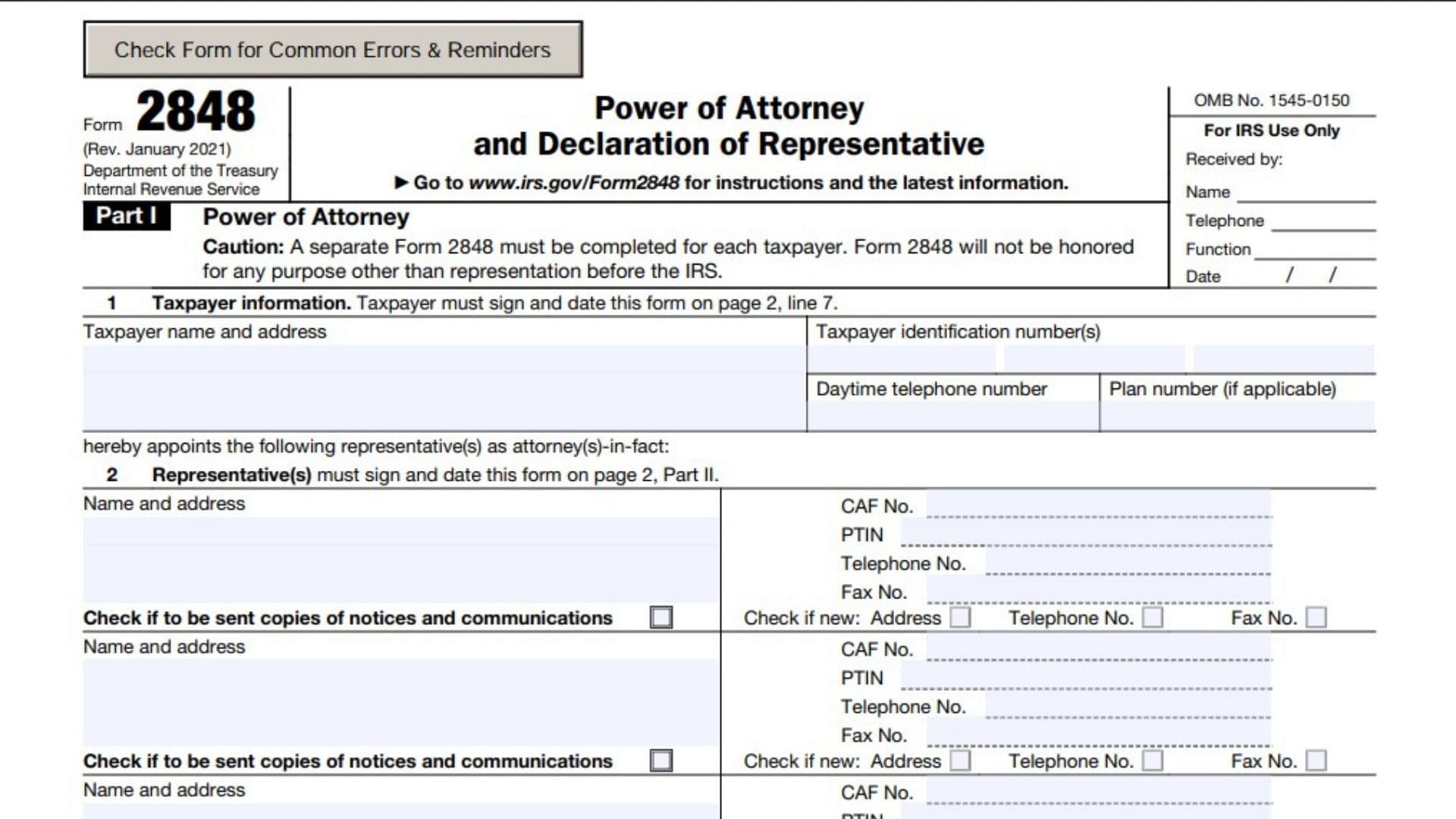

IRS Form 2848, officially titled Power of Attorney and Declaration of Representative, is a critical document that allows taxpayers to authorize an individual or organization to represent them before the Internal Revenue Service (IRS). This form is commonly used for situations such as audits, appeals, or tax disputes, enabling a representative to access confidential tax information and perform specific acts on behalf of the taxpayer. The form must be completed accurately to avoid delays or rejection, and it includes sections for taxpayer information, representative details, authorized acts, and signatures. Whether you’re appointing a tax professional, attorney, or family member as your representative, understanding how to file and complete Form 2848 is essential for ensuring smooth communication with the IRS.

What is Form 2848?

IRS Form 2848 is a legal document that grants power of attorney to an individual or organization for tax-related matters. It allows the designated representative to communicate and act on behalf of the taxpayer in dealings with the IRS. This includes accessing tax records, signing agreements, and representing the taxpayer during audits or appeals. The form specifies the scope of authority granted, such as the types of tax matters covered (e.g., income tax or payroll tax), applicable tax years or periods, and additional authorized acts like signing returns. Importantly, Form 2848 only applies to tax-related matters—it does not grant authority outside IRS dealings.

How to File Form 2848?

Form 2848 can be filed via three methods:

- Online Submission:

- Create a Secure Access account on the IRS website.

