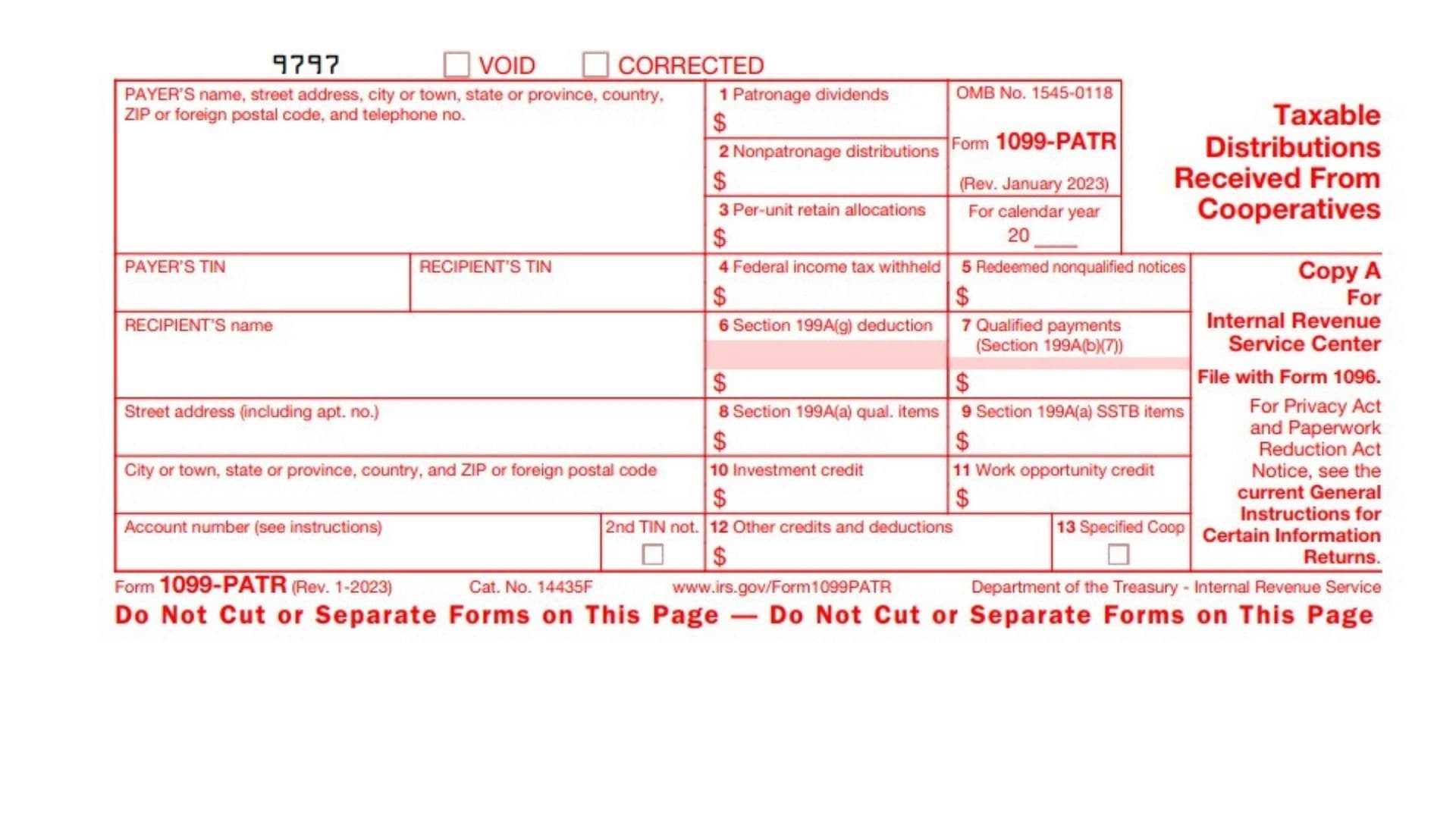

IRS Form 1099-PATR, titled Taxable Distributions Received From Cooperatives, is used to report distributions from cooperatives to their patrons. These distributions include patronage dividends, nonpatronage distributions, per-unit retain allocations, and other credits or deductions. Cooperatives issue this form to their members (individuals or businesses) to report taxable income derived from cooperative activities. The form also includes information about Section 199A deductions, investment credits, and other tax-related items that may impact the recipient’s tax return. Recipients must include the amounts reported on this form in their income tax filings unless specified as nontaxable. This form is crucial for ensuring accurate reporting of income and compliance with tax laws.

How to File Form 1099-PATR?

To file Form 1099-PATR, follow these steps:

- Obtain the Official Form: You cannot use a printed copy of the online version for filing with the IRS. Order scannable forms from the IRS website or file electronically using the FIRE (Filing Information Returns Electronically) system.

- Fill Out the Form: Complete all required fields accurately, including payer and recipient information.

- Submit to the IRS: File Copy A with the IRS by the due date specified in the General Instructions for Certain Information Returns.

- Provide Copies to Recipients: Furnish Copy B to each recipient by January 31 of the following year.

- Retain Records: Keep a copy of the completed form for your records.

How to Complete Form 1099-PATR?

Payer Information

- Enter the cooperative’s name, address, and telephone number in the designated section.

- Include the payer’s Taxpayer Identification Number (TIN).

Recipient Information

- Provide the recipient’s name, address, and TIN (only the last four digits will appear on Copy B for security).

Box 1: Patronage Dividends

- Report patronage dividends paid in cash, qualified written notices of allocation, or other property. Exclude nonqualified allocations.

Box 2: Nonpatronage Distributions

- Enter distributions from nonpatronage sources, including cash payments or qualified written notices of allocation.

Box 3: Per-Unit Retain Allocations

- Record per-unit retain allocations paid in cash or qualified certificates.

Box 4: Federal Income Tax Withheld

- Report any backup withholding due to missing or incorrect TINs.

Box 5: Redeemed Nonqualified Notices

- Include amounts received when redeeming nonqualified written notices of allocation or retain allocations from patronage sources.

Box 6: Section 199A(g) Deduction

- Show the recipient’s share of Section 199A(g) deductions passed through by the cooperative.

Box 7: Qualified Payments (Section 199A(b)(7))

- Report payments that impact Section 199A(a) deductions related to trades or businesses.

Box 8: Section 199A(a) Qualified Items

- Enter amounts that qualify for Section 199A(a) deductions but are not related to specified service trades or businesses (SSTBs).

Box 9: Section 199A(a) SSTB Items

- Record amounts qualifying for Section 199A(a) deductions from SSTBs.

Box 10: Investment Credit

- Report any investment credits passed through by the cooperative using Form 3468.

Box 11: Work Opportunity Credit

Box 12: Other Credits and Deductions

- Specify additional credits or deductions passed through by the cooperative.

Box 13: Specified Cooperative Indicator

- Check this box if reporting information from a specified agricultural or horticultural cooperative under Section 199A(g)(4)(A).