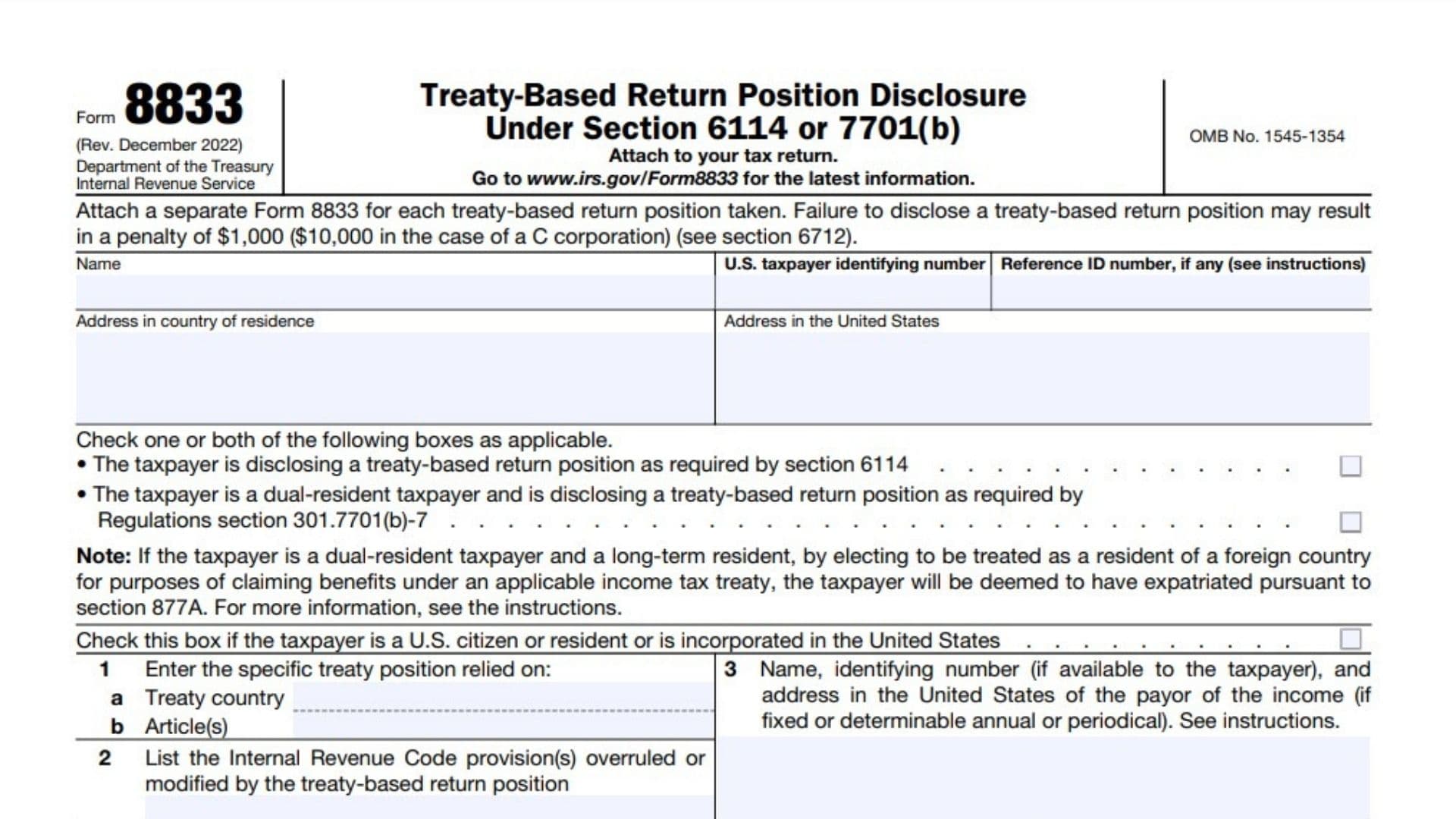

IRS Form 8833, titled Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b), is essential for taxpayers who wish to disclose a treaty-based return position as mandated by the U.S. tax code. This form is particularly relevant for individuals or entities claiming benefits under a tax treaty between the United States and another country, which may alter the application of certain provisions of the Internal Revenue Code. The purpose of Form 8833 is to ensure compliance with U.S. tax laws by requiring taxpayers to disclose how a treaty affects their tax obligations, thus potentially reducing their overall tax liability. In this article, we will explore what IRS Form 8833 is, how to file it, and provide detailed line-by-line instructions for completing the form accurately.

What is IRS Form 8833?

Form 8833 is a disclosure form that must be attached to a taxpayer’s return when claiming benefits under a tax treaty. It serves to inform the IRS about any treaty-based positions taken that may modify or override specific provisions of the Internal Revenue Code. Taxpayers must file this form annually for each treaty position claimed; failure to do so may result in significant penalties, including fines of up to $1,000 or $10,000 for corporations. The form is crucial for dual-resident taxpayers who need to clarify their residency status and claim treaty benefits accordingly.

How to File Form 8833?

To file Form 8833, follow these steps:

- Complete your primary tax return (e.g., Form 1040-NR or Form 1120-F).

- Attach Form 8833 to your tax return.

- If you are not required to file a tax return otherwise, submit Form 8833 directly to the IRS Service Center where you would typically file your return.

How to Complete Form 8833?

Here’s a detailed guide on how to fill out each line of IRS Form 8833:

- Name: Enter your name as it appears on your tax return.

- U.S. Taxpayer Identifying Number: Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Reference ID Number: If applicable, enter any reference ID number assigned to you by a U.S. person related to information reporting.

- Address in Country of Residence: List your full address in the country where you reside.

- Address in the United States: Provide your U.S. address.

- Check Applicable Boxes: Indicate whether you are disclosing a treaty-based position under Section 6114 or if you are a dual-resident taxpayer.

Specific Lines on Form 8833

- Enter Specific Treaty Position Relied On:

- a) Treaty country

- b) Article(s) of the treaty being claimed

- List Internal Revenue Code Provisions Overruled or Modified: Identify any specific provisions that are affected by the treaty.

- Name and Address of Payor: Include the name and address of the income payor if it pertains to fixed or determinable annual or periodic income.

- Limitation on Benefits Article: Specify any provisions from the limitation on benefits article that apply.

- Specific Reporting Requirements: Answer whether you are disclosing a position that requires specific reporting as per Regulations section 301.6114-1(b). If yes, provide relevant subsections.

- Explain Treaty-Based Position Taken: Provide a summary of facts supporting your position and list any relevant income amounts affected by the treaty benefits claimed.

Final Steps

After completing all sections of Form 8833:

- Review all entries for accuracy.

- Ensure that you have attached it correctly to your primary tax return.

- Submit your completed forms by the due date for your tax return.