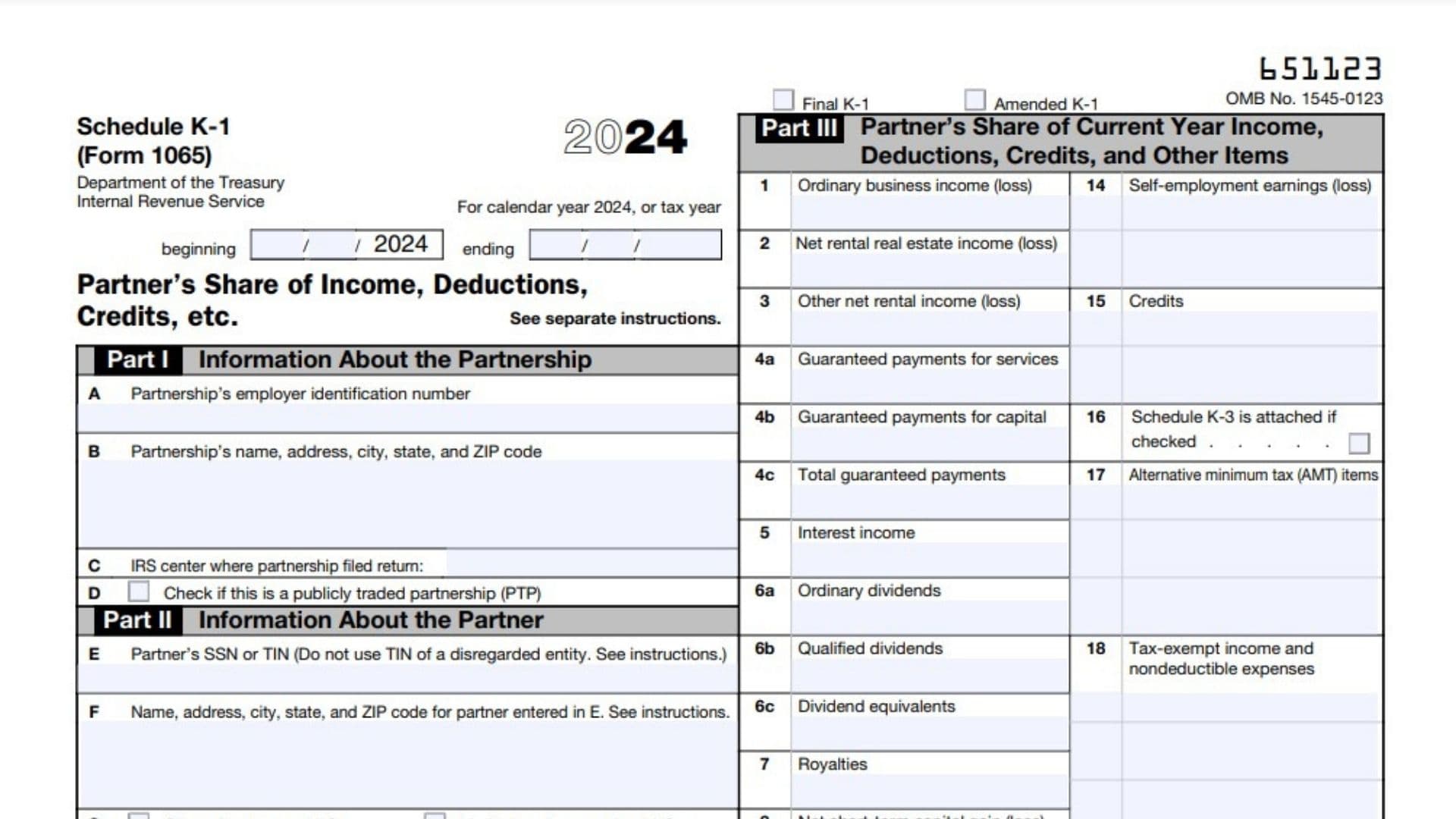

IRS Schedule K-1 (Form 1065) is used by partnerships to report a partner’s share of income, deductions, credits, and other items from the partnership. Each partner receives a Schedule K-1 that details their specific share of the partnership’s financials, such as their share of profits, losses, liabilities, and capital accounts, which are essential for individual tax filings. This form is crucial for reporting items that may be distributed to partners throughout the year, including guaranteed payments, rental income, and capital gains. The form ensures that the income and deductions from a partnership are correctly allocated to each partner, enabling them to report it accurately on their individual tax returns.