- Log in at IRS.gov/Submit2848 and upload the completed form with an electronic signature.

- Online submissions are processed faster and recorded in the Centralized Authorization File (CAF).

- Fax Submission:

- Fax the completed form to the appropriate IRS office listed in the “Where To File Chart” within the instructions.

- Ensure all sections are signed and dated before faxing.

- Mail Submission:

- Mail the form to the IRS address provided in the “Where To File Chart.”

- Include handwritten signatures; electronic signatures are not accepted for mailed forms.

Regardless of submission method, keep a copy of the completed form for your records.

How to Complete Form 2848?

Part I – Power of Attorney

- Taxpayer Information:

- Enter your full name and address as listed on your tax return.

- Provide your Taxpayer Identification Number (TIN), which could be your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN).

- Include your daytime telephone number for contact purposes.

- If applicable, enter a plan number associated with employee benefit plans.

- Representative(s):

- List each representative’s name and address clearly. You can appoint up to four representatives but note that only two will receive notices from the IRS directly.

- Provide their CAF (Centralized Authorization File) number if available; write “None” if they don’t have one yet (the IRS will issue one).

- Include their PTIN (Preparer Tax Identification Number), telephone number, and fax number if applicable.

- Check boxes for representatives who should receive copies of notices or communications from the IRS and indicate if their contact information has changed by marking “Check if new.”

- Acts Authorized:

- Specify the type of tax matters your representative is authorized to handle (e.g., income tax, payroll tax).

- List relevant tax form numbers (e.g., Form 1040 for individual income taxes) and applicable years or periods (e.g., 2023–2025). Avoid vague terms like “all years”—be specific about past and future years up to three years ahead.

- Specific Use Not Recorded on CAF:

- Check this box only if you are granting power of attorney for a one-time use not recorded in CAF (e.g., representation during a specific audit).

5a. Additional Acts Authorized:

- Indicate any additional permissions granted to your representative beyond standard acts listed in line 3, such as signing returns or authorizing disclosures to third parties.

- If granting authority to sign returns due to incapacity or other reasons, include a statement citing relevant regulations under CFR 1.6012-1(a)(5).

5b. Specific Acts Not Authorized:

- List any actions you explicitly prohibit your representative from performing (e.g., negotiating checks issued by the government). Leave blank if no restrictions apply.

- Retention/Revocation of Prior Powers of Attorney:

- By default, filing Form 2848 revokes prior powers of attorney for identical matters and periods unless you check this box and attach copies of previous forms you want to retain in effect.

- Taxpayer Declaration and Signature:

- Sign and date this section as required; unsigned forms will be returned by the IRS without processing. If signed by someone other than the taxpayer (e.g., corporate officer or guardian), include their title and certify legal authority to act on behalf of the taxpayer.

Part II – Declaration of Representative

This section of IRS Form 2848 is crucial as it officially validates the authority of the representative(s) to act on behalf of the taxpayer. Each representative listed in Part I, Line 2 must complete Part II by providing their designation, licensing details, and signature under penalties of perjury. Below is a detailed breakdown of how to complete this section line-by-line:

- Designation Letter (Column 1):

- Enter the letter corresponding to the representative’s designation from the provided list (e.g., “a” for attorney, “b” for CPA, “c” for enrolled agent).

- Other designations include:

- d: Officer of the taxpayer organization.

- e: Full-time employee of the taxpayer.

- f: Family member (e.g., spouse, parent, child).

- g: Enrolled actuary authorized under 29 U.S.C. 1242.

- h: Unenrolled return preparer with limited authority.

- k: Qualifying student or law graduate working in a Low Income Taxpayer Clinic (LITC) or Student Tax Clinic Program (STCP).

- r: Enrolled retirement plan agent.

- Licensing Jurisdiction or Authority (Column 2):

- Specify the state or other licensing jurisdiction where the representative is authorized to practice (e.g., “California State Bar”).

- For designations “d,” “e,” and “f,” enter the title, position, or relationship to the taxpayer instead of licensing jurisdiction.

- Bar, License, Certification, Registration, or Enrollment Number (Column 3):

- Provide the representative’s professional identification number if applicable (e.g., bar number for attorneys or license number for CPAs).

- If no number applies to their designation (e.g., family member), leave this field blank.

- Signature (Column 4):

- The representative must sign their name as it appears in Part I, Line 2. Unsigned forms will be rejected by the IRS.

- Date (Column 5):

- Enter the date when the representative signed this declaration. Ensure it matches the timeline of submission and aligns with other signatures on the form.

Key Notes for Completing Part II:

- Representatives must sign in the exact order listed in Part I, Line 2. This ensures consistency and avoids processing delays.

- If multiple representatives are listed, each must complete a separate row in Part II with their respective details and signature.

- Representatives affirm under penalties of perjury that they are eligible to practice before the IRS and are not currently suspended or disbarred from such practice.

Common Mistakes to Avoid

- Missing signatures from either taxpayer or representative(s).

- Incorrect TINs or incomplete contact information for representatives.

- Omitting specific years/periods under Acts Authorized.

- Forgetting attachments when retaining prior powers of attorney.