IRS Form 1099-OID, also known as the Original Issue Discount (OID) form, is used by taxpayers to report the original issue discount (OID) they received from various debt instruments such as bonds, certificates of deposit (CDs), or other debt-related investments. The OID is essentially the difference between the face value of the debt instrument and its issue price, and it is typically considered taxable income. Taxpayers who hold such instruments may need to report OID as interest income over the life of the instrument, including interest on U.S. Treasury obligations. This form helps ensure that any income derived from OID is reported properly to the IRS. If you are a nominee holder (holding the OID for someone else), the form must be filed accordingly to show the amounts attributed to each individual owner.

How to File Form 1099-OID?

To file Form 1099-OID, you must first ensure that you have received the necessary information from the issuer of the debt instrument. Here are the basic steps for filing:

- Gather Information: Collect the details about the obligation, including the issuer’s information, the OID amount, and any state or federal tax withheld.

- Obtain IRS Forms: Download or order the official IRS forms from the IRS website. Be sure to use the correct version of the form, as Copy A is used for filing with the IRS, while Copy B is for the recipient.

- Complete the Form: Fill out Form 1099-OID with all the necessary information. This includes the payer’s and recipient’s details, OID amount, market discounts, any tax withheld, and other relevant information.

- Submit Form 1099-OID:

- If you are filing fewer than 10 forms, you may submit them on paper.

- If you are filing 10 or more forms, you are required to file electronically.

- If you are filing multiple forms, submit Form 1096 (Transmittal of Income Tax Information Returns) along with your 1099 forms.

- Distribute Copies: Provide Copy B of the form to the recipient, and send Copy A to the IRS. If applicable, send the forms to the appropriate state tax authority.

- File by Deadline: Ensure you file your forms by the IRS deadline for the tax year.

How to Complete Form 1099-OID?

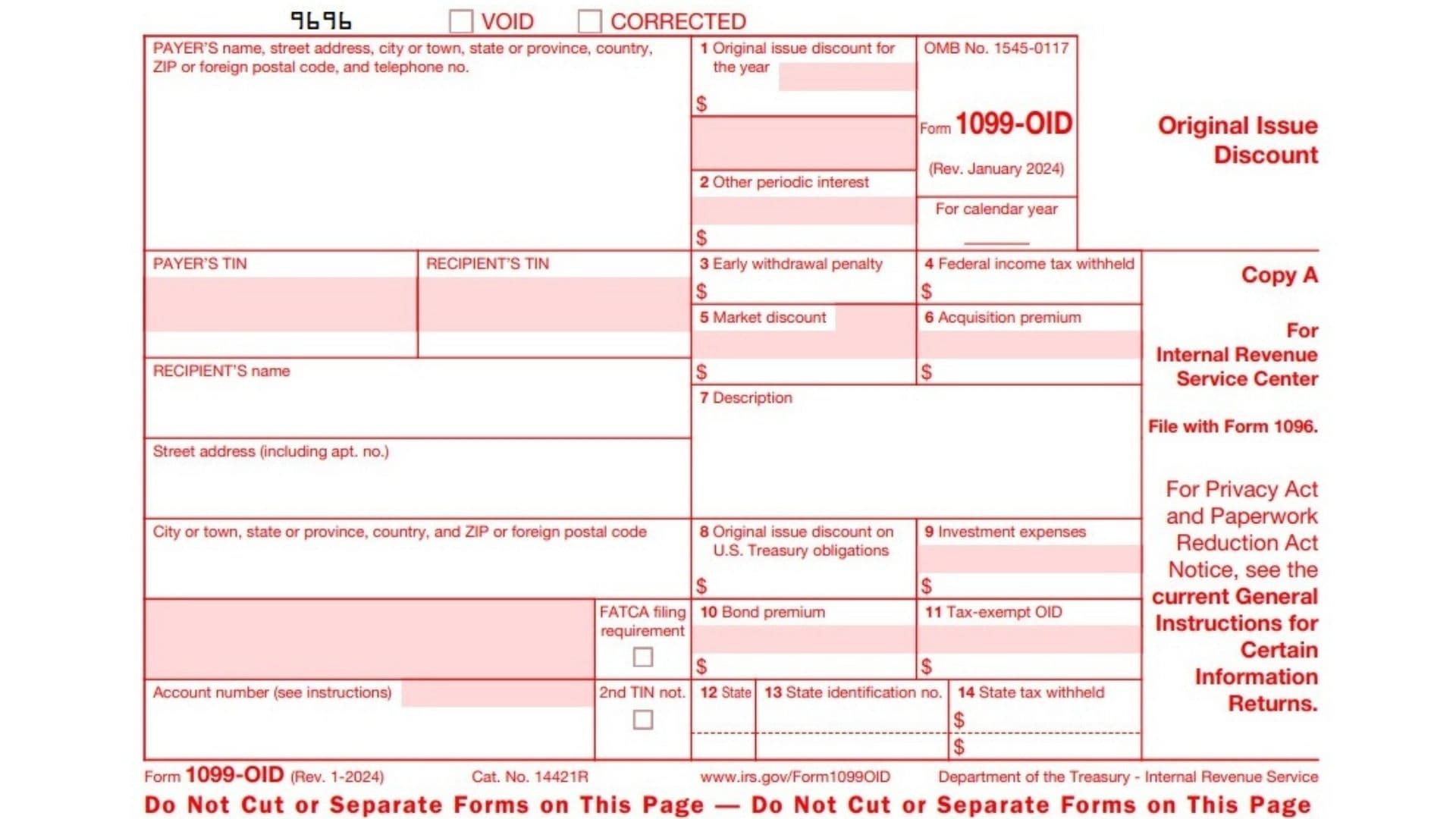

Here’s a detailed breakdown of the lines on Form 1099-OID and what information to include in each:

- Box 1 (Original Issue Discount for the Year): Report the amount of OID you received on taxable obligations for the part of the year you held the instrument. This amount is taxable as interest income.

- Box 2 (Other Periodic Interest): Report any other interest income received for the year that is separate from OID.

- Box 3 (Early Withdrawal Penalty): If you withdrew the funds before the maturity date (e.g., from a CD), report the penalty here.

- Box 4 (Federal Income Tax Withheld): Report any federal income tax withheld during the year. This amount will be credited against your total tax liability.

- Box 5 (Market Discount): If applicable, report the market discount that accrued on a debt instrument you held during the year. This is relevant for certain covered securities.

- Box 6 (Acquisition Premium): If you purchased the instrument at a premium, report the amount of acquisition premium amortization for the year that reduces the OID.

- Box 7 (Description): This box will contain the description or CUSIP number of the debt instrument, which helps identify the obligation.

- Box 8 (OID on U.S. Treasury Obligations): Report the OID amount on U.S. Treasury obligations for the portion of the year you owned the instrument.

- Box 9 (Investment Expenses): If you are a holder of a REMIC (Real Estate Mortgage Investment Conduit), report any share of investment expenses here.

- Box 10 (Bond Premium): If you held a taxable bond at a premium, report the bond premium amortization allocable to interest payments here.

- Box 11 (Tax-Exempt OID): Report any OID on tax-exempt obligations for the part of the year you held them.

12-14. State Information: Boxes 12-14 report the state tax withheld, the state identification number, and the state where the tax is being paid.