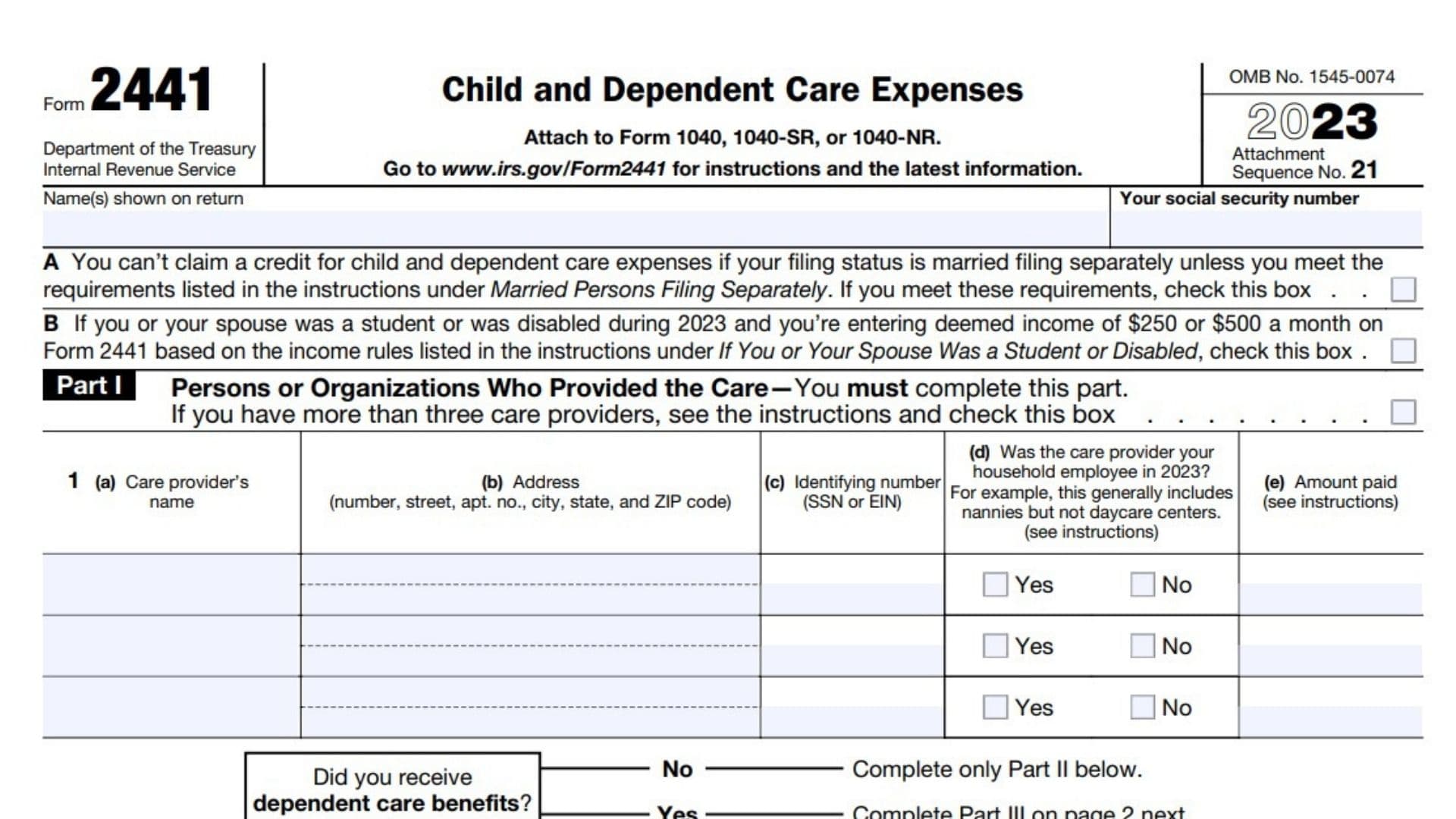

Form 2441 is a special form that must be filed along with your tax return to claim the child and dependent care credit. It includes sections for reporting the names of persons or organizations that you paid for care, their addresses, identifying numbers and the amounts you paid them. It also has several other fields that require yes/no answers and more detailed information about the qualifying person for whom you are claiming the credit. The form also has a section to report any dependent care benefits you received from your employer or other sources. These benefits might appear in box 10 of your W-2 form or on a separate Form 2441 statement that your employer might provide. The instructions to Form 2441 explain how you must adjust these amounts based on your income, filing status and other factors.

Who Can Claim the Child and Dependent Care Credit?

To qualify for the credit, you must have earned income. Earned income is usually money that you earn through work or business activities. However, the IRS defines earned income in more limited circumstances to include certain taxable disability payments you might receive while you are unable to work, tax-free combat pay from military service and some investment income, such as interest, dividends and capital gains.