How to File IRS Schedule K-1 (Form 1065)?

To file IRS Schedule K-1 (Form 1065), follow these steps:

- Obtain Partnership Information: The partnership must complete Part I of Schedule K-1, providing the partnership’s employer identification number (EIN), name, and address. The form should also indicate whether the partnership is publicly traded and where it filed its return with the IRS.

- Partner Information: In Part II, provide details about each partner, including their Social Security Number (SSN) or Taxpayer Identification Number (TIN), name, address, and whether they are a general or limited partner. The partnership must also report the partner’s share of profit, loss, and capital.

- Liability Information: Partners must report their share of partnership liabilities (nonrecourse, qualified nonrecourse financing, or recourse) as of the beginning and end of the tax year.

- Capital Account Analysis: In Part II, the partnership must report each partner’s capital account activity, including contributions, withdrawals, and net income or loss. Any property contributed with a built-in gain or loss must also be reported.

- Income, Deductions, and Credits: In Part III, the partnership provides the partner’s share of income and deductions for the year. This includes ordinary business income, rental income, guaranteed payments, dividends, royalties, capital gains, and other specific income or deductions like Section 179 deductions, self-employment earnings, tax credits, and tax-exempt income.

- Attach Additional Information: If the partner’s share involves foreign taxes paid, alternative minimum tax (AMT) items, or multiple activities for at-risk or passive activity purposes, provide the necessary statements and details.

- Filing with the IRS: The partnership must file the Schedule K-1 along with Form 1065 to the IRS by the deadline, typically March 15. Copies of the form should also be provided to each partner on or before the due date of the partnership return.

- Partner’s Tax Filing: Partners must include the information from Schedule K-1 in their individual tax returns, typically on Form 1040, and apply any credits, deductions, or income as reported.

How to Complete Schedule K-1 (Form 1065)?

Part I – Information About the Partnership:

- Box A – Partnership’s Employer Identification Number (EIN):

- Enter the EIN of the partnership. This number is issued by the IRS and used to identify the partnership.

- Box B – Partnership’s Name, Address, City, State, and ZIP Code:

- Provide the complete name, address, city, state, and ZIP code of the partnership.

- Box C – IRS Center Where Partnership Filed Return:

- Indicate the IRS center where the partnership filed its return (the name of the location where the partnership submitted Form 1065).

- Box D – Publicly Traded Partnership (PTP):

- Check this box if the partnership is a publicly traded partnership.

Part II – Information About the Partner:

- Box E – Partner’s SSN or TIN:

- Enter the partner’s Social Security Number (SSN) or Taxpayer Identification Number (TIN). Do not use the TIN of a disregarded entity.

- Box F – Name, Address, City, State, and ZIP Code for Partner:

- Provide the full name, address, city, state, and ZIP code of the partner listed in Box E.

- Box G – General Partner or LLC Member-Manager / Limited Partner or Other LLC Member:

- Check the box that indicates whether the partner is a general partner, LLC member-manager, limited partner, or another type of LLC member.

- Box H1 – Domestic Partner / Box H2 – Foreign Partner:

- Check the appropriate box to indicate whether the partner is a domestic or foreign partner.

- Box I1 – Type of Entity:

- Indicate the type of entity the partner is. Options may include individual, corporation, trust, or partnership.

- Box I2 – Retirement Plan (IRA/SEP/Keogh/etc.):

- If the partner is a retirement plan (such as an IRA, SEP, or Keogh), check this box.

- Box J – Partner’s Share of Profit, Loss, and Capital:

- Beginning: Enter the percentage share of profit, loss, and capital at the beginning of the year.

- Ending: Enter the percentage share at the end of the year.

- If there was a decrease in the partner’s share due to the sale or exchange of the partnership interest, check the box.

- Box K1 – Partner’s Share of Liabilities:

- Nonrecourse: Report the partner’s share of nonrecourse liabilities (liabilities where no individual partner is personally liable).

- Qualified Nonrecourse Financing: Report the partner’s share of qualified nonrecourse financing (often used in real estate).

- Recourse: Report the partner’s share of recourse liabilities (liabilities where the partner can be held personally liable).

- Beginning and Ending: Report the amount of liabilities the partner is responsible for at the beginning and end of the year.

- Box K2 – Liabilities from Lower-Tier Partnerships:

- Check this box if the liabilities reported in Box K1 include amounts from lower-tier partnerships.

