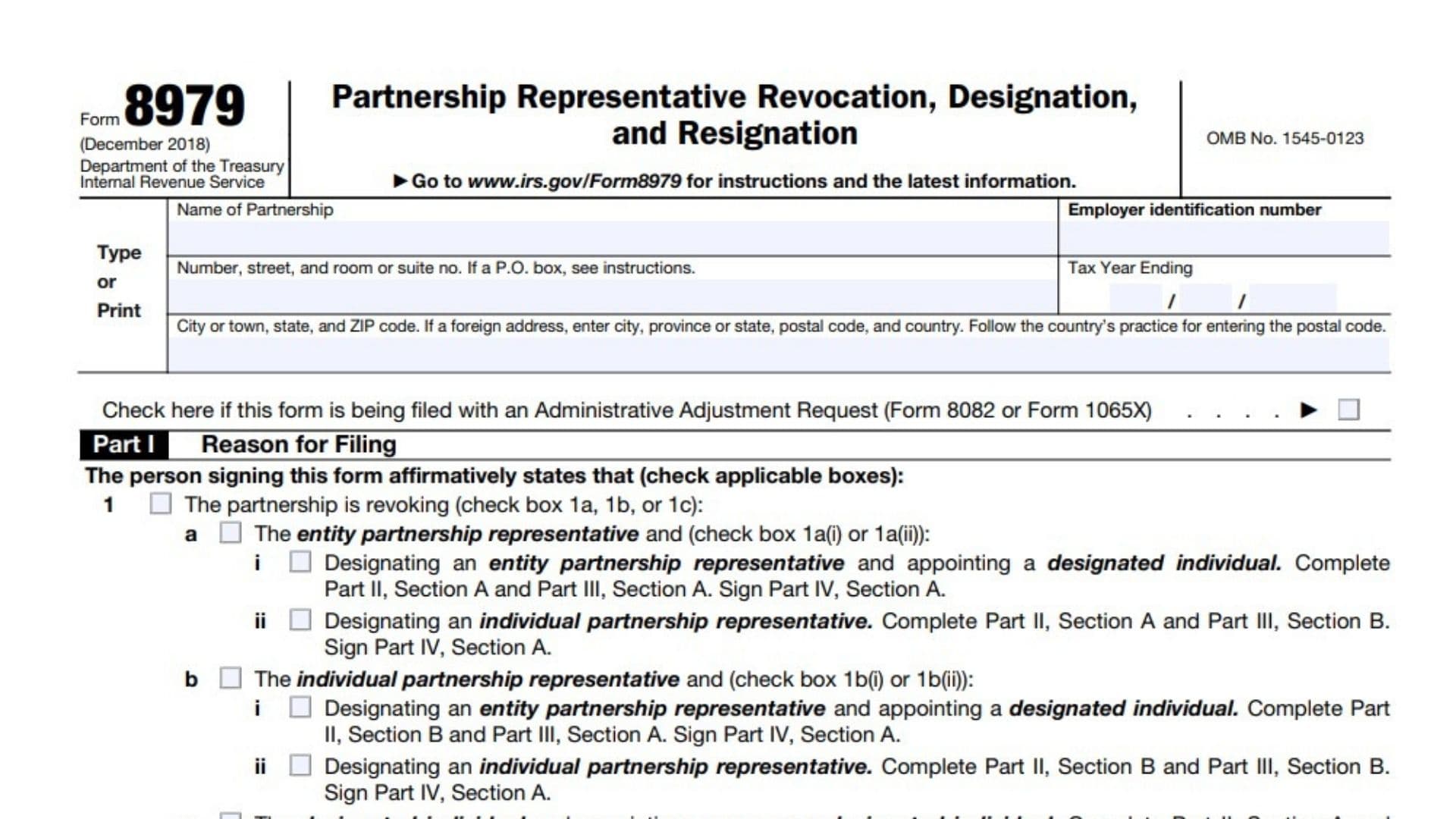

IRS Form 8979, officially titled Partnership Representative Revocation, Designation, and Resignation, is a crucial form used by partnerships to manage changes related to their partnership representative or designated individual. This form allows partnerships to revoke an existing representative, appoint a successor, or record the resignation of a representative or designated individual. The partnership representative plays a vital role in handling tax matters with the IRS under the Bipartisan Budget Act (BBA) procedures. Filing Form 8979 ensures that the IRS has up-to-date information on who is authorized to represent the partnership in tax-related matters. Failure to file this form accurately and promptly can lead to compliance issues and penalties.

How to File Form 8979?

Form 8979 must be submitted directly to the IRS point of contact, such as a revenue agent or appeals officer, depending on the situation. It may also be filed alongside other forms like an Administrative Adjustment Request (AAR). Ensure you follow these steps:

- Determine the Reason for Filing: Identify whether you are revoking, resigning, or designating a new representative.

- Complete All Relevant Sections: Fill out each applicable part of the form based on your filing purpose.

- Sign and Date: Ensure that all required signatures are included in Part IV.

- Submit the Form: Mail or fax the completed form to your assigned IRS contact.

How to Complete Form 8979?

Header Section

- Name of Partnership: Enter the full legal name of your partnership.

- Employer Identification Number (EIN): Provide your partnership’s EIN as assigned by the IRS.

- Address: Include the complete address of the partnership, including street number, city, state, ZIP code, and suite number if applicable.

- Tax Year Ending: Specify the ending date of the tax year for which this form applies.

Part I – Reason for Filing

Check one or more boxes that describe why you are filing this form:

- Revocation:

- Check box 1a if revoking an entity partnership representative and appointing a new one (complete Part II, Section A; Part III, Section A; and Part IV).

- Check box 1b if revoking an individual partnership representative (complete Part II, Section B; Part III; and Part IV).

- Check box 1c if revoking a designated individual and appointing a successor (complete Part II, Section A; Part III; and Part IV).

- Resignation:

- Check box 2a if an entity representative is resigning (complete Part II, Section A; and Part IV).

- Check box 2b if an individual representative is resigning (complete Part II, Section B; and Part IV).

- No Current Representative:

- Check box 4a or 4b if no representative exists and you are designating one (complete Part III and Part IV).

Part II – Revocations or Resignations

Section A – Revocation or Resignation of an Entity Partnership Representative

- Enter the name of the entity partnership representative.

- Provide their taxpayer identification number (TIN).

- Include their full address with city, state/province, ZIP/postal code, country code, and phone number.

- If applicable, enter details for the designated individual being revoked or resigning.

Section B – Revocation or Resignation of an Individual Partnership Representative

- Provide the full name of the individual being revoked or resigning.

- Enter their TIN.

- Include their full address with city, state/province, ZIP/postal code, country code, and phone number.

Part III – Designations and/or Appointment

Section A – Designation of Entity Partnership Representative

- Enter details for the new entity partnership representative:

- Name

- TIN

- Full U.S. address with phone number

- Provide information for any newly appointed designated individual.

Section B – Designation of an Individual Partnership Representative

- Enter details for the new individual partnership representative:

- Full name

- TIN

- Full U.S. address with phone number

Part IV – Signature Section

Complete one of these sections based on your filing purpose:

- Section A: For revocation by the partnership.

- Section B: For resignation by an entity partnership representative.

- Section C: For resignation by an individual partnership representative.

- Section D: For resignation by a designated individual.

- Section E: For designation without revocation.

Each section requires:

- Signature of an authorized person.

- Printed/typed name of the authorized person.

- Title (if signing on behalf of an entity).

- Date in MM/DD/YYYY format.