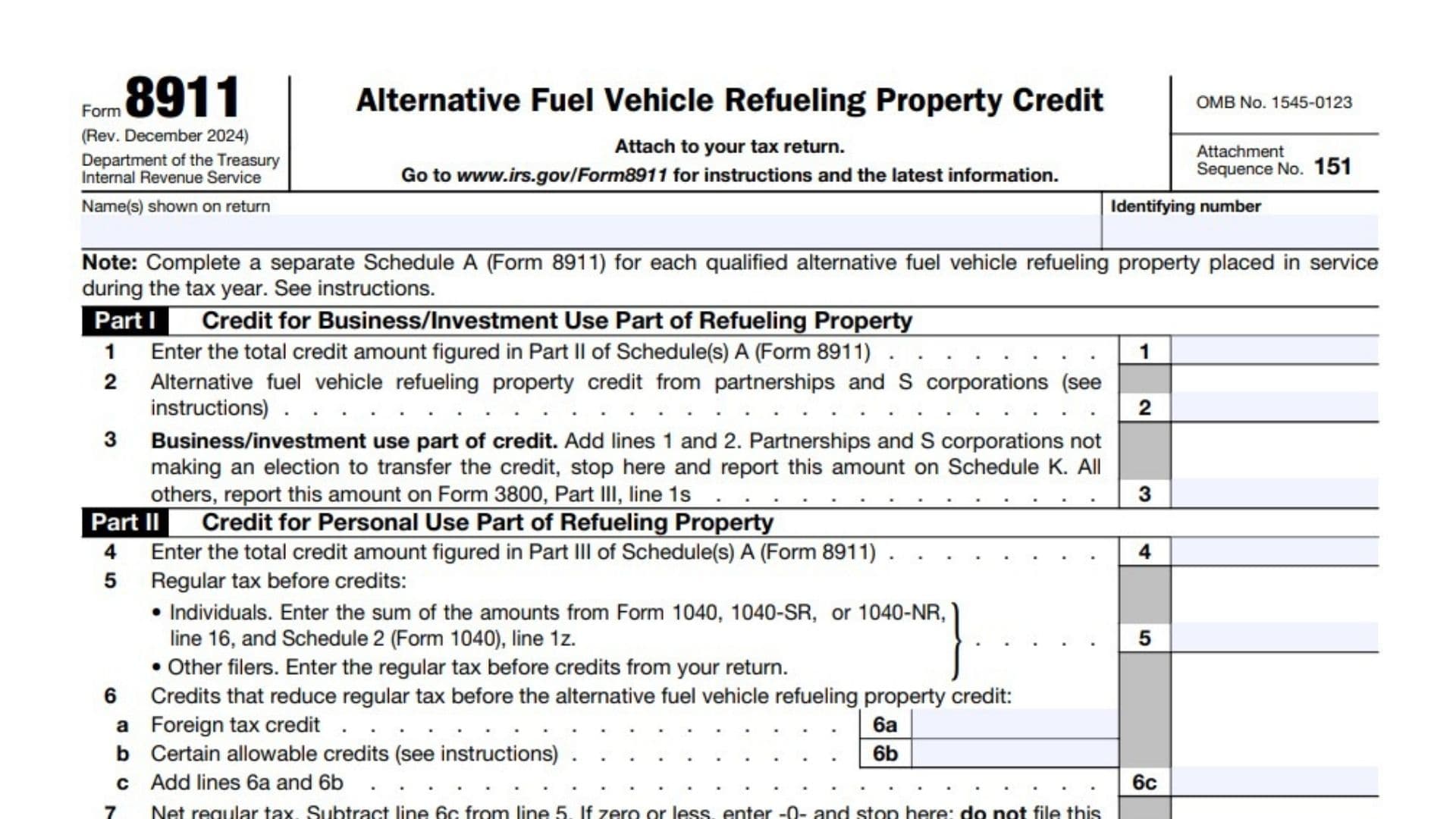

IRS Form 8911, titled Alternative Fuel Vehicle Refueling Property Credit, is used by taxpayers to calculate and claim a tax credit for the installation of alternative fuel vehicle refueling property. This credit encourages individuals and businesses to support eco-friendly initiatives by installing electric vehicle (EV) charging stations or similar equipment for refueling vehicles that use alternative fuels like electricity, natural gas, hydrogen, or ethanol.

The credit is available to both individuals and businesses, but specific eligibility criteria must be met. The form has two main sections: one for business/investment use and another for personal use. Taxpayers must attach this form to their tax return and use it to report the calculated credit to the IRS. This credit can reduce your tax liability, making it an attractive incentive for promoting sustainable energy use.

How to File Form 8911?

- Determine Eligibility: Ensure that the refueling property installed qualifies for the credit. Refer to IRS guidelines for eligible property and ensure it was placed in service during the current tax year.

- Gather Documentation: Collect receipts, invoices, and other proof of installation costs for the refueling property. For business claims, also prepare Schedule K if filing through a partnership or S corporation.

- Access the Form: Download IRS Form 8911 from the IRS website or obtain a physical copy.

- Attach to Tax Return: Complete the form and attach it to your annual tax return, such as Form 1040 or 1120, depending on your filing status.

How to Complete Form 8911?

Part I: Credit for Business/Investment Use of Refueling Property

- Line 1: Enter the total credit amount calculated from Part II of Schedule A (Form 8911). This involves adding up the eligible costs for business-related refueling property.

- Line 2: Include any credits passed through from partnerships or S corporations. These amounts should be obtained from the entity’s Schedule K-1.

- Line 3: Add lines 1 and 2. If you are not making an election to transfer the credit, partnerships and S corporations report this amount on Schedule K. All other filers report it on Form 3800, Part III, line 1s.

Part II: Credit for Personal Use of Refueling Property

- Line 4: Enter the total credit amount calculated from Part III of Schedule A (Form 8911). This represents costs for refueling property used personally.

- Line 5: Enter your regular tax before credits. For individual taxpayers, this is the sum of amounts from Form 1040, line 16, and Schedule 2 (Form 1040), line 1z.

- Line 6a: Enter your foreign tax credit, if applicable.

- Line 6b: Enter any other allowable credits, as instructed in IRS guidelines.

- Line 6c: Add lines 6a and 6b to calculate your total credits that reduce regular tax.

- Line 7: Subtract line 6c from line 5. If the result is zero or less, do not file the form unless claiming a credit on line 3.

- Line 8: Enter the tentative minimum tax from Form 6251 (line 9 for individuals).

- Line 9: Subtract line 8 from line 7. If zero or less, do not proceed unless claiming a credit on line 3.

- Line 10: Enter the smaller value between lines 4 and 9. This is your personal-use credit amount, which will be entered on Schedule 3 (Form 1040), line 6j.