IRS Form 8801 is designed for individuals, estates, and trusts to claim a credit for the prior year’s Alternative Minimum Tax (AMT). This form is essential for taxpayers who paid AMT in previous years but were unable to use the credit due to limitations on their tax liability. By completing Form 8801, you can determine the amount of unused AMT credit you can claim for the current year or carry forward to future years. Form 8801 involves calculating the net minimum tax on exclusion items, determining any carryforward amounts, and computing the minimum tax credit for the year. Taxpayers with capital gains or qualified dividends may also need to complete additional computations. The credit applies only to non-exclusion items and is carried over until fully utilized.

How to File Form 8801?

- Determine Eligibility:

- Ensure you paid AMT in prior years and have unused AMT credit available.

- Gather relevant tax documents, including prior years’ Form 6251 and Schedule I.

- Download Form 8801:

- Obtain the form and instructions from the IRS website.

- Fill Out the Form:

- Follow the step-by-step instructions below to complete each section accurately.

- Attach Form to Tax Return:

How to Complete Form 8801?

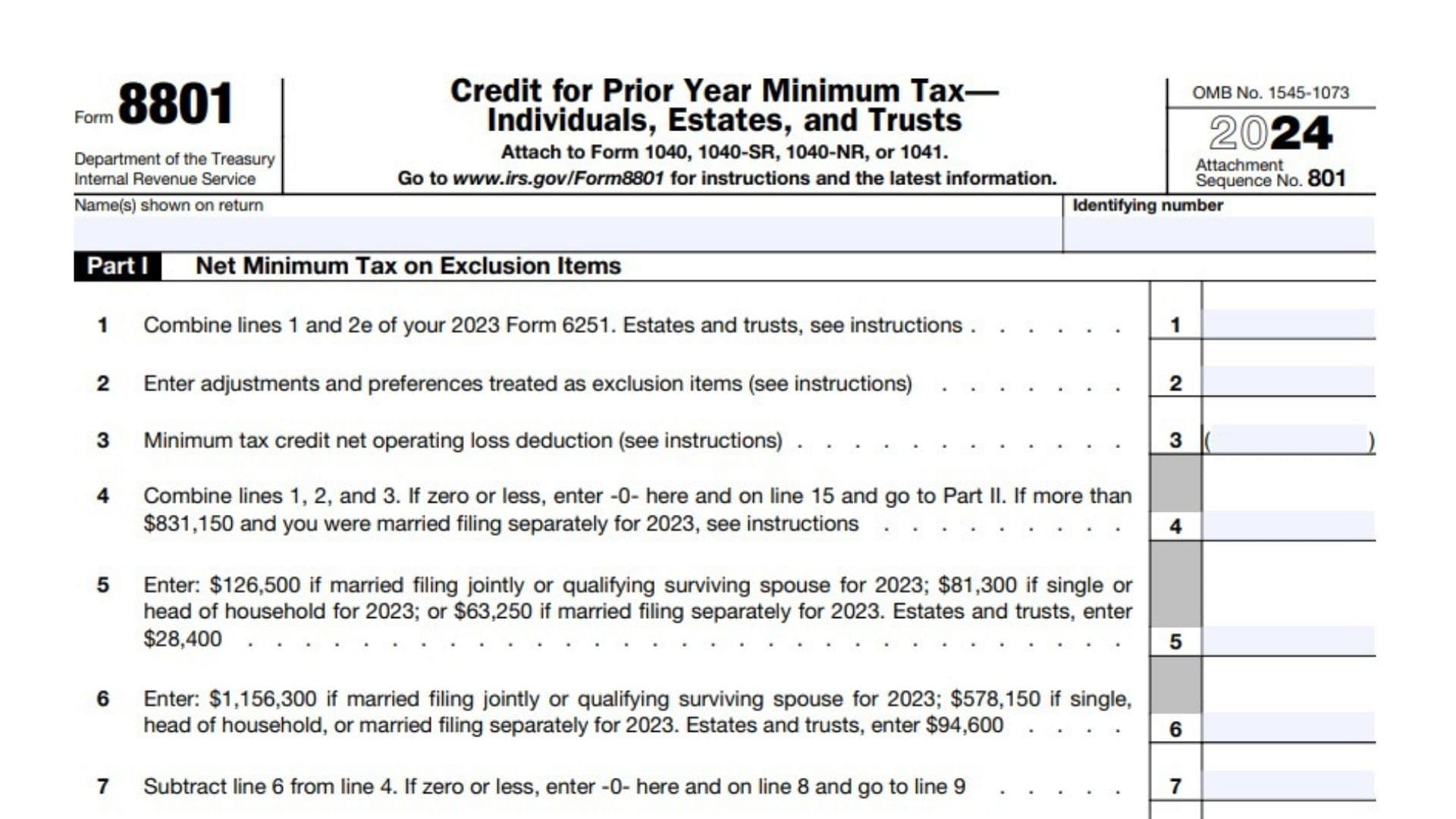

Part I: Net Minimum Tax on Exclusion Items

- Line 1: Combine lines 1 and 2e from your 2023 Form 6251. For estates and trusts, refer to the instructions.

- Line 2: Enter adjustments and preferences treated as exclusion items.

