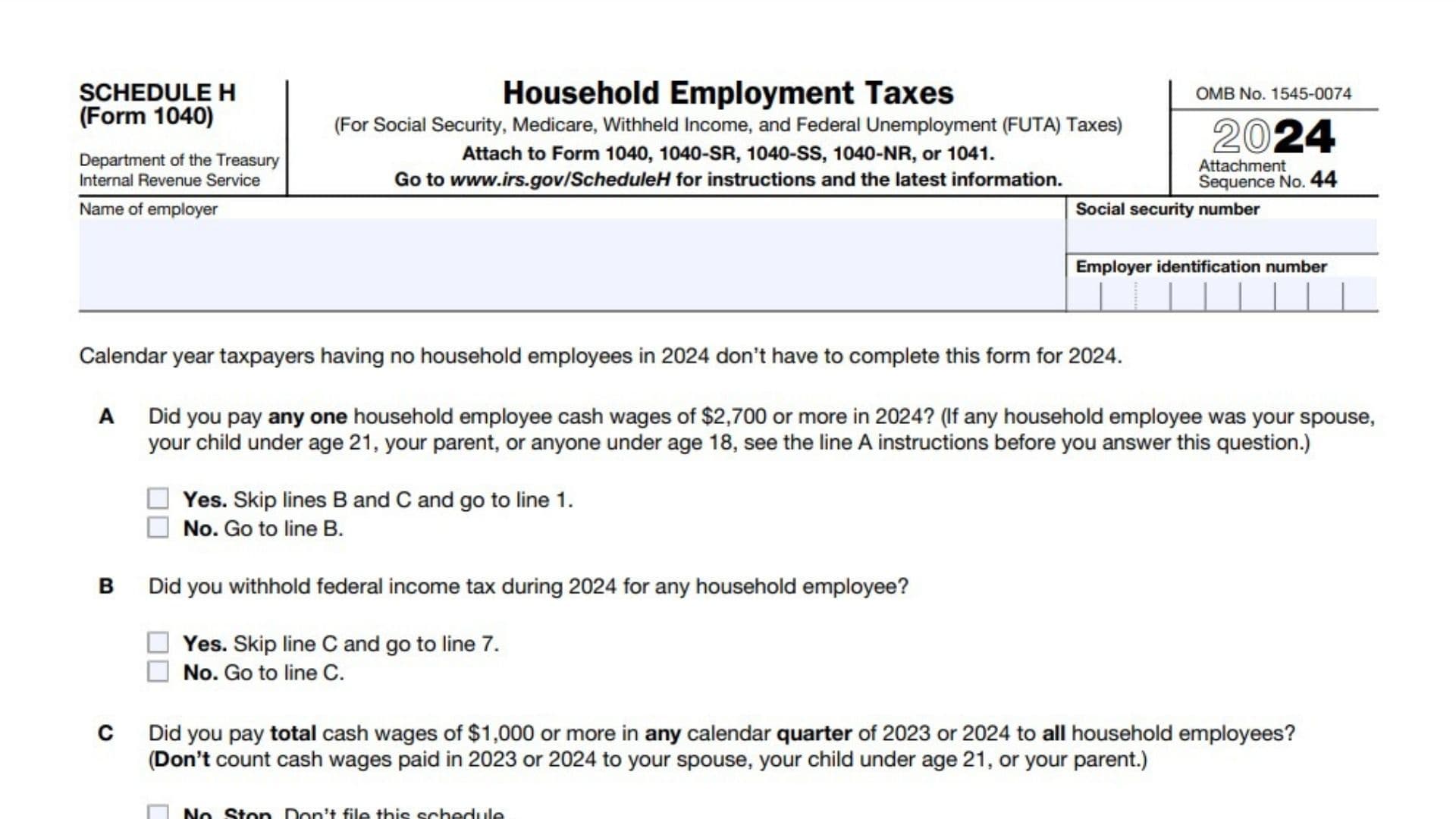

IRS Schedule H (Form 1040) is a tax form used by taxpayers who employ household workers, such as nannies, housekeepers, or caregivers, to report and pay employment taxes. These taxes include Social Security, Medicare, and federal unemployment (FUTA) taxes. If you paid a household employee at least $2,700 in cash wages in 2024 or $1,000 in any calendar quarter of 2023 or 2024, you are required to file this form. However, wages paid to certain family members (e.g., your spouse, child under age 21, or parent) are generally excluded. This form helps ensure compliance with federal employment tax laws for household employers.