- Box K3 – Liabilities Subject to Guarantees:

- Check this box if any of the liabilities reported in Box K1 are subject to guarantees or other payment obligations by the partner.

- Box L – Partner’s Capital Account Analysis:

- Beginning Capital Account: Report the partner’s capital at the beginning of the year.

- Capital Contributed During the Year: Report any capital the partner contributed during the year.

- Current Year Net Income (Loss): Report the net income or loss for the partner for the current year.

- Other Increase (Decrease): Report any other changes to the capital account during the year (attach an explanation if necessary).

- Withdrawals and Distributions: Report the amount of capital the partner withdrew or received during the year.

- Ending Capital Account: Report the capital balance at the end of the year.

- Box M – Property Contributed with Built-in Gain (Loss):

- If the partner contributed property that has a built-in gain or loss, check “Yes” and attach a statement. If not, check “No.”

- Box N – Partner’s Share of Net Unrecognized Section 704(c) Gain or (Loss):

- Report the partner’s share of unrecognized Section 704(c) gain or loss at both the beginning and end of the year.

- Line 1 – Ordinary Business Income (Loss):

- Report the partner’s share of ordinary business income or loss from the partnership’s operations.

- Line 2 – Net Rental Real Estate Income (Loss):

- Report the partner’s share of net rental income or loss from real estate activities.

- Line 3 – Other Net Rental Income (Loss):

- Report the partner’s share of other rental income or loss not related to real estate.

- Line 4a – Guaranteed Payments for Services:

- Report any guaranteed payments made to the partner for services rendered.

- Line 4b – Guaranteed Payments for Capital:

- Report any guaranteed payments made to the partner for capital.

- Line 4c – Total Guaranteed Payments:

- Sum of the amounts reported in Lines 4a and 4b.

- Line 5 – Interest Income:

- Report the partner’s share of interest income earned by the partnership.

- Line 6a – Ordinary Dividends:

- Report the partner’s share of ordinary dividend income.

- Line 6b – Qualified Dividends:

- Report the partner’s share of qualified dividend income eligible for favorable tax treatment.

- Line 6c – Dividend Equivalents:

- Report the partner’s share of dividend equivalents if applicable.

- Line 7 – Royalties:

- Report the partner’s share of royalty income.

- Line 8 – Net Short-Term Capital Gain (Loss):

- Report the partner’s share of short-term capital gains or losses.

- Line 9a – Net Long-Term Capital Gain (Loss):

- Report the partner’s share of long-term capital gains or losses.

- Line 9b – Collectibles (28%) Gain (Loss):

- Report the partner’s share of capital gains or losses on collectibles (subject to the 28% tax rate).

- Line 9c – Unrecaptured Section 1250 Gain:

- Report the partner’s share of unrecaptured Section 1250 gain, which relates to certain depreciated real estate.

- Line 10 – Net Section 1231 Gain (Loss):

- Report the partner’s share of Section 1231 gains or losses, which generally apply to the sale of business property.

- Line 11 – Other Income (Loss):

- Report any other income or loss items that do not fall into the previous categories.

- Line 12 – Section 179 Deduction:

- Report the partner’s share of the Section 179 deduction for qualifying property.

- Line 13 – Other Deductions:

- Report the partner’s share of other deductions not previously listed.

- Line 14 – Self-Employment Earnings (Loss):

- Report the partner’s share of self-employment income or loss from the partnership.

- Line 15 – Credits:

- Report the partner’s share of any tax credits that apply to them from the partnership’s activities.

- Line 16 – Schedule K-3 Attached:

- Check this box if Schedule K-3 is attached, which provides more information for international tax matters.

- Line 17 – Alternative Minimum Tax (AMT) Items:

- Report the partner’s share of any items that may be subject to the AMT.

- Line 18 – Tax-Exempt Income and Nondeductible Expenses:

- Report the partner’s share of tax-exempt income and expenses that are nondeductible for tax purposes.

- Line 19 – Distributions:

- Report the amount of distributions the partner received from the partnership during the year.

- Line 20 – Other Information:

- Report any other relevant information not covered in the above lines.

- Line 21 – Foreign Taxes Paid or Accrued:

- Report the partner’s share of foreign taxes that the partnership paid or accrued.

- Line 22 – More Than One Activity for At-Risk Purposes:

- Indicate if there is more than one activity for at-risk purposes and attach the required statement.

- Line 23 – More Than One Activity for Passive Activity Purposes:

- Indicate if there is more than one activity for passive activity purposes and attach the required statement.