- Line 3: Enter any net operating loss deductions associated with the minimum tax credit.

- Line 4: Combine lines 1, 2, and 3. If the result is zero or less, skip to line 15.

- Line 5: Enter the applicable dollar amount for your filing status (e.g., $126,500 for married filing jointly).

- Line 6: Enter the exclusion threshold amount for your filing status.

- Line 7: Subtract line 6 from line 4. If zero or less, enter -0-.

- Line 8: Multiply line 7 by 25% (0.25).

- Line 9: Subtract line 8 from line 5.

- Line 10: Subtract line 9 from line 4.

- Line 11: Compute tax using AMT rules. Refer to the instructions for specific scenarios.

- Line 12: Enter the foreign tax credit on exclusion items.

- Line 13: Subtract line 12 from line 11.

- Line 14: Enter the AMT amount from your 2023 Form 6251, line 10.

- Line 15: Subtract line 14 from line 13 to determine the net minimum tax.

Part II: Minimum Tax Credit and Carryforward

- Line 16: Enter the AMT amount from your 2023 Form 6251, line 11.

- Line 17: Enter the amount from line 15.

- Line 18: Subtract line 17 from line 16. If negative, enter as a negative amount.

- Line 19: Enter the carryforward amount from your 2023 Form 8801, line 26.

- Line 20: Enter the unallowed qualified electric vehicle credit, if applicable.

- Line 21: Combine lines 18 through 20.

- Line 22: Enter your 2024 regular tax liability minus allowable credits.

- Line 23: Enter the AMT amount from your 2024 Form 6251, line 9.

- Line 24: Subtract line 23 from line 22.

- Line 25: Enter the smaller of line 21 or line 24 as your minimum tax credit.

- Line 26: Subtract line 25 from line 21 to determine the credit carryforward to 2025.

Part III: Tax Computation Using Maximum Capital Gains Rates

- Line 27: Enter the amount from line 10 of Form 8801.

- Line 28: Enter the applicable amounts from your 2023 Qualified Dividends and Capital Gain Tax Worksheet or Schedule D Tax Worksheet.

- Line 29: Add lines 28 and 29 to calculate the adjusted capital gain amount.

Part III: Tax Computation Using Maximum Capital Gains Rates

- Line 30: Add lines 28 and 29 and enter the smaller result or the amount from line 10 of your 2023 Schedule D Tax Worksheet. This determines the adjusted capital gain amount.

- Line 31: Enter the smaller value between line 27 (total net amount subject to the tax computation) or line 30. This establishes the portion of your income taxed at a lower rate.

- Line 32: Subtract line 31 from line 27. The result is the remaining taxable income after accounting for the adjusted capital gain.

- Line 33: If the value on line 32 is $220,700 or less ($110,350 or less if married filing separately for 2023), multiply the amount by 26% (0.26). Otherwise, multiply by 28% (0.28) and subtract $4,414 ($2,207 if married filing separately for 2023).

- Line 34: Enter the threshold amount applicable to your filing status:

- $89,250 if married filing jointly or a qualifying surviving spouse.

- $44,625 if single or married filing separately.

- $59,750 if head of household.

- $3,000 for estates or trusts.

- Line 35: Enter the amount from line 5 of your 2023 Qualified Dividends and Capital Gain Tax Worksheet, line 14 of the 2023 Schedule D Tax Worksheet, or the appropriate value for estates/trusts from 2023 Form 1041 or Schedule D.

- Line 36: Subtract line 35 from line 34. If zero or less, enter -0-.

- Line 37: Enter the smaller value between line 27 or line 28.

- Line 38: Enter the smaller value between line 36 or line 37.

- Line 39: Subtract line 38 from line 37.

- Line 40: Enter the applicable threshold value for your filing status:

- $492,300 if single.

- $276,900 if married filing separately.

- $553,850 if married filing jointly or qualifying surviving spouse.

- $523,050 if head of household.

- $14,650 for estates or trusts.

- Line 41: Enter the amount from line 36.

- Line 42: Enter the appropriate amount for 2023 as described in the instructions, referencing dividends or capital gains worksheets or Schedule D.

- Line 43: Add lines 41 and 42.

- Line 44: Subtract line 43 from line 40. If zero or less, enter -0-.

- Line 45: Enter the smaller value between line 39 or line 44.

- Line 46: Multiply line 45 by 15% (0.15).

- Line 47: Add lines 38 and 45.

- Line 48: Subtract line 47 from line 37.

- Line 49: Multiply line 48 by 20% (0.20).

- Line 50: Add lines 32, 47, and 48.

- Line 51: Subtract line 50 from line 27.

- Line 52: Multiply line 51 by 25% (0.25).

- Line 53: Add lines 33, 46, 49, and 52.

- Line 54: If line 27 is $220,700 or less ($110,350 or less if married filing separately for 2023), multiply line 27 by 26% (0.26). Otherwise, multiply line 27 by 28% (0.28) and subtract $4,414 ($2,207 if married filing separately for 2023).

- Line 55: Enter the smaller value between line 53 or line 54. This amount is then carried to line 11 of Form 8801. If Form 2555 was filed for 2023, enter this amount on line 4 of the Foreign Earned Income Tax Worksheet.