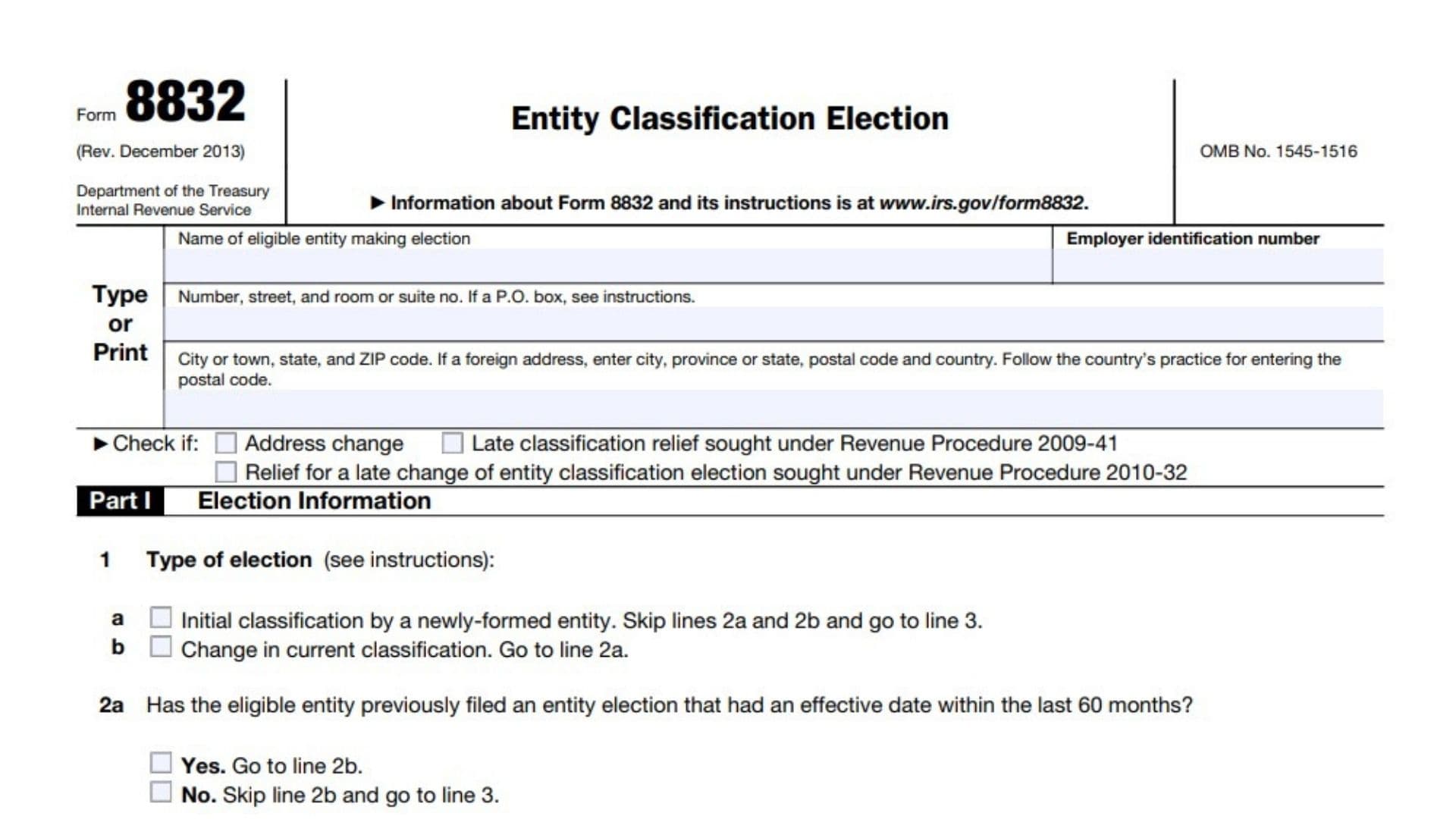

IRS Form 8832 is a vital document used by eligible entities to choose their classification for federal tax purposes. By default, certain domestic and foreign entities are automatically classified under specific tax rules unless they file Form 8832 to change their classification. For instance:

- A domestic eligible entity with a single owner is classified as a disregarded entity, while one with multiple owners is classified as a partnership.

- Foreign entities can be classified as partnerships, corporations, or disregarded entities based on ownership and liability status.

The form is often used by businesses to gain greater control over their tax liabilities or align their tax treatment with their operational structure. For example, a Limited Liability Company (LLC) might file Form 8832 to be taxed as a corporation rather than the default partnership structure.

How to File IRS Form 8832?

- Determine Eligibility: Only eligible entities, such as LLCs, partnerships, and certain foreign entities, can file Form 8832. Corporations and tax-exempt organizations under Section 501(a) cannot use this form.

- Gather Required Information:

- The entity’s name and Employer Identification Number (EIN).

- Address and contact details.

- Type of election (initial classification or change).

- Effective date of the election.

- Complete the Form: Follow the detailed instructions in Part I or Part II, depending on whether you’re making a new election or requesting late election relief.

- Sign the Form: Ensure all owners or authorized representatives sign the consent statement.

- Attach Supporting Documents (if applicable): Include additional documents for late election relief or required amendments.

- File the Form: Submit Form 8832 to the appropriate IRS Service Center listed in the instructions.

- Attach a Copy: Include a copy of the form with the entity’s federal tax or information return for the tax year of the election.

How to Complete Form 8832?

Part I: Election Information

- Line 1: Indicate whether this is the entity’s initial classification or a change in classification.

- Line 2: If applicable, confirm whether the entity has filed a previous election within the last 60 months and if the election was for an initial classification.

- Line 3: Specify whether the entity has more than one owner to determine if it can elect to be treated as a partnership or disregarded entity.

- Line 4: For single-owner entities, provide the owner’s name and identifying number.

- Line 5: If the entity is part of an affiliated group filing a consolidated return, include the parent corporation’s name and EIN.

- Line 6: Check the appropriate box for the type of entity (e.g., domestic corporation, partnership, foreign partnership, etc.).

- Line 7: For foreign entities, indicate the country of organization.

- Line 8: Specify the effective date of the election (must be within 75 days prior or 12 months after filing).

- Line 9 & 10: Provide the contact person’s name and phone number for IRS inquiries.

Part II: Late Election Relief

- Line 11: Explain why the entity did not file its classification election on time. Include details that establish “reasonable cause” for the late filing.

Consent Statement

All required parties must sign and date the consent statement at the bottom of Part I or Part II, declaring the truthfulness of the information provided.

Key Tips and Considerations

- Default Rules: Many entities are automatically classified unless Form 8832 is filed. If the default classification meets your needs, filing this form might not be necessary.

- Effective Date: The election’s effective date cannot be more than 75 days prior or 12 months after filing.

- Late Filing Relief: If filing late, ensure you meet the conditions for relief outlined in Revenue Procedure 2009-41.

- Filing Location: Send the completed form to the appropriate IRS Service Center based on your state or entity’s location (see the table in the form’s instructions).