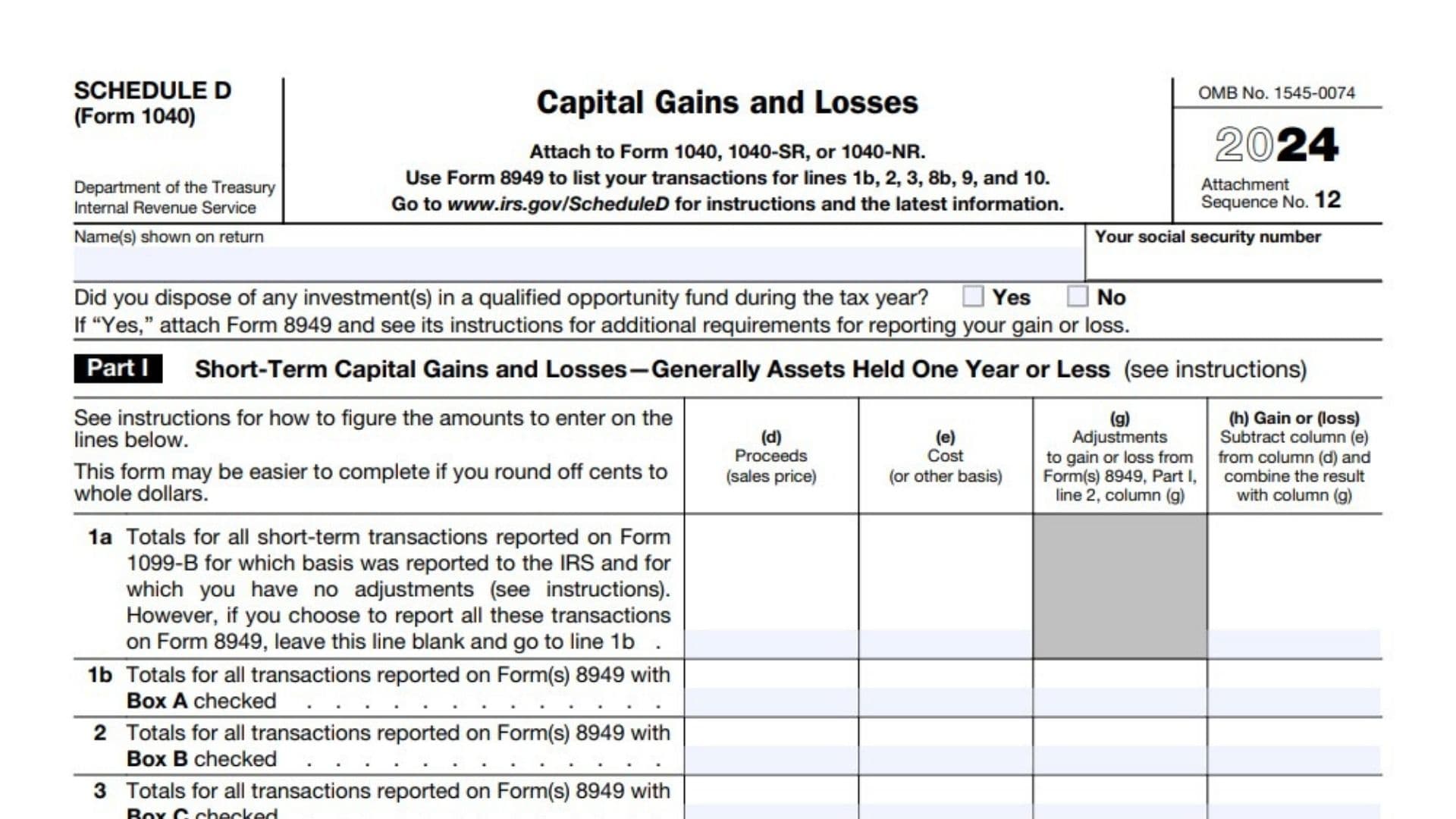

IRS Schedule D (Form 1040) is a tax form used by individuals to report capital gains and losses from the sale of assets such as stocks, bonds, and real estate. This form is essential for taxpayers who have engaged in transactions that resulted in capital gains or losses during the tax year. The information provided on Schedule D helps determine the overall tax liability based on these transactions. Taxpayers must attach Schedule D to their Form 1040, Form 1040-SR, or Form 1040-NR when filing their annual income tax returns. The form consists of three parts: Part I for short-term capital gains and losses (assets held for one year or less), Part II for long-term capital gains and losses (assets held for more than one year), and Part III for summarizing the total capital gains and losses. Properly completing Schedule D ensures that taxpayers accurately report their investment income and comply with IRS regulations.

How to File Schedule D (Form 1040)?

Filing Schedule D involves several steps that require careful attention to detail. Here’s how to do it:

- Gather Necessary Documents:

- Collect all relevant documents related to your capital asset transactions, including Form 1099-B from brokers, purchase receipts, and any records of sales.

- Complete Form 8949:

- Before filling out Schedule D, complete Form 8949 to list your individual transactions. This form captures details about each sale, including dates, proceeds, cost basis, and adjustments.

- Attach Schedule D:

- Once you have completed Form 8949, transfer the totals from that form to Schedule D. Ensure you attach Schedule D to your Form 1040 when filing your taxes.

How to Complete Schedule D (Form 1040)?

Part I: Short-Term Capital Gains and Losses

- Line 1a: Enter the total proceeds from short-term transactions reported on Form 1099-B where basis was reported to the IRS.

- Line 1b: Report totals for all short-term transactions listed on Form 8949 with Box A checked.

- Line 2: Report totals for all transactions listed on Form 8949 with Box B checked.

- Line 3: Report totals for all transactions listed on Form 8949 with Box C checked.

- Line 4: Enter any short-term gain from Form 6252 or other forms as applicable.

- Line 5: Include net short-term gain or loss from partnerships or S corporations from Schedule K-1.

- Line 6: Enter any short-term capital loss carryover from your Capital Loss Carryover Worksheet.

- Line 7: Calculate net short-term capital gain or loss by combining lines 1a through 6 in column (h).

Part II: Long-Term Capital Gains and Losses

- Line 8a: Enter totals for long-term transactions reported on Form 1099-B where basis was reported.

- Line 8b: Report totals for long-term transactions listed on Form 8949 with Box D checked.

- Line 9: Report totals for long-term transactions listed on Form 8949 with Box E checked.

- Line 10: Report totals for long-term transactions listed on Form 8949 with Box F checked.

- Line 11: Include any gains from Form 4797 or other applicable forms.

- Line 12: Enter net long-term gain or loss from partnerships or S corporations from Schedule K-1.

- Line 13: Report any capital gain distributions as indicated in the instructions.

- Line 14: Enter any long-term capital loss carryover as applicable.

- Line 15: Calculate net long-term capital gain or loss by combining lines 8a through 14 in column (h).

Part III: Summary

- Line 16: Combine lines from Part I (line 7) and Part II (line 15) to determine total capital gain or loss.

- If line 16 is a gain, report it on Form 1040.

- If line 16 is a loss, skip lines below until line 21.

- If line is zero, enter -0- on Form 1040.

- Lines 17-20: These lines pertain to specific calculations if both lines indicate gains; follow instructions based on your situation.

- Line 21: If there’s a loss, enter the smaller of the loss amount or $3,000 ($1,500 if married filing separately).

- Line 22: Determine if you have qualified dividends; complete additional worksheets if necessary based on your responses.