How to Complete Schedule H (Form 1040)?

Initial Eligibility Questions (A, B, C)

A. Did you pay any one household employee cash wages of $2,700 or more in 2024?

- Yes: Skip lines B and C and proceed to Part I.

- No: Go to B.

B. Did you withhold federal income tax during 2024 for any household employee?

- Yes: Skip line C and go to Part I, line 7.

- No: Proceed to C.

C. Did you pay total cash wages of $1,000 or more in any calendar quarter of 2023 or 2024 to all household employees?

- No: Stop. Do not file Schedule H.

- Yes: Skip lines 1–9 and go directly to Part II, line 10.

Part I: Social Security, Medicare, and Federal Income Taxes (Lines 1–9)

- Enter the total cash wages subject to Social Security tax (excluding exempt family members).

- Multiply Line 1 by 12.4% (0.124) to calculate Social Security tax.

- Enter the total cash wages subject to Medicare tax (no cap).

- Multiply Line 3 by 2.9% (0.029) to calculate Medicare tax.

- Enter wages subject to Additional Medicare Tax withholding (wages exceeding $200,000 for single filers).

- Multiply Line 5 by 0.9% (0.009) for Additional Medicare Tax withholding.

- Enter any federal income tax withheld from your household employee’s wages.

- Add Lines 2, 4, 6, and 7 to calculate the total Social Security, Medicare, and federal income taxes due.

- Did you pay $1,000 or more in any calendar quarter of 2023 or 2024?

- No: Stop here and include the amount from Line 8 on Schedule 2 (Form 1040), Line 9. Do not complete Part II.

- Yes: Proceed to Part II.

Part II: Federal Unemployment (FUTA) Tax (Lines 10–27)

- Did you pay unemployment contributions to only one state?

- If yes and all conditions below are met → Complete Section A.

- If no → Skip Section A and complete Section B.

- Did you pay all state unemployment contributions for 2024 by April 15, 2025?

- Were all wages taxable for FUTA tax also taxable for your state’s unemployment tax?

If you answered “Yes” to Lines 10–12, complete Section A; otherwise, skip Section A and complete Section B.

Section A: Single-State Unemployment Contributions (Lines 13–16)

- Enter the name of the state where unemployment contributions were paid.

- Enter the total contributions paid to your state unemployment fund.

- Enter the total cash wages subject to FUTA tax (up to $7,000 per employee).

- Multiply Line 15 by 0.6% (0.006) to calculate FUTA tax.

Section B: Multi-State or Credit Reduction States (Lines 17–26)

17–19: Complete columns for each state where contributions were paid:

- Column A: State name.

- Column B: Wages subject to FUTA tax.

- Column C: Contributions paid to state unemployment funds.

- Column D: Credit reduction amount for applicable states.

20–22: Calculate totals:

- Add up all wages in Column B for Line 20.

- Add up all contributions in Column C for Line 21.

- Add up all credit reductions in Column D for Line 22.

23–26: Determine FUTA tax liability:

- Multiply total FUTA-taxable wages by the full FUTA rate of 6% (0.06) on Line 23.

- Subtract state contributions from Line 23 on Line 24.

- Add credit reductions from Line 22 on Line 25.

- Subtract prior-year overpayments from Line 25 on Line 26.

Line 27: Final Steps

Are you required to file Form 1040?

- Yes: Include the amount from Line 26 on Schedule 2 (Form 1040), Line 9.

- No: You may need to complete Part IV below.

Part IV: Address and Signature

Complete this section only if required by the instructions:

- Provide your full address, including street name, city, state, and ZIP code.

- Sign under penalties of perjury that the information provided is accurate.

- If a preparer assisted with this form, include their name, signature, PTIN, firm information, and contact details.