IRS Form 6252 is used to report income from an installment sale, which is a method of selling property where the seller receives at least one payment after the end of the tax year in which the sale occurs. This form allows taxpayers to spread out the recognition of income from the sale over several years, aligning tax liability with actual cash flow rather than recognizing all income in the year of sale. Installment sales can apply to various types of property, including real estate and personal property, but they do not include sales of stock or securities traded on established markets. By using Form 6252, sellers can report their gross profit, calculate installment sale income for each year payments are received, and ensure compliance with IRS regulations regarding capital gains and losses.

How to File IRS Form 6252?

Filing IRS Form 6252 involves several steps to ensure accurate reporting of installment sale income. Here’s how to proceed:

- Gather Documentation: Collect all relevant information regarding the sale, including purchase agreements, payment schedules, and any related financial documents.

- Complete Part I: This part focuses on gross profit and contract price and must be filled out for each year of the installment agreement.

- Complete Part II: This section calculates installment sale income based on payments received during the tax year.

- Complete Part III (if applicable): If the property was sold to a related party, complete this part for additional reporting requirements.

- Attach Form 6252: Include this form with your annual tax return (Form 1040) when filing.

How to Complete Form 6252?

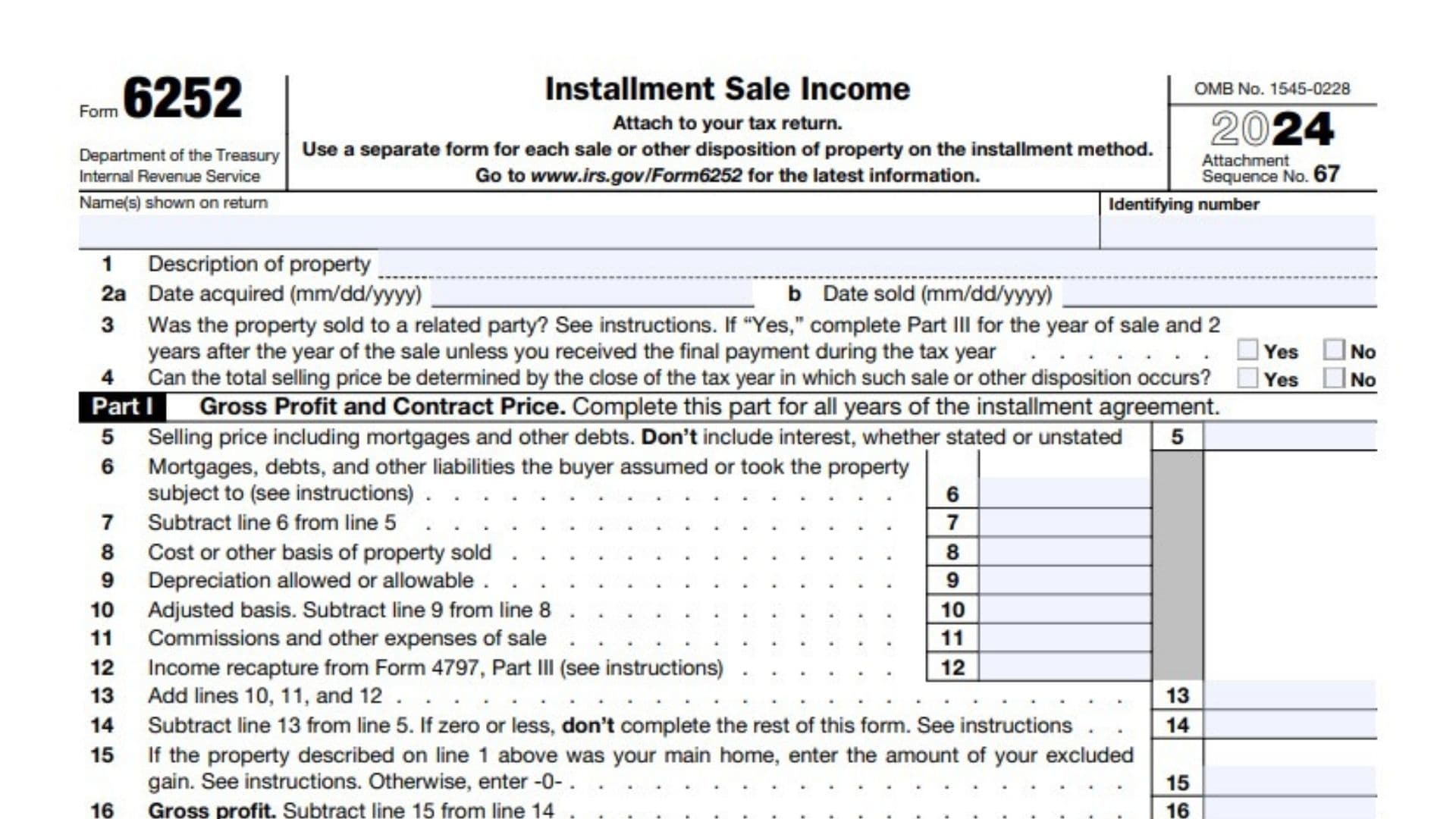

Part I: Gross Profit and Contract Price

- Line 1: Enter a description of the property sold and its corresponding code (e.g., timeshare or residential lot).

- Line 2a: Enter the date you acquired the property (mm/dd/yyyy).

- Line 2b: Enter the date you sold the property (mm/dd/yyyy).

- Line 3: Indicate whether the property was sold to a related party by checking “Yes” or “No.”

- Line 4: Check “Yes” if you can determine the total selling price by the end of the tax year; otherwise check “No.”

- Line 5: Enter the total selling price, including any mortgages or debts assumed by the buyer.

- Line 6: Report any mortgages or debts that were assumed by the buyer.

- Line 7: Subtract line 6 from line 5 to find your net selling price.

- Line 8: Enter your cost basis in the property sold (original cost plus improvements minus any casualty losses).

- Line 9: Report depreciation allowed or allowable on this property.

- Line 10: Calculate your adjusted basis by subtracting line 9 from line 8.

- Line 11: Enter any commissions or other expenses incurred during the sale.

- Line 12: Report any income recapture from Form 4797, Part III.

- Line 13: Add lines 10, 11, and 12 together.

- Line 14: Subtract line 13 from line 5; if zero or less, do not complete further parts of this form.

- Line 15: If applicable, enter any excluded gain if this was your main home; otherwise enter -0-.

- Line 16: Calculate gross profit by subtracting line 15 from line 14.

- Line 17: Subtract line 13 from line 6; if zero or less, enter -0-.

- Line 18: Add lines 7 and line 17 for contract price.

Part II: Installment Sale Income

- Line 19: Calculate gross profit percentage by dividing line 16 by line 18; express as a decimal.

- Line 20: If this is the year of sale, enter amount from line 17; otherwise enter -0-.

- Line 21: Report payments received during this year (do not include interest).

- Line 22: Add lines 20 and 21 together for total payments received this year.

- Line 23: Report payments received in prior years (do not include interest).

- Line 24: Multiply line 22 by line 19 to determine installment sale income; if less than zero do not file this form.

- Line 25: Enter any ordinary income recapture applicable under section rules.

- Line 26: Subtract line 25 from line 24; report this amount on Schedule D or Form 4797 as necessary.

Part III: Related Party Installment Sale Income

- Line 29: Check appropriate box if conditions are met regarding related party sales; skip lines below if checked.

- Lines 30-37: Complete these lines based on amounts realized from related party transactions as required per instructions provided in Part III.