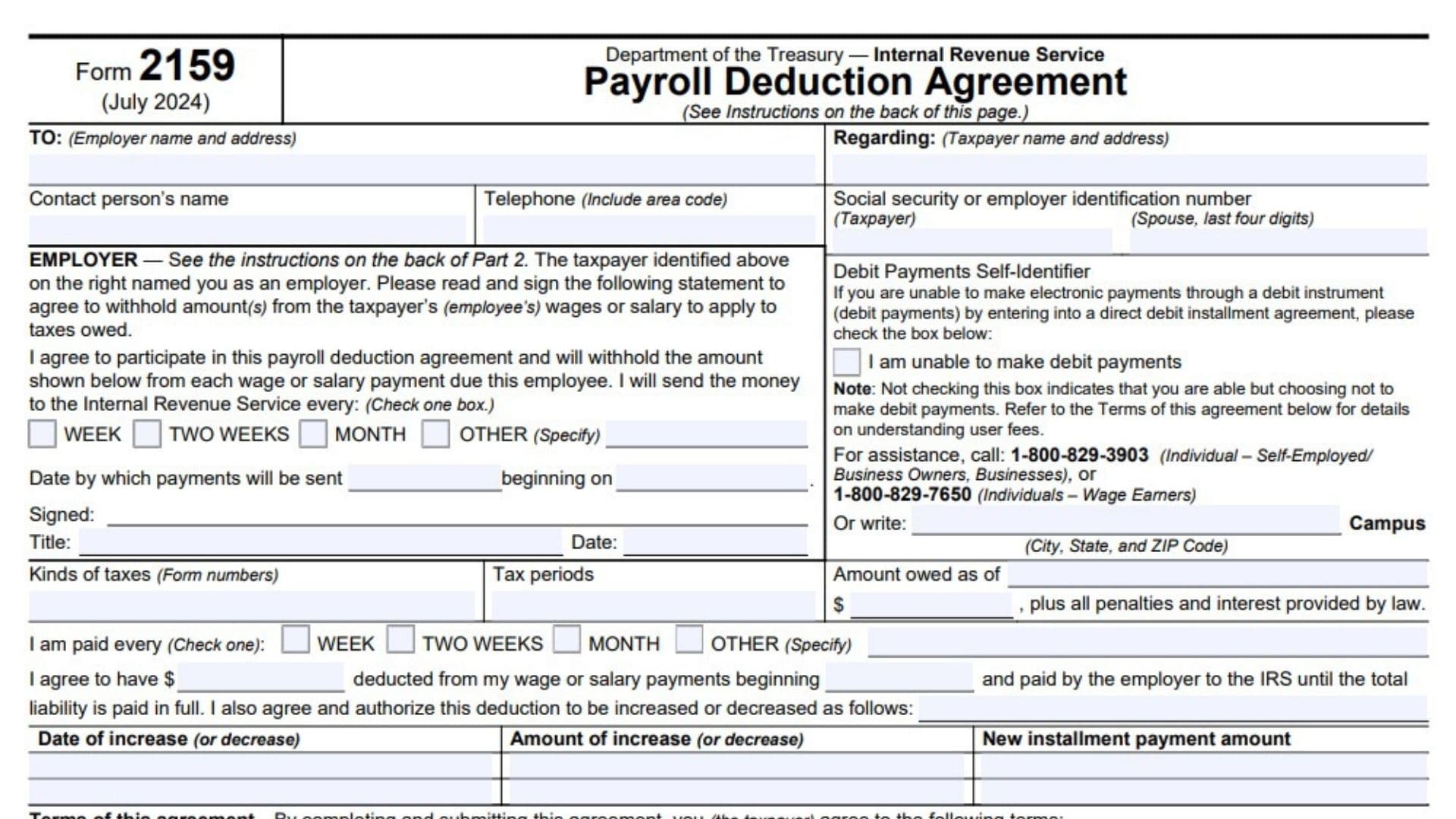

IRS Form 2159, Payroll Deduction Agreement, is a formal arrangement between a taxpayer, their employer, and the IRS to resolve unpaid tax liabilities. The form authorizes an employer to deduct a specified amount from the taxpayer’s wages or salary at regular intervals and remit it directly to the IRS. This method ensures timely payments while providing taxpayers with an automated way to settle their debts. The agreement is particularly useful for taxpayers who cannot make electronic payments or prefer payroll deductions over other installment payment methods. It also includes provisions for adjusting deductions if necessary and outlines responsibilities for both taxpayers and employers. Additionally, the form specifies user fees for setting up the agreement, which may be reduced or waived for eligible low-income taxpayers.

How to File Form 2159?

To file IRS Form 2159, follow these steps:

- Obtain the Form: Taxpayers can download Form 2159 from the IRS.

- Complete the Form: Both the taxpayer and their employer must fill out specific sections of the form (detailed instructions below).

- Submit to Employer: The taxpayer provides the completed form to their employer for review and signature.

- Return to IRS: The employer returns the signed form to the address provided by the IRS in accompanying correspondence.

The IRS reviews and approves the agreement before it becomes effective.

How to Complete Form 2159?

Section 1: Taxpayer Information

- Fill in your full name, current address, and Social Security Number (SSN) or Employer Identification Number (EIN). If this is a joint liability, include your spouse’s name and their last four SSN digits.

Section 2: Employer Information

- Provide your employer’s name, address, contact person’s name, and telephone number (with area code). This allows communication between your employer and the IRS if needed.

Section 3: Payment Details

- Indicate how often you are paid by checking one of the following boxes:

- WEEK

- TWO WEEKS

- MONTH

- OTHER (Specify)

- Enter the amount you agree to have deducted from each paycheck.

- Specify the start date for deductions.

Section 4: Adjustments

- If you have agreed with the IRS on future adjustments to deduction amounts:

- Enter the date of increase or decrease.

- Specify the adjustment amount.

- Provide the new installment payment amount.

- Leave this section blank if no adjustments were discussed.

Section 5: Debit Payments Self-Identifier

- Check this box if you are unable to make electronic payments through a debit instrument. Not checking this box indicates that you are capable but prefer not to use debit payments.

Section 6: Employer Agreement

- Employers must:

- Confirm participation by completing their section of the form.

- Indicate when payments will be forwarded to the IRS.

- Sign and date the form.

Employers should also ensure that payments are made payable to “United States Treasury” and include identifying information such as your name and SSN on each payment.

Terms of Agreement

- By signing this form:

- You agree to make timely payments as per schedule.

- You acknowledge that failure to comply may result in termination of the agreement or collection actions by the IRS.

Low-income taxpayers may qualify for reduced user fees if certain conditions are met (refer to Form 13844 for details).

Signatures

- Both you (and your spouse if applicable) must sign and date the form. Employers must also sign in their designated section.

Additional Notes

- The user fee for setting up this agreement is $178 but may be reduced to $43 for low-income taxpayers who meet eligibility criteria.

- If you default on payments, reinstatement fees may apply ($89 or reduced fee of $43 for eligible individuals).

- Employers should return Part 1 of the form to the IRS at the address provided in accompanying correspondence or on the front of Form 2159.