IRS Form 4563 is designed for individuals who are bona fide residents of American Samoa and have income that may qualify for an exclusion from U.S. federal income taxes. This form applies if your income was earned from sources within American Samoa or was effectively connected to a trade or business conducted there. The exclusion recognizes the unique tax relationship between American Samoa and the United States and prevents double taxation of certain incomes. Form 4563 requires information about your residency status, type of income earned, and details about periods spent outside of American Samoa. If you meet the criteria for the exclusion, this form allows you to calculate the amount that can be excluded from your gross income when filing your Form 1040 or 1040-SR.

How to File IRS Form 4563?

- Eligibility:

- You must be a bona fide resident of American Samoa for the entire tax year.

- Your income must be sourced from American Samoa or connected to a trade/business there.

- U.S. Government employees cannot exclude income earned from federal services.

- Attach Form 4563 to Your Tax Return:

- Documentation:

- Maintain accurate records, including income sources and periods of absence from American Samoa.

- Keep documentation for any addresses or family members that might impact your eligibility.

How to Complete Form 4563?

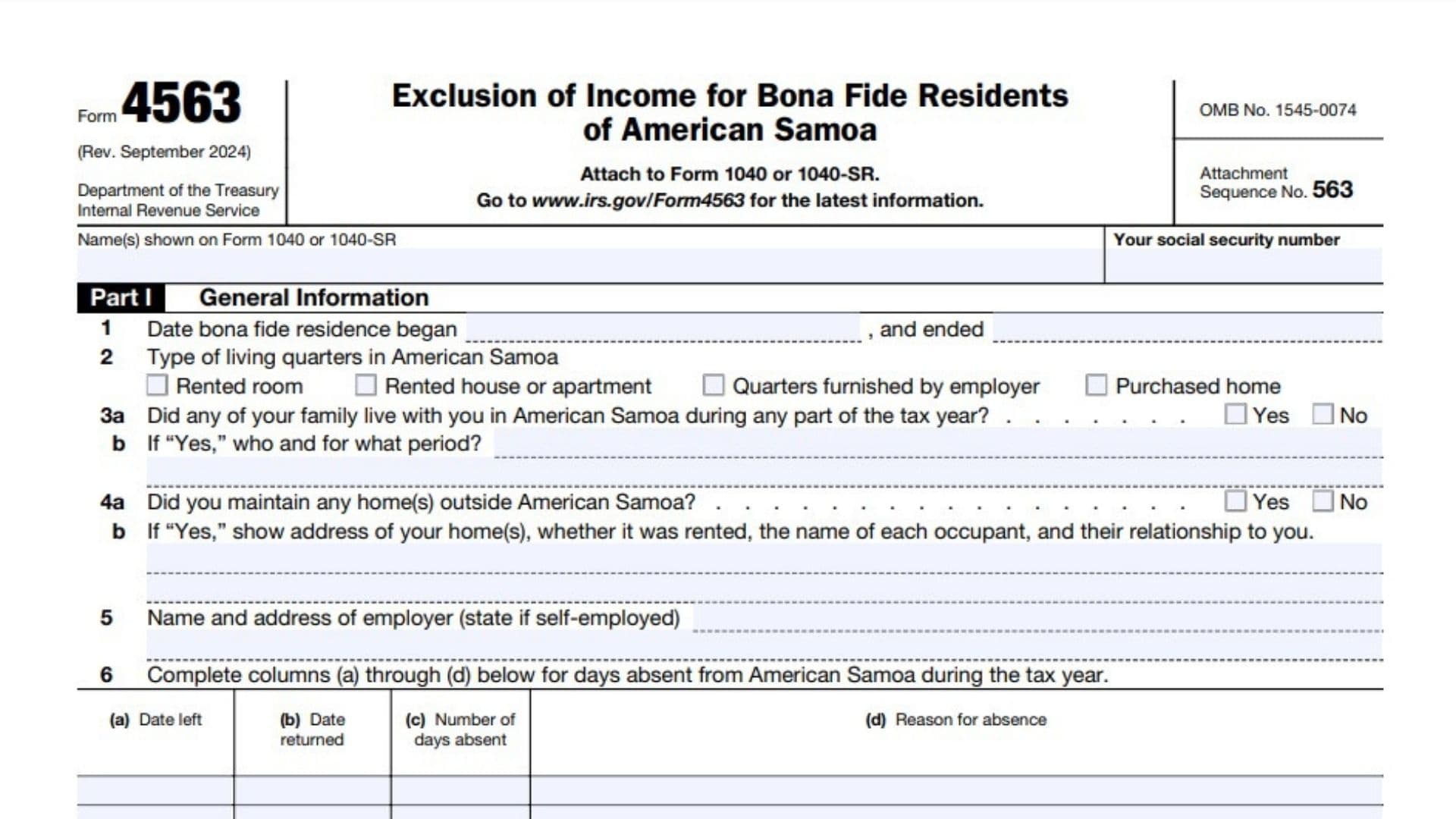

Part I: General Information

- Line 1: Enter the dates marking the beginning and end of your bona fide residency in American Samoa for the tax year.

- Line 2: Indicate your living quarters in American Samoa (e.g., rented room, purchased home, employer-furnished housing).

- Line 3: Specify if any family members lived with you in American Samoa during the tax year. If “Yes,” provide details about their stay.

- Line 4: Indicate if you maintained any home outside of American Samoa. If “Yes,” include the address, whether it was rented, and the occupants’ names and relationships.

- Line 5: Provide your employer’s name and address. If self-employed, state so clearly.

- Line 6: For any days spent outside American Samoa, complete columns (a) through (d) with the dates, number of days absent, and reasons for the absence.

Part II: Figure Your Exclusion

- Line 7: Record wages, salaries, and tips earned in American Samoa. Include only income from services performed there.

- Line 8: Enter taxable interest income from American Samoan sources (e.g., local banks).

- Line 9: Include ordinary dividends from American Samoan corporations.

- Line 10: Report business income linked to your activities in American Samoa.

- Line 11: Document capital gains from the sale of real estate or investments located in American Samoa.

- Line 12: Record income from rental properties, royalties, or similar sources in American Samoa.

- Line 13: Enter any farm income sourced within American Samoa.

- Line 14: List other types of income, specifying the source and amount.

- Line 15: Add lines 7 through 14 to determine the total exclusion amount for the tax year.