If you are married, both you and your spouse must file a joint return to claim the credit. You can also claim the credit if you are single or file as head of household. If you and your spouse are divorced or separated, each of you can file a separate return to claim the credit. If you are a widow, you can claim the credit if your deceased spouse was a qualified dependent for whom you claimed the credit in the previous year.

If you were an active-duty member of the military on extended active duty, the rules for determining whether to claim the credit are different. In some cases, you might be able to claim the care credit for the year you were overseas as well as the following year. In other cases, you can only claim the credit for the care provided during the year that you were in the military. The rules for determining which years you can claim the credit are explained in the instructions to Form 2441.

How to Complete Form 2441?

Part I – Persons or Organizations Who Provided the Care

Line 1: In this part, you must enter your care providers and their info in each row. ( 3 rows in total)

- If you received dependent care benefits, complete Part III on page 2 next.

- If not, complete only Part II.

Part II – Credit for Child and Dependent Care Expenses

Line 2: Fill out the information about your qualifying person(s). Check the box if you have more than three qualifying persons.

Line 3: Add the amounts in column (d) of line 2. Don’t enter more than $3,000 if you had one qualifying person or $6,000 if you had two or more persons. If you completed Part III, enter the amount from line 31.

Line 4: Enter your earned income.

Line 5: Enter your spouse’s earned income (married filing jointly only).

Line 6: Enter the smallest of line 3, 4, or 5

Line 7: Enter the amount from Form 1040, 1040-SR, or 1040-NR, line 11

Line 8: Enter on line 8 the decimal amount shown in the table included in the Form that applies to the amount on line

Line 9a: Multiply line 6 by the decimal amount on line 8

Line 9b: If you paid 2021 expenses in 2022, complete Worksheet A in the instructions. Enter the amount from line 13 of the worksheet here. Otherwise, enter -0- on line 9b and go to line 9c

Line 9c: Add lines 9a and 9b and enter the result

Line 10: Enter the amount from the Credit Limit Worksheet in the IRS Instructions. This is your Tax liability limit.

Line 11: Enter the smaller of line 9c or line 10 here and on Schedule 3 (Form 1040), line 2. This is your Credit for child and dependent care expenses.

Part III – Dependent Care Benefits

Line 12:

- Enter the total amount of dependent care benefits you received in 2022.

- Amounts you received as an employee should be shown in box 10 of your Form (s) W-2

- Don’t include amounts reported as wages in box 1 of Form (s) W-2

- If you were self-employed or a partner, include amounts you received under a dependent care assistance program from your sole proprietorship or partnership.

Line 13: Enter the amount, if any, you carried over from 2020 and/or 2021 and used in 2022.

Line 14: If you forfeited or carried over to 2023 any of the amounts reported on line 12 or 13, enter the amount.

Line 15: Combine lines 12 through 14.

Line 16: Enter the total amount of qualified expenses incurred in 2022 for the care of the qualifying person(s).

Line 17: Enter the smaller of line 15 or 16.

Line 18: Enter your earned income.

Line 19: Enter the amount shown that applies to you.

- If married filing jointly, enter your spouse’s earned income.

- If married, filing separately, see the IRS Instructions.

- All others, enter the amount from line 18.

Line 20: Enter the smallest of line 17, 18, or 19.

Line 21:

- Enter $5,000 ($2,500 if married filing separately and you were required to enter your spouse’s earned income on line 19)

- If you entered an amount on line 13, add it to the $5,000 or $2,500 amount you enter on line 21

- However, don’t enter more than the maximum amount allowed under your dependent care plan

- If your dependent care plan uses a non-calendar plan year, see the IRS Instructions

Line 22: Yes, or No question. If “No”, enter -0-. If “Yes,” enter the amount there.

Line 23: Subtract line 22 from line 15.

Line 24: Deductible benefits

- Enter the smallest of line 20, 21, or 22.

- Also, include this amount on your return’s appropriate line(s).

Line 25: Excluded benefits

- If you checked “No” on line 22, enter the smaller of line 20 or 21.

- Otherwise, subtract line 24 from the smaller of line 20 or line 21.

- If zero or less, enter -0-

Line 26: Taxable benefits

- Subtract line 25 from line 23.

- If zero or less, enter -0-.

- Also, enter this amount on Form 1040, 1040-SR, or 1040-NR, line 1e

— To claim the child and dependent care credit, complete lines 27 through 31 below—

Line 27: Enter $3,000 ($6,000 if two or more qualifying persons)

Line 28: Add lines 24 and 25.

Line 29:

- Subtract line 28 from line 27

- If zero or less, stop. You can’t take the credit.

- Exception. If you paid 2021 expenses in 2022, see the instructions for line 9b.

Line 30:

- Complete line 2 on page 1 of your Form 2441

- Don’t include in column (d) any benefits shown on line 28 above.

- Then, add the amounts in column (d) and enter the total here.

Line 31:

- Enter the smaller of line 29 or 30

- Also, enter this amount on line 3 on page 1 of this Form and complete lines 4 